7 iPhone Apps That Could Save You Thousands

Credit: Yulia Grigoryeva

/ Shutterstock

Credit: Yulia Grigoryeva

/ Shutterstock

Toggle Dark Mode

More people than ever are looking for new ways to save money, for holiday gifts, or even for merely paying rent. Fortunately, many apps can help with that – for this guide, we’re focusing specifically on money-saving apps that can help you build some extra cash, especially if you’re shopping online.

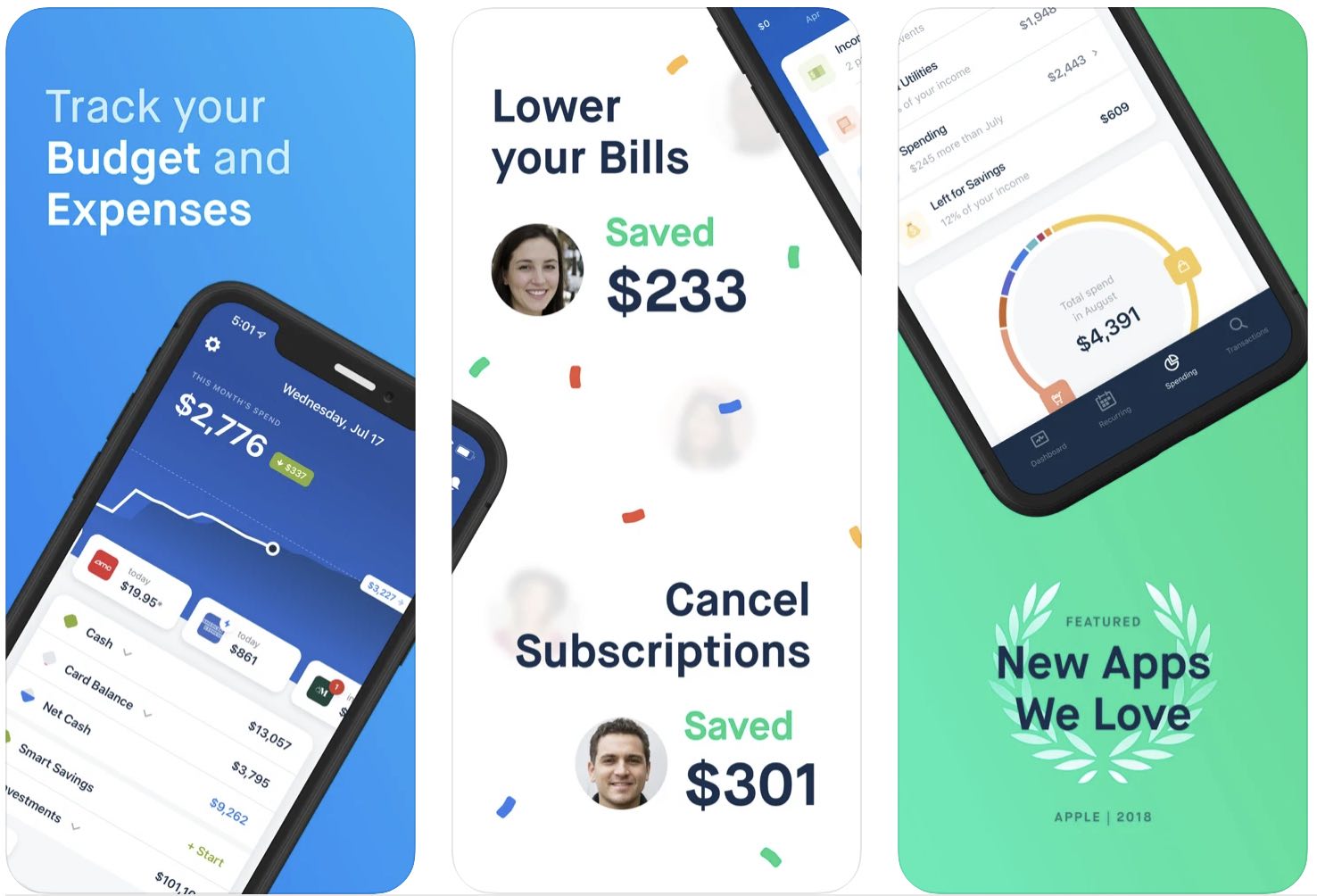

Truebill

These days, it’s hard to keep track of all your subscriptions – especially after you’ve stopped using a service or app and may have forgotten about it entirely. In other cases, like phone or cable bills, you may be paying too much or are signed up for the wrong things without even knowing it. Truebill is an app to help manage all of that: It tracks your subscriptions and bills and looks for anything unexpected or suspicious. It also allows you to immediately cancel the subscriptions you don’t want. The app can send a wide variety of alerts for everything from account fees or overdraft penalties to interest payments and changes in credit, so you can customize it for what you have in mind. It’s a friendly solution for hectic finances.

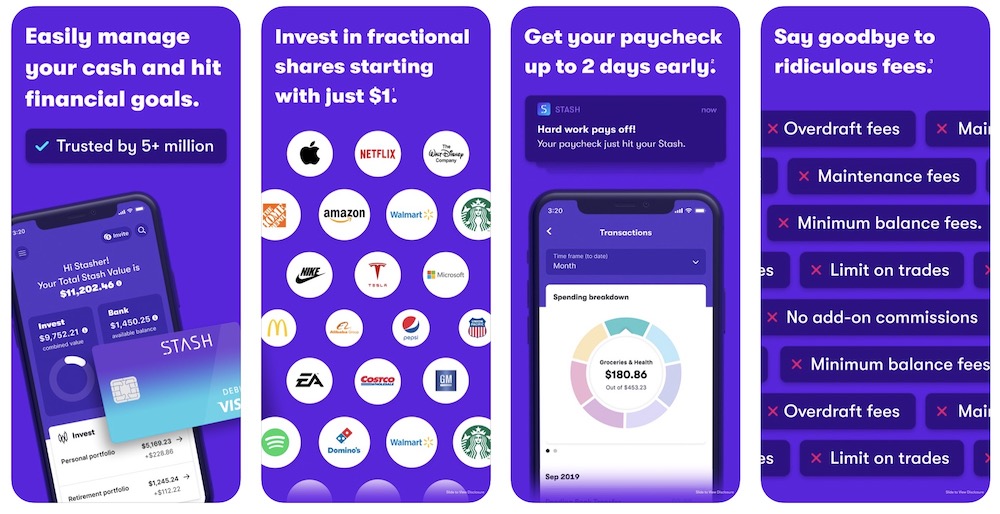

Stash

Investing can be incredibly intimidating to new investors. That’s something Stash is hoping to change. With the mobile app, you can start investing money in a variety of stocks and ETFs for as little as $1.

The goal is to make it accessible for beginner investors – from the start, you’ll prompted with a questionnaire that helps evaluate your risk and goals with investing. You’ll need to pay at least $1 per month1 for an account, although that comes with access to an online bank account and debit card.2 Stash will also give you a $5 bonus* to invest after you sign up and deposit at least $5 into your invest account.

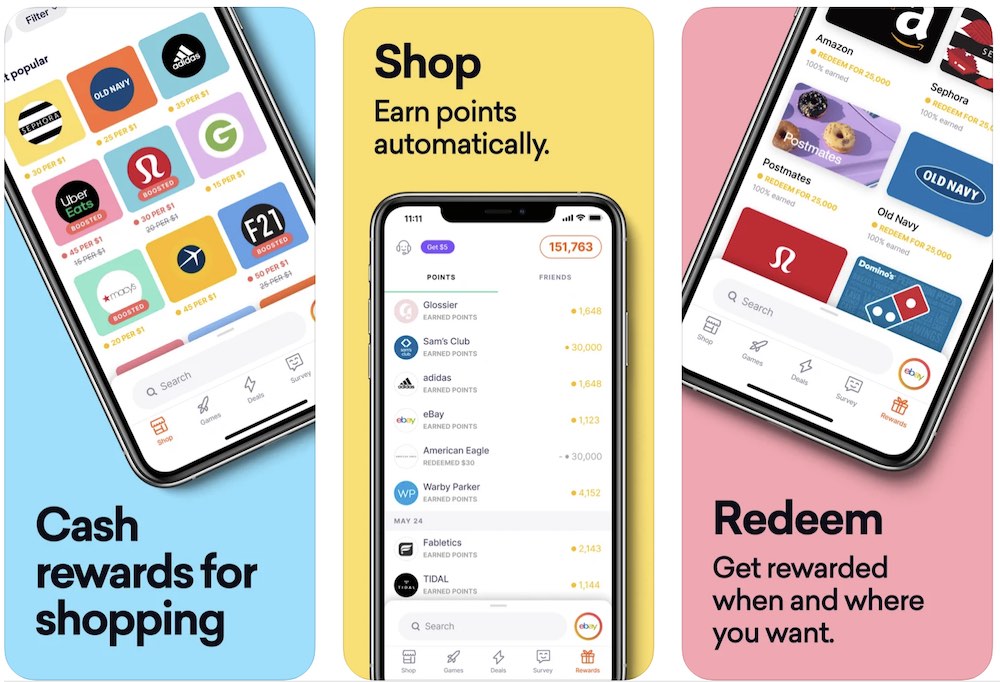

Drop

Drop is one of the more effective rewards program apps where you can earn cash by doing various activities. Here, you’ll link a credit card to the app and allow it to watch what you do (not the most comfortable thing for privacy, but that’s how you earn money). Then the app collects information on your activity as you play online games, shop online, and take surveys that the Drop app suggests. In exchange for these insights, which can be used by advertisers, you’ll rack up points to swap for gift cards. The gift cards you can choose range from Amazon and Walmart to Starbucks, Stubhub, Adidas, Expedia, and Sephora, among many, many others. It’s a great app to download before Black Friday or other holiday shopping sprees.

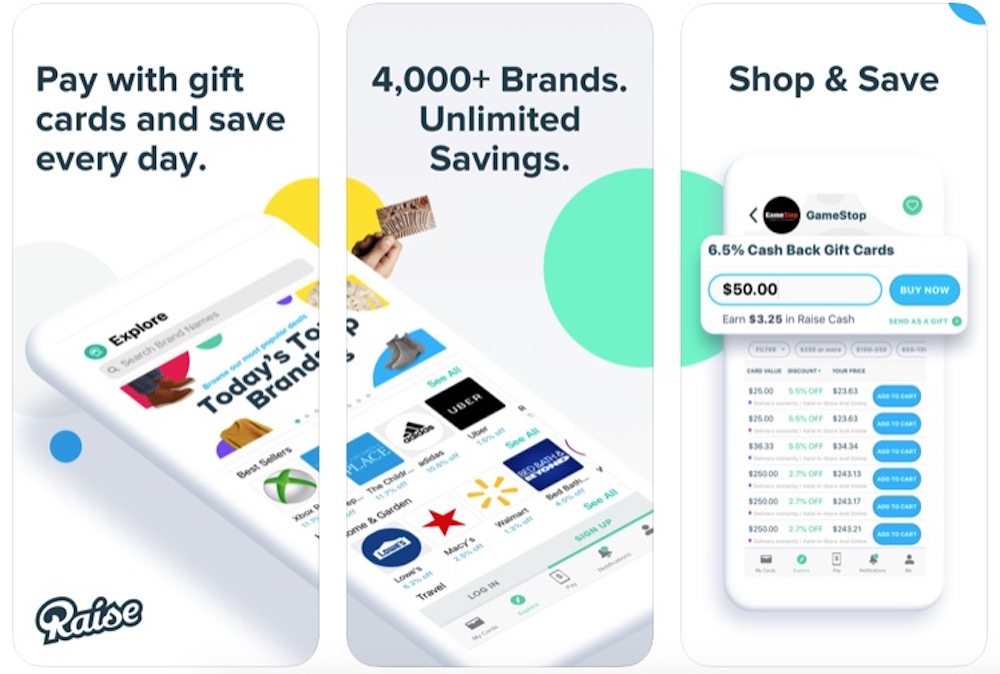

Raise

Raise is a shopping app that specializes in brokering discounted gift cards. You can rack up savings by shopping normally online, but most of the app’s activity is focused on selling your unused gift cards to earn money, or buying ones at a discount. You can also earn cashback by sending gift cards to your friends or family through the app, which makes it another great choice for the holidays. When selling the gift cards you don’t plan to use, the app allows you to set your own prices, so you do have a role in how well your sales do. You can also get notifications for current deals and track your favorite brands if you have your eye on something in particular. The app covers pretty much every major brand with an online presence, so there’s a whole lot to choose from.

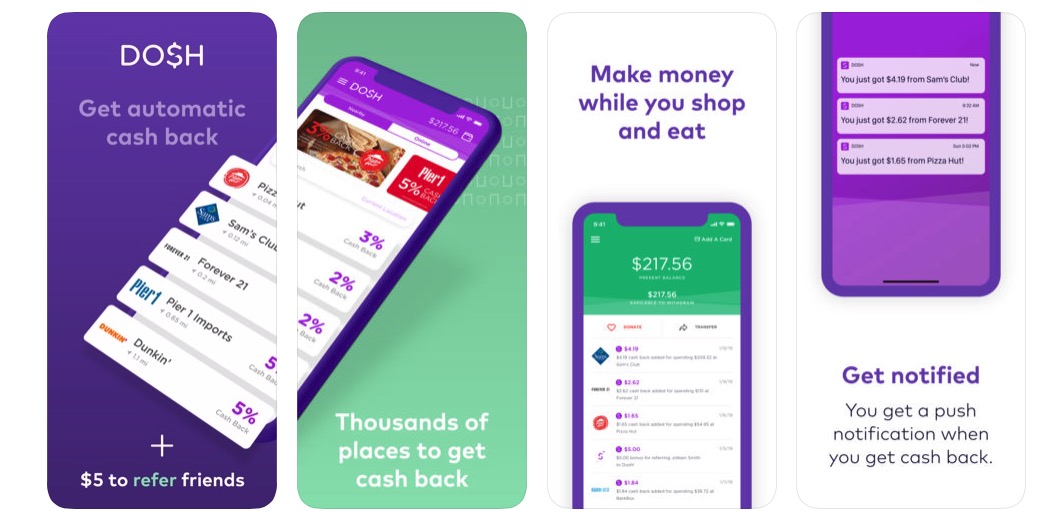

Dosh

Dosh may have a funny name, but it’s a great rewards program app that focuses on frequent, everyday purchases in-store and online. The app can help you earn cash back automatically when you link your card and use it for mundane activities like using Uber, buying Wendy’s food, picking up medications at Walgreens, ordering a meal on Grubhub, purchasing an Apple Music plan, and a lot more. You can also save money when booking hotels through the app – and, of course, there are a lot of online shopping opportunities, too. Unlike many rewards apps, you don’t get points or coupons rewards – the results are given back directly as cash, which you can transfer to your bank once you reach the threshold of $25.

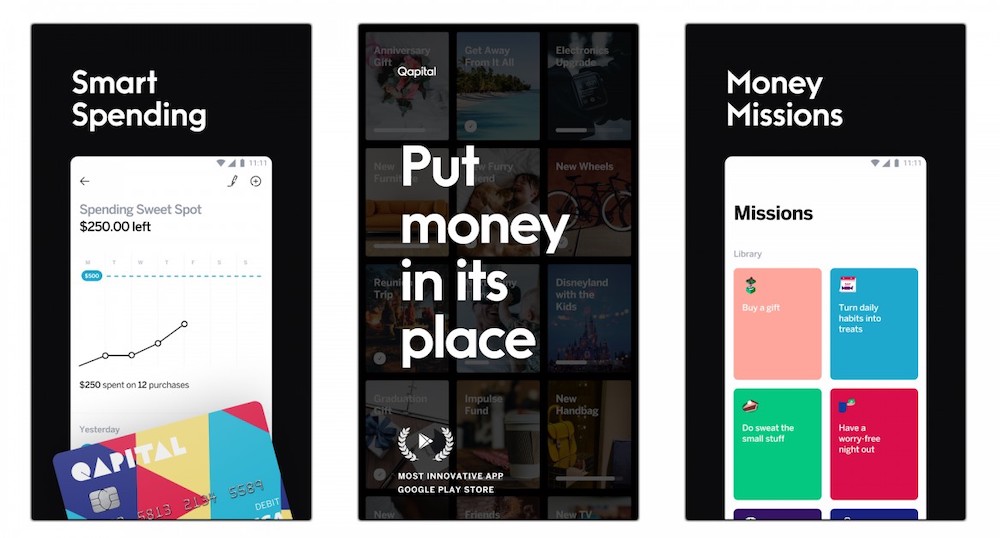

Qapital

Qapital is a finance app with a twist – it’s designed to automatically deposit small amounts of cash into your savings account as you succeed at specific personal goals. These goals can be customized with Rules that you can set yourself, but they are traditionally focused on personal fitness. So, say you run a certain number of miles or walk a certain amount of steps, as reported by your fitness devices and apps like Apple Health – then the app will send some money to your savings account! This can also apply to many other habits, from social media use to using Uber. Of course, there’s also a lot more to the app, including investment options, budgeting tools, and spending trackers, which can all combine into a broad approach for saving money in different ways.

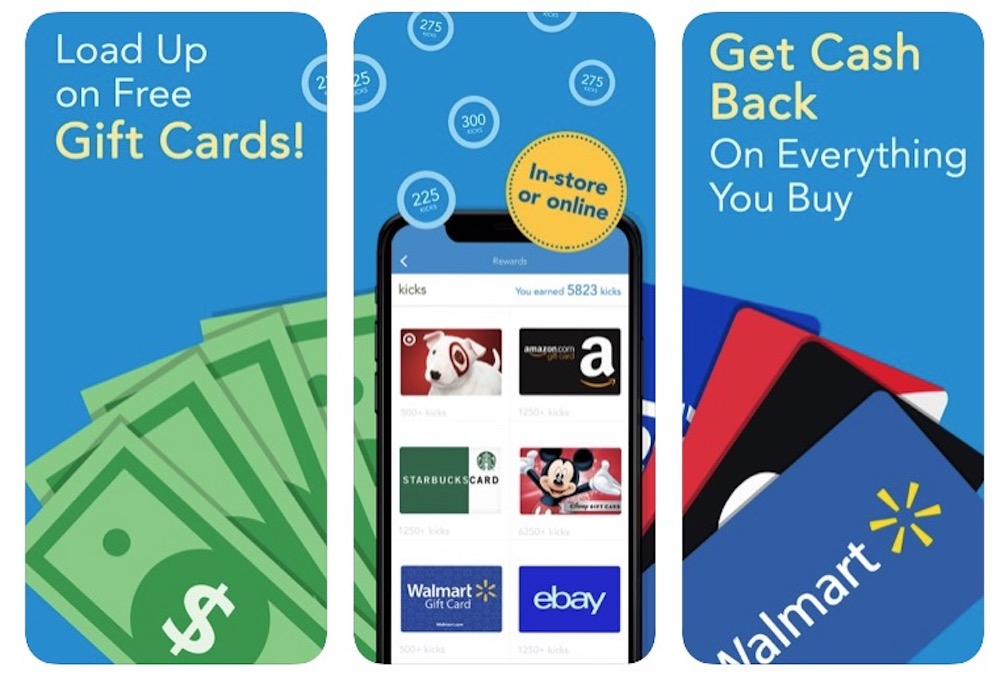

Shopkick

Shopkick’s rewards program does support online shopping at major sites, but also includes a brick-and-mortar aspect for earning gift cards. You see, advertisers want to know what stores you visit and what products you are buying off the shelves there. Allow the app to track your location, scan the barcodes of products you buy, and submit your receipt after purchase – then you’ll earn rewards, discounts, and gift cards from major brands.

————-

Disclosure:

* iDrop News is a paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures.

For Securities priced over $1,000, purchase of fractional shares starts at $0.05.

1This material is not intended as investment advice and is not meant to suggest that any securities are suitable investments for any particular investor. Investment advice is only provided to Stash customers. All investments are subject to risk and may lose value. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

2Stash Monthly Wrap Fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

Stash through the “Diversification Analysis” feature does not rebalance portfolios or otherwise manage the Personal Portfolio Account for Clients on a discretionary basis. Each Client is solely responsible for implementing any such advice. This investment recommendation relies entirely on the responses you’ve provided regarding your risk tolerance. Stash does not verify the completeness or accuracy of such information. Investing involves risk, including possible loss of principal. No asset allocation is a guarantee against loss of principal.

Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser. Investing involves risk and investments may lose value.

We may earn a commission from affiliate links. Continue Below.