The iPhone Is Suddenly Doing Better in China

CookieWei / Shutterstock

CookieWei / Shutterstock

Toggle Dark Mode

As Apple continues to work on delivering Apple intelligence in China, it seems that iPhone sales in the Middle Kingdom have taken a surprising turn for the better.

China has long been considered one of Apple’s most critical markets for the iPhone, which isn’t surprising, considering it accounts for nearly a fifth of the world’s population and a quarter of the global smartphone market. Of the over 300 million smartphones sold worldwide in the first quarter of 2025, nearly 72 million were sold in China.

Needless to say, Apple wants to claim its piece of that pie, but it’s been challenging for the iPhone as it’s also the most competitive smartphone market in the world. Chinese brands still dominate, with local homegrown heroes like Huawei and Xiaomi being the more popular choices.

It also doesn’t hurt those companies that they benefit more from government subsidies than Apple does. The Chinese government helps offset the purchase price of cheaper phones, but most of Apple’s iPhone lineup exceeds that threshold, leaving Chinese consumers to pay full price if they want an Apple flagship.

Over the past two years, Apple’s market share in China has declined, most notably to 13.7% in Q1 2025, from around 20% in early 2024. According to estimates, it shipped only 9.8 million iPhones in China during that quarter, and that’s just the most recent of what’s been a bad run since late 2022 — a period during which it had only one quarter where it posted year-over-year revenue growth in China.

Meanwhile, Xiaomi increased its shipments by 40% year-over-year in Q1 2025. Consumer spending on smartphones in China also tends to run lower than in the US, with the average selling price (ASP) of a Chinese smartphone at $270 (in USD) compared to $430 in the United States. Part of that’s due to subsidies, but there’s also a much larger selection of very capable Chinese-made smartphones that are sold exclusively in that country, as well as new Chinese-approved AI models that Apple can’t (yet) compete with. By comparison, the iPhone’s ASP in China is $790 (in USD), compared to $900 in the US.

iPhone Sales Bounce Back

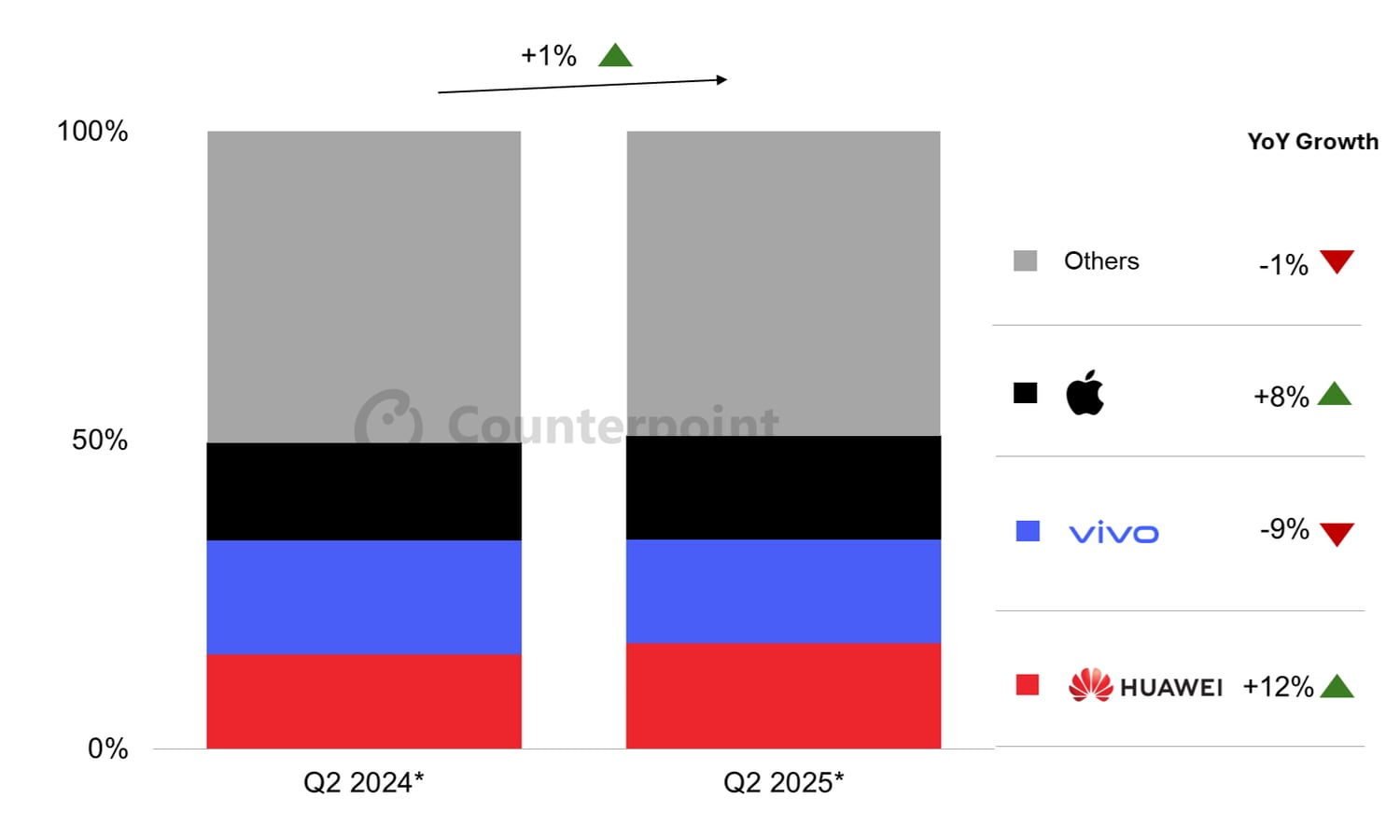

Nevertheless, Apple seems to have turned things around in the second quarter. New data from Counterpoint Research reveals that iPhone sales in mainland China grew in Q2 2025 by 8 percent over the year-ago quarter.

While that’s a healthy increase for the iPhone, Apple’s growth is still overshadowed by Huawei, which posted a 12 percent year-over-year growth and remains poised to take the number one spot in the Chinese market for the quarter.

The growth in iPhone sales wasn’t merely random. As CNBC notes, Apple has been making a full-court press with Chinese e-commerce firms, which began offering discounts on the iPhone 16 models during the quarter to coincide with the 618 shopping festival — essentially China’s version of Black Friday and Amazon Prime Day combined.

During that period, major Chinese e-tailers such as JD.com and Tmall were offering discounts of up to $350 off retail prices for the iPhone 16, while Apple also increased the trade-in values of older models to encourage upgrades. These discounts also brought entry-level iPhone models within the reach of China’s subsidies, making them even more attractive to buyers.

“Apple’s adjustment of iPhone prices in May was well timed and well received, coming a week ahead of the 618 shopping festival,” Ethan Qi, Counterpoint’s associate director, said in a press release.

The bump is even more remarkable considering that Counterpoint reported the 618 sales period was flat year-over-year, “reflecting sluggish consumer spending over the festival period.” In other words, Chinese consumers didn’t spend significantly more overall than last year, but they did spend more on iPhones.

Still, it’s too early to break out the champagne for Apple’s ambitions in China. Since much of the sales bump was driven by both discounts and subsidies, it could easily be an aberration. China’s government is also expected to scale back the national subsidy on smartphones later this year.

A change in subsidies could ultimately benefit iPhone sales by narrowing the gap between Apple’s pricier models and other popular smartphones in the Chinese market. Further, Apple has yet to launch Apple Intelligence in China. While its AI features have received a lukewarm reception in Western markets, Chinese smartphone consumers are much more enthusiastic about AI features, as many of them rely entirely on their mobile devices. The challenge for Apple won’t be a lukewarm reception for Apple Intelligence, but rather if it can compete with the tools already being offered by its competitors, who have had a substantial head start in this market.