5 Investment Apps That Can Make You Money (Just By Signing Up)

Credit: Qualit Design / Shutterstock

Credit: Qualit Design / Shutterstock

Toggle Dark Mode

Today’s investment apps have a variety of user-friendy ways to invest a certain amount of your money into stocks and funds, using bots, targeted goals, and include a variety of stock tips. They can be incredibly useful, especially for busy millennials and professionals who may have better use of their time (plus some variety for those who like to trade and experiment).

Even better yet, a number of these apps come with some sweet starting gifts or deals to help provide cash for investment and make it easier to get started. Here are our favorites and what you can expect.

Stash

Stash is an all-purpose app designed to help people invest, bank, and save1. You can set up a retirement account2, use their debit card that lets you to earn Stock-Back® rewards3, receive your paycheck up to two days early with direct deposit4, and a whole lot more. It can be a good choice if you don’t have any financial apps, and want one that can take care of nearly everything at once. The beginner program starts at $1 a month5, but you can choose to add more features based on what you’re looking for. When you sign up for a new account from our link, Stash will give you a $5 bonus to invest once you deposit at least $5 into your invest account.*

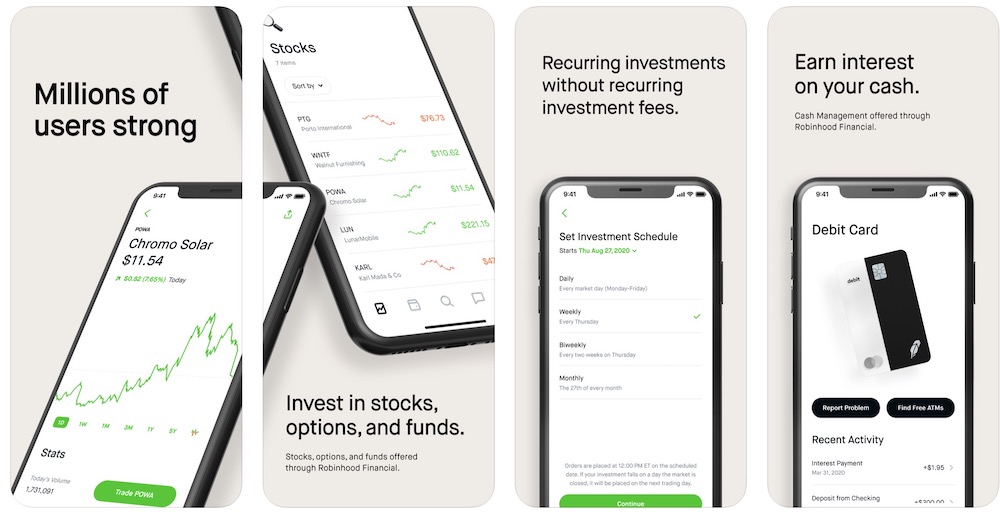

Robinhood

Robinhood is designed for app users who like to take a much more active role in their investments. While it’s not exactly for daytraders, it does allow for frequent selling and buying, customizing options for your own goals, and lots of access to real-time market data about particular stocks for your investment needs. There are also options for customizing market news, learning the ropes for picking out the right stocks for you, and the ability to earn competitive interest on your brokerage account.

But perhaps the best features for frequent investors is the ability to make $0 commission for any self-directed individual cash or margin brokerage accounts for U.S. securities (non-commission trading fees may still apply). This type of discount is usually relegated to the big brokerage sites and it’s really nice to see it here. You also get one share of free stock when you open an account.

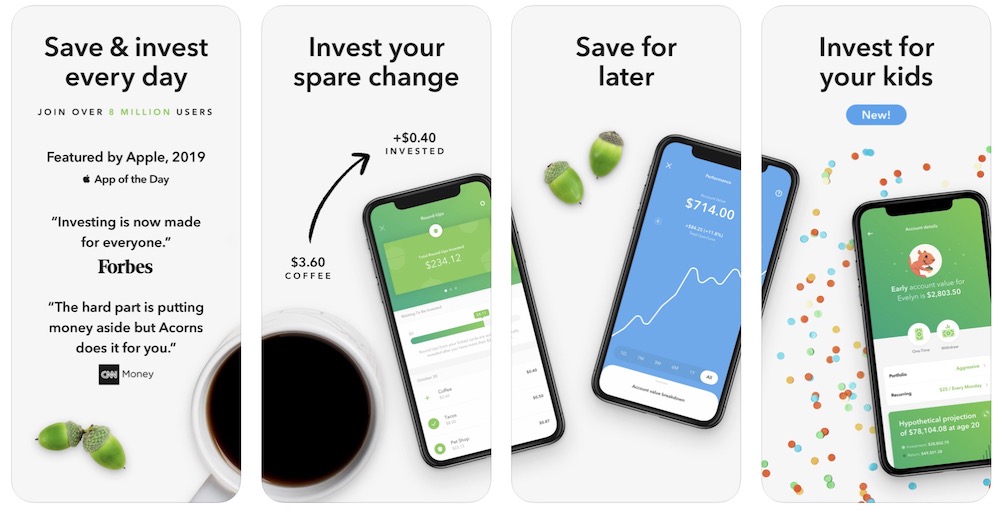

Acorns

Acorns is an app about growing your savings, even if you are just starting out. It allows you to find ways to save, as well as round up on everyday purchases and add the extra to a savings account where your money can grow. You can also set up recurring investments as you please to make sure some of your income is always invested in the right accounts each month. This makes Acorns a great pick for people who aren’t as interested in making lots of stock or fund decisions but need an important platform to begin their savings.

Acorns offers a $10 bonus investment via Fond when you sign up and make an investment of your own, plus they offer cash for referrals if you want to try to get others interested in the app.

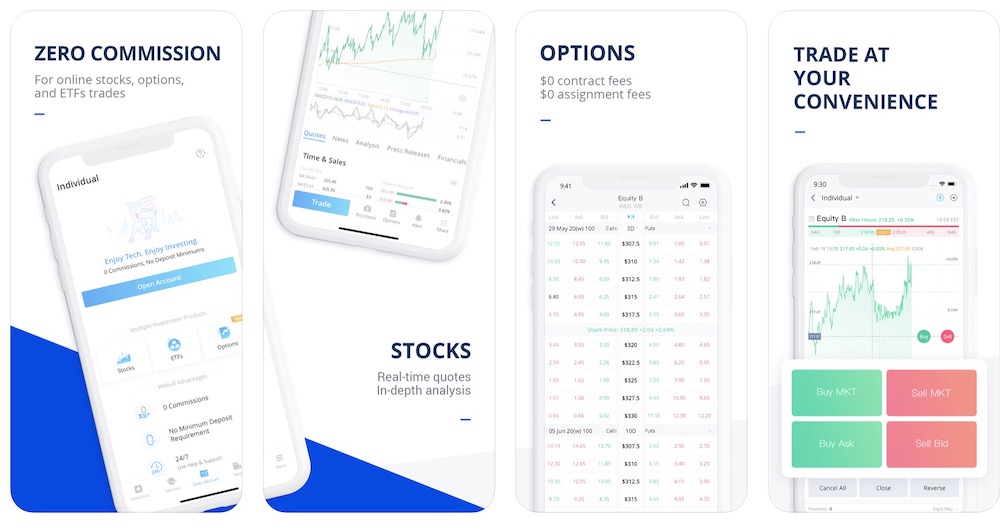

WeBull

WeBull is designed for active traders who want to make decisions on the go and is especially useful for finding specific stocks and making quick trading decisions. Bids and asks are very easy to play, and WeBull enables setting up trade options before and after market hours so you can be ready for the next day. There are also many analytics tools that you can learn to use over time to pinpoint what you value in a stock and what its strengths are.

There are several current important WeBull deals. Make an initial deposit of $100, and you’ll get two free stocks valued between $8 to $1,600 (a bit of a lottery, but still fun). Transfer $2,000 from another account, and they will reimburse all your transfer fees, too. You can also refer friends to get more free stocks if you want.

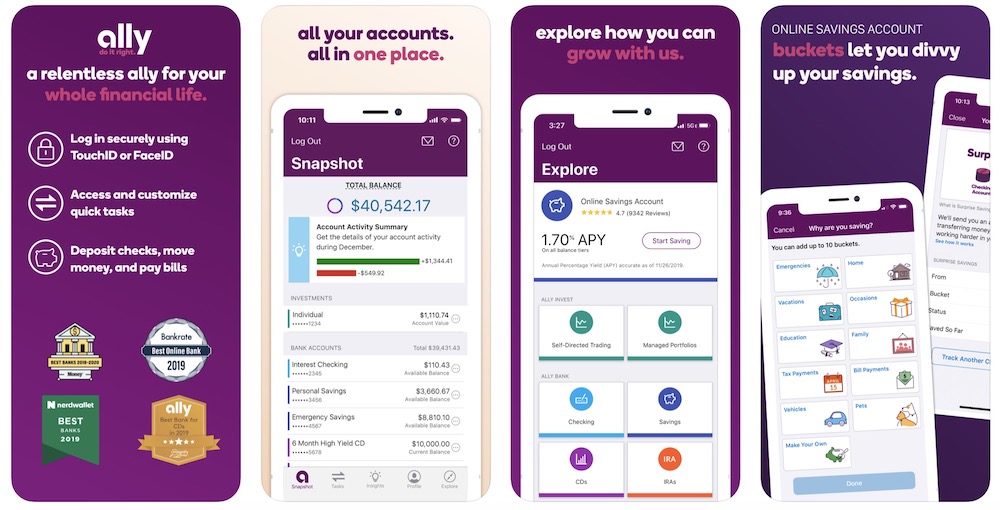

Ally Invest

Ally is more of a traditional investment platform, but they have a strong mobile app that makes management on the go pretty effortless. They also offer $0 commission-free trading and 50-cent fees per contract. But the real treat here is, when you open and fund an account, you can get $50 to $3,500 in bonus cash for investing upon sign-up as long as you have a big deposit. It’s certainly worth taking a look if you want to invest or move a lot of money onto the platform and would like a big reward for doing so.

Disclosures:

* iDrop News is a paid non-client endorsement. See Apple App Store and Google Play reviews. View important disclosures. Promotion is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A. Inc., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any funds earned through this promotion.

1Stash offers access to investment and banking accounts under each subscription plan. Each type of account is subject to different regulations and limitations. See the Advisory Agreement and the Deposit Account Agreement for more information.

2 Stash does not monitor whether a customer is eligible for a particular type of IRA, or a tax deduction, or if a reduced contribution limit applies to a customer. These are based on a customer’s individual circumstances. You should consult with a tax advisor.

3Stash Stock-Back® Rewards is not sponsored or endorsed by Green Dot Bank, Green Dot Corporation, Visa U.S.A., or any of their respective affiliates, and none of the foregoing has any responsibility to fulfill any stock rewards earned through this program. Stock-Back Rewards that are issued to a participating customer’s personal brokerage account via the Stash Stock-Back Program, are not FDIC Insured, Not Bank Guaranteed and May Lose Value.

4Early availability depends on timing of payor’s payment instructions and fraud prevention restrictions may apply. As such, the availability or timing of early direct deposit may vary from pay period to pay period.

5The Stash Monthly Wrap Fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

Stash Banking Account opening is subject to identity verification by Green Dot Bank. Bank Account Services provided by and Stash Visa Debit Card (Stock-Back® Card) issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. Investment products and services provided by Stash Investments LLC, not Green Dot Bank, and are Not FDIC Insured, Not Bank Guaranteed, and May Lose Value.

Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser. Investing involves risk and investments may lose value.

We may earn a commission from affiliate links. Continue Below.