8 Brilliant Money-Saving Apps You’ll Swear by This Year

Credit: Muqamba / Shutterstock

Credit: Muqamba / Shutterstock

Toggle Dark Mode

Everyone likes saving more money – and let’s face it, saving money in 2020 may be more important than ever, for everyone, from single professionals to families reconsidering their budgets.

There are plenty of apps out there that promise to help you save money with various features, but which ones actually work? What are the best options these days?

We took a look, and we’re ready to make some recommendations if your budget needs a rework or your savings aren’t quite where they should be.

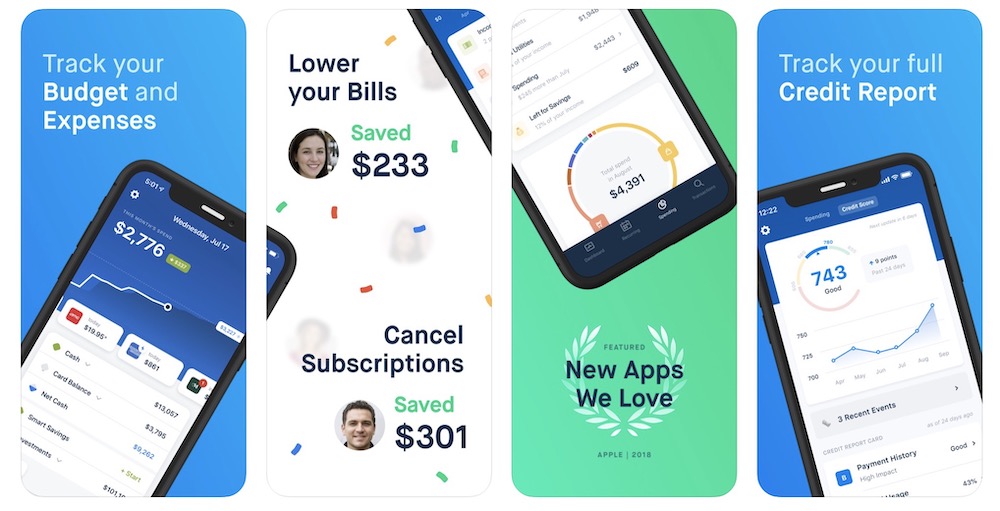

Truebill thinks you’re paying too much. Specifically, it wants to track your finances and check to see if you are paying for any subscription you no longer need or have forgotten about (according to its research, around 84% of people are). The app can also take a look at your phone, cable, security monitoring, and other monthly bills, and see if you are being subtly overcharged over time, then give you options to negotiate lower payments for these bills. Other features help you monitor spending and arrange for better savings!

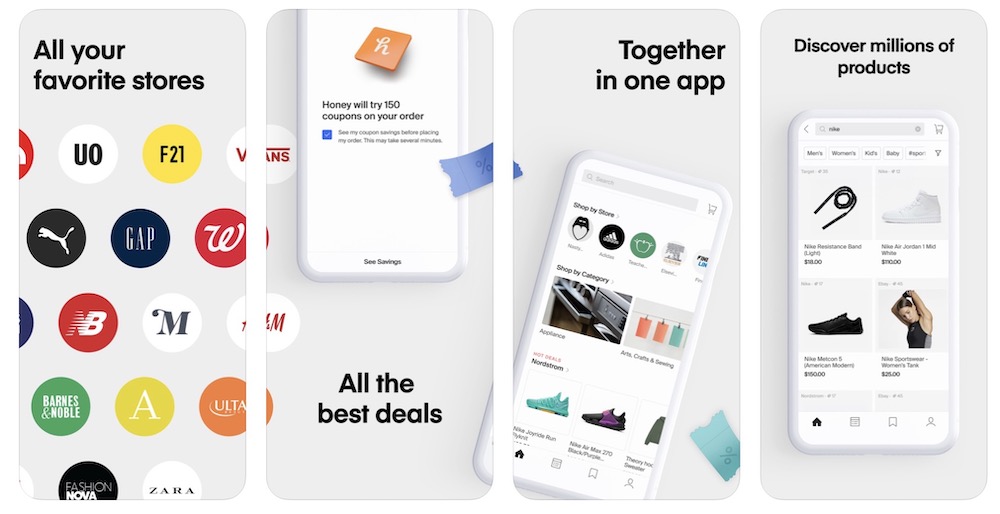

Honey

Honey is an automatic deal-finding app with several excellent features for anyone who shops online. First, it will automatically locate coupon codes for a product in your shopping cart (coupon codes that actually work), and apply them for you so you can partake in any ongoing deals you might not have known about.

Second, the app helps keep track of prices for specific products that you can add to a “Droplist.” It will then alert you about price drops online for that product so you can compare prices and find the lowest available without needing to do all that Googling yourself. The app is also smart enough to, say, add in the shipping and calculate Prime deals on Amazon while you’re comparing.

Honey reports that people save around an average of $126 per year using it, although this will vary based on how often you shop online. You can easily add it as an extension to browsers like Chrome, too… and all of its features are free.

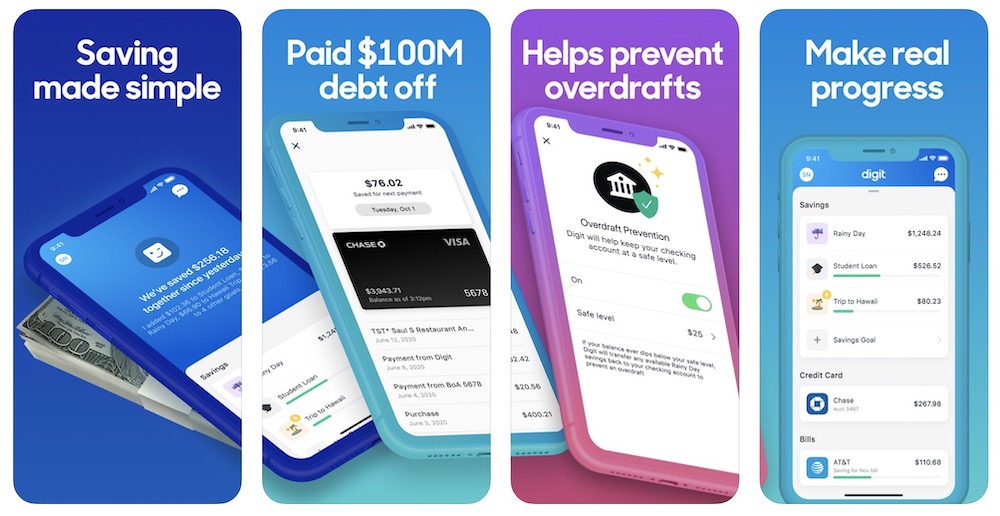

Digit

Digit is one of the best auto-saving apps available. You connect your bank accounts so it can analyze your spending, then give it information about your bills and monthly expenses. Then you add in a goal – say, saving up for a vacation, buying concert tickets, or setting money aside to pay off credit card debt.

Amass several of these goals, and Digit will give you a daily rundown of your balance, your bills, expected purchases, and the minimum amount you’ve set to keep in your checking account no matter what. Then things get cool: Digit will tell you how much money is safe to save today, and divvy up that money into the different goals you are saving for based on their importance. It’s a great way to create savings goals and then safely meet them every day.

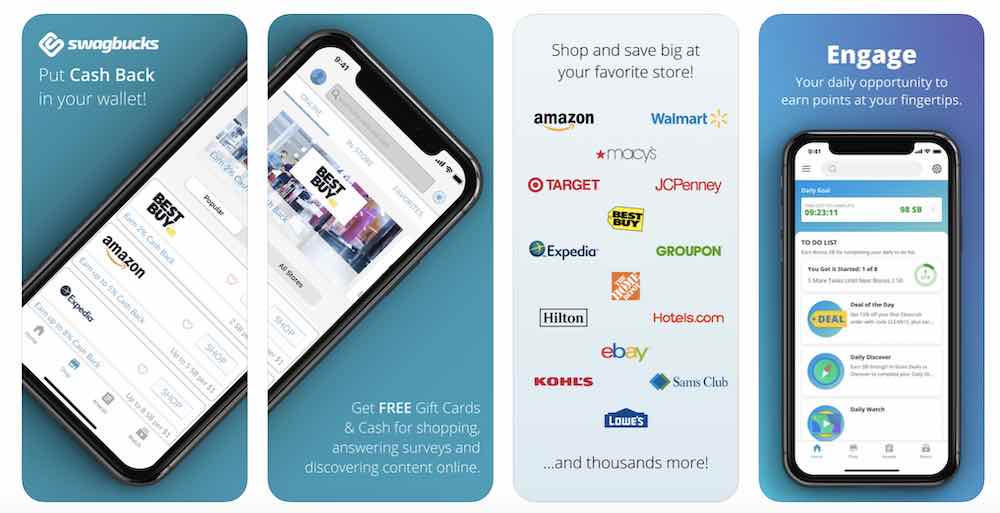

Swagbucks

Swagbucks is an interesting app that essentially pays you for participating in online marketing. You create an account and sign up, then you are presented with a variety of activities you can do: This includes shopping online stores, watching online videos, using search engines, answering surveys, and more. Basically, you’re carrying out online behaviors that marketers want to study to boost numbers or learn more about customers.

As you do this, you earn points, which you can use via Swagbucks to redeem gift cards for major stores like Amazon and Wal-Mart where you can buy almost anything, or even redeem cash for a PayPal account. This is a great way to generate extra cash for small luxury items or gifts you can purchase online, which then allows you to use your primary stream of income on more important things like savings.

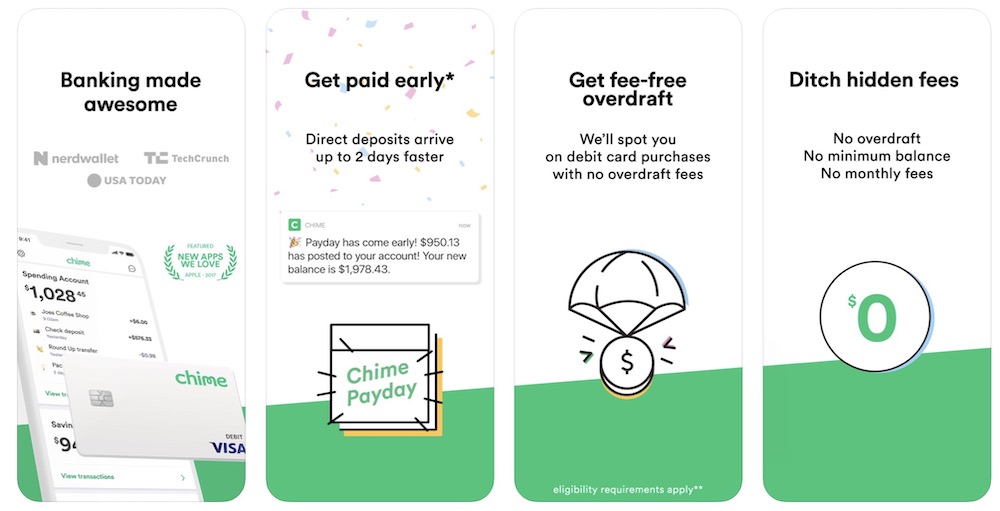

Chime

Chime markets itself as a mobile banking app, but it’s also a nifty way to save money while carrying out everyday bank account transactions. First, the app allows you to skip out on monthly banking fees and transaction fees that might otherwise apply. Second, Chime’s Direct Deposit feature allows you to get paid up to two days early for faster results.

But the most important feature is the automated savings account that helps make sure you save with every paycheck. With this account and the accompanying Chime credit card, every time you make a credit card transaction, it will round up to the nearest dollar and deposit that money in your savings account. Every time you get a paycheck, 10% will automatically be transferred to that account, too. It’s surprising how fast this adds up! But you have to make sure your bank accounts are compatible with the app before you dive in.

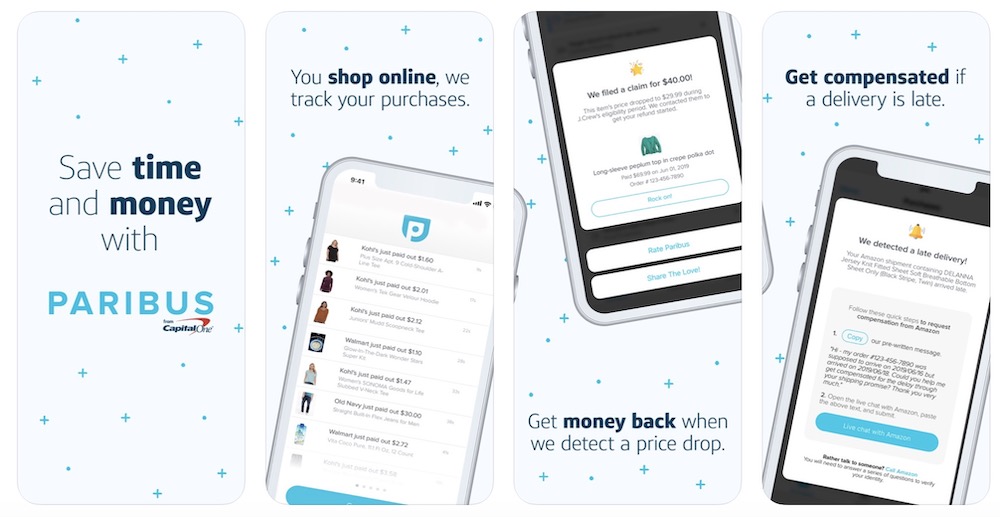

Paribus

Think of Paribus as an online shopping lawyer that helps you make sure you save money when you buy lots of online products. This isn’t a deal-finding app, though: Instead, it tracks major online brands, online product prices, and your online shopping activity to see if you missed on savings.

If a retail price drops after you buy a product, or if you experience late deliveries, or if you want to return something, then Paribus will let you know and offer services to get price matching or compensation that can literally put money back into your pocket.

The caveat is that it doesn’t work everywhere, but it does track more than 25 big sites including Amazon, Target, Best Buy, Gap, and Home Depot.

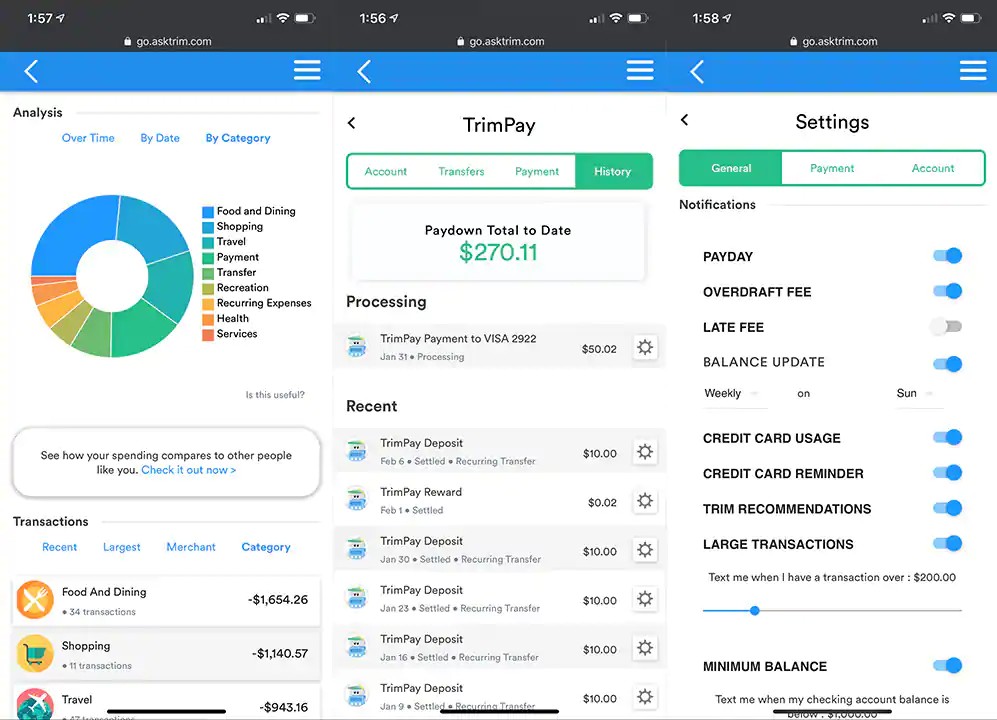

Trim

Trim doesn’t have an actual app just yet – but it is a bit like Truebill, in that it will help you negotiate recurring bills and even medical bills and insurance payments, while making sure unwanted or old subscriptions are canceled. But it comes with extra savings options, including a special savings account that gives you a 4% annualized bonus on your first $2,000. It also negotiates with banks and credit card providers to get lower interest rates or waive interest charges/fees for debts you are working to pay off.

The trade-off is that to access all of these services, you will need to pay for them, and negotiation doesn’t come cheap. The full service is $10 per month, while using just bill negotiation services will cost 33% of the annual savings you make. However, those prices could be well worth it if you are dealing with numerous debts or trying to find the lowest possible payments for everything.

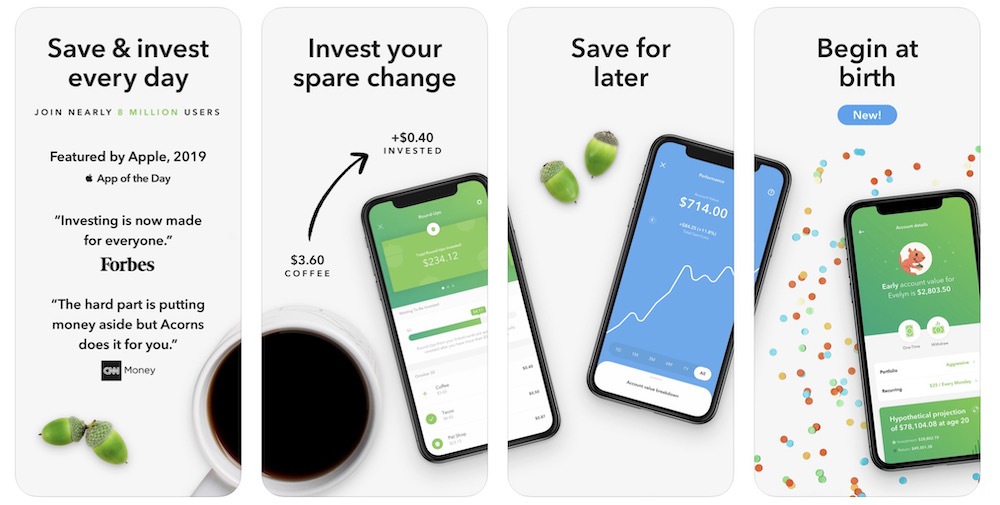

Acorns

Acorns combines several of the money-saving features from other apps on our list into an alternative package that you may prefer. It allows you to automate deposits straight to retirement or savings accounts so you don’t “forget” to save. The app will also round up your purchases via its special credit card and deposit the spare change in a savings account, like Chime. There’s even a feature called Found Money that will pay you extra to shop with top brands, a bit like Swagbucks, and then use this money for fun or more savings.

However, this is one app that isn’t actually free. The first tier of the service will cost $1 per month. A personal account, which adds investment management, a debit card, and savings services, will cost $3 per month. A family plan with accounts for kids and special offers costs $5 per month.

We may earn a commission from affiliate links. Continue Below.