Track Your Money, Wealth and Net Worth With These Two Apps

Toggle Dark Mode

Keeping track of your finances can be hard. Not only do most people not get through on how to do it, but tracking where your money goes by yourself can be really tricky.

Fortunately, you don’t need to do it alone. There are many finance apps you can download and use on your iPhone at any time. What’s more, you don’t even need to use your phone, as you can use most of these apps from your computer.

But with so many budgeting apps out there, which one should you use? Well, there are two apps that stand out from the rest: Empower and Mint.

Both of these apps are great and will help you track your expenses and manage your wealth accordingly. Here’s what you need to know about them.

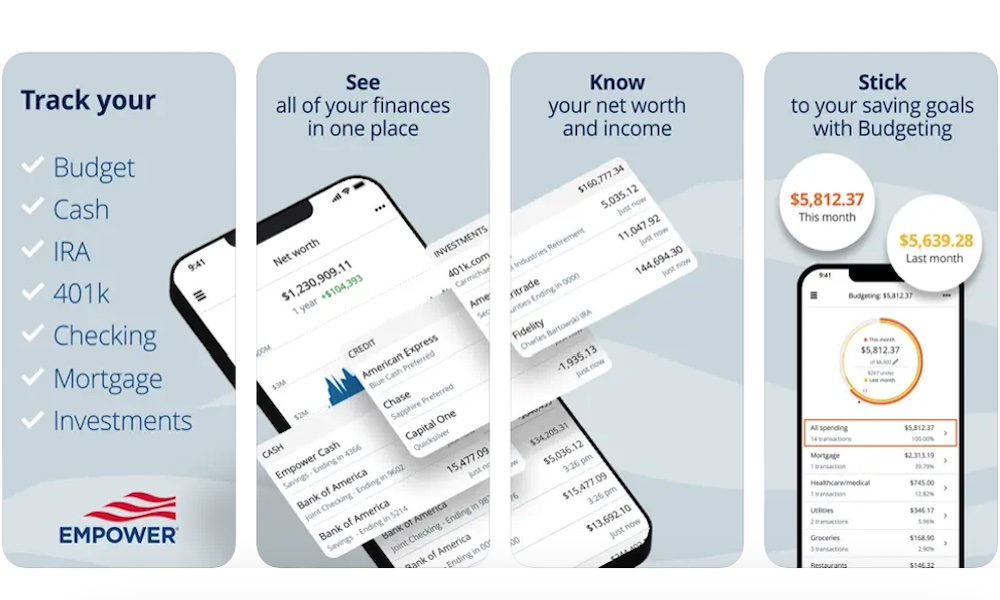

Empower

Empower, previously known as Personal Capital, is one of the best apps you can get to track pretty much every aspect of your financial life.

For starters, you can track and manage all your accounts, including bank accounts, 401K, and IRA. You can even track all your investments and the stocks you’ve bought for yourself, which is more than most other budgeting apps can do.

Of course, Empower doesn’t only show you the good; you can also use it to keep track of your own debt. It might look ugly, but if you want to improve your financial situation, you’ll need to know exactly how much you owe and how you can tackle it.

Empower uses all this information to give you your exact net worth. This will help you keep a mental picture of how much you’re actually worth, and you can then start preparing to maintain or improve your financial situation.

Of course, Empower isn’t just a plain app to track your wealth. The app also lets you create a customizable budget. You can organize all your income and savings by different categories and dates. You can then check where your money is actually going to see if you’re wasting or saving money.

The best part is that Empower also offers a plan for retirement. You can set a plan in the app, and Empower will show you if you’re on track with your goals. It doesn’t matter if you’re 20 or 45; now is always the best time to save for retirement. Sign up for Empower here to get access to your free dashboard.

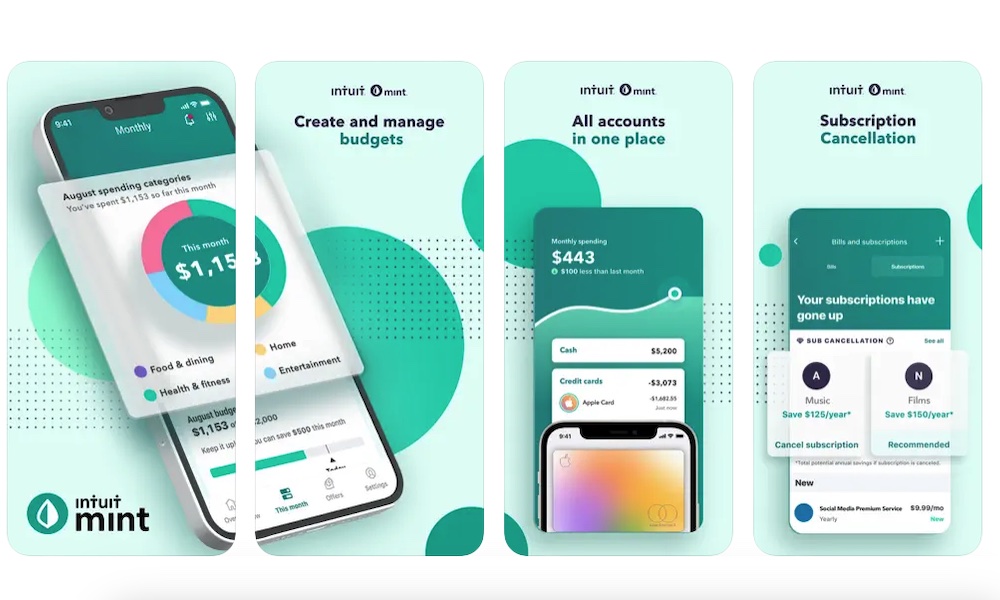

Mint

You’ve probably heard of Mint before. It’s only one of the most popular budget and expense manager apps you can find online. And there’s a reason for that.

For starters, just like other budgeting apps, you’ll be able to keep all of your accounts in one place. You can keep your bank accounts, your loans, and your investments.

Additionally, you can also connect your credit cards and keep track of your free credit score. All of this will help you know your exact net worth and how much money you actually have.

Once you’ve got that covered, you can start creating a budget that fits your needs. You can add as many categories as you need, and the app will give you suggestions on the amount of money you should use for each one.

When it comes to budgeting, Mint is one of the most flexible apps. You can create budgets for your week, month, or a few months in advance.

And if you don’t know what you’re doing, you can get personalized “Mintsights,” which is an app that looks into your finances and gives a better look at your overall financial health.

What’s cool is that if you have a bad habit of spending too much, Mint will send notifications to your phone, letting you know when you’re near the limit.

And if you aren’t sure what you’re saving money for, you can create your own goals in the app. Whether you want to take a nice, long vacation or you just want to have some money for rainy days, Mint has you covered.

Another cool feature that you won’t find on many other apps is the ability to cancel any of your subscriptions.

First, the app will let you know if you’re subscriptions are getting more expensive and will tell you about subscriptions you don’t really use anymore. And if you don’t want to be subscribed anymore, all you need to do is use the Mint app and directly cancel your subscriptions with just a few taps.

Overall, Mint is a really customizable, easy-to-use app that’ll make your financial life a little bit easier.

Take Control of Your Money

Whether you’re already in control of your finances or you’re just getting started, these two apps have everything you need to track your wealth and your expenses.

Yes, these apps have a monthly payment you’ll have to subscribe to if you want to get all the premium features. However, if they help you keep track of your money, then this will be the perfect investment for you.