PSA: Watch Out for This New Apple Pay Scam

Credit: DenPhotos / Shutterstock

Credit: DenPhotos / Shutterstock

Toggle Dark Mode

Apple Pay is a convenient way to pay for merchandise and services and it is a more secure way to pay compared to a credit card or debit card. However, that doesn’t mean Apple Pay users are immune from getting scammed. Let’s take a look at how it happens, how you can avoid it happening, and what to do if it happens to you.

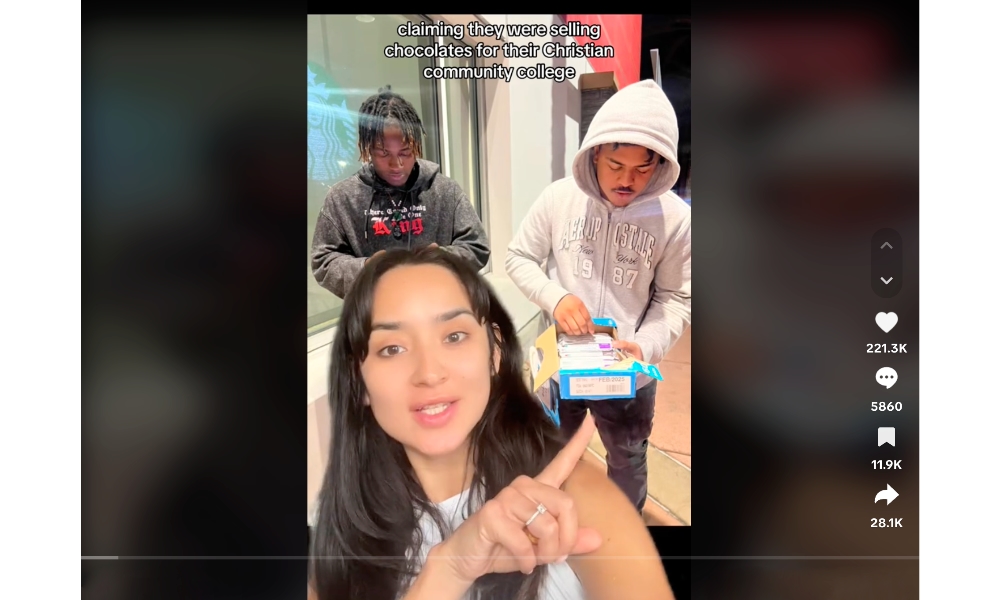

TikToker Hanna (@mamaahannaa) decided to do a charitable deed and help two young two men raise money for their community college. Unfortunately, she was instead targeted (while outside of a Target department store) for a new kind of scam.

In a now-viral TikTok video, Hanna talks about how she was approached outside of a Target store by two young men who said they were selling chocolates to raise money for their Christian community college. Hanna decided to purchase $10 worth of candy to support the young men and their cause.

When Hanna brought up Apple Pay on her iPhone to pay for the chocolates, one of the young men instead quickly tapped his phone on hers initiating the transaction before she could. This resulted in an “accidental” transfer of $975 instead of the $10 she expected to pay. Hanna may not have known about the overcharge until later, except she asked for a receipt for the transaction, and it was then that the young men began apologizing for “accidentally” overcharging her $975.

“At this point, I still wanted to believe him because he seemed very apologetic, and I was very naive,” Hanna said in a follow-up video. “I had had a very long day, and I didn’t wanna have to deal with this right now.”

Hanna immediately contacted Apple Pay customer support, hoping to get it quickly reversed. Unfortunately, Apple Pay support agents told her they did not have sufficient evidence to prove that she paid the $975 by mistake.

She also contacted Apple Card issuer Goldman Sachs and was informed that the dispute could take up to three months to resolve.

This scam appears to target good-hearted folks that are wanting to help but who are in a rush and may not notice they’ve been scammed until it’s too late.

As pointed out by The Daily Dot, you could be a victim of this scam without being directly approached by a scammer. Instead, bad actors can hang around booths or vendors at crowded events and slide into a tap-to-pay transaction before it can be initiated by the vendor.

It’s going to be a busy time of year with music and food festivals, flea markets, and outdoor events of all kinds this summer, soon to be followed by the holiday shopping season, so crooks are sure to be trying to pull off scams like this. Any time you are paying via tap-to-pay using Apple Pay or similar tap-to-pay systems like those offered by some banks and department stores, always double-check the transaction amount before double-clicking your iPhone to bring up Apple Pay.

Never bring up Apple Pay to be ready ahead of paying. Tap-to-pay systems like Apple Pay use near-field communication (NFC) chips, which have an effective connection distance of about four inches. Do not initiate payment until you are over the trusted payment terminal or device and can see the amount on the terminal or the other user’s device.

If you do fall victim to a scam, don’t bother calling Apple, as they don’t have any control over your account. Instead, immediately contact the bank that issued the credit or debit card.