Stunning Apple Results Post Biggest Surprise Since 2021

dennizn / Adobe Stock

dennizn / Adobe Stock

Toggle Dark Mode

It looks like Apple has dodged multiple bullets so far this week. First, there was the fear that Apple’s biggest manufacturing partner, Foxconn, was halting trading pending a major iPhone-related announcement. Turns out, the market-moving news had nothing to do with tariffs or the iPhone, but the kickoff of a strategic partnership that could help Foxconn become a leader in AI data center design and development.

Yesterday, Apple announced its fiscal third quarter (ending June 28) financial results. Guess what? Tariffs or no tariffs, Apple beat analyst expectations by almost five percent.

This may not sound like much, but in dollars, this 5% amounts to nearly $5 billion. While analysts projected Apple’s revenue would be $89.54 billion, Apple reported $94.04 billion for its third quarter, with a gross margin of 46.5%. That’s almost $44 billion, folks.

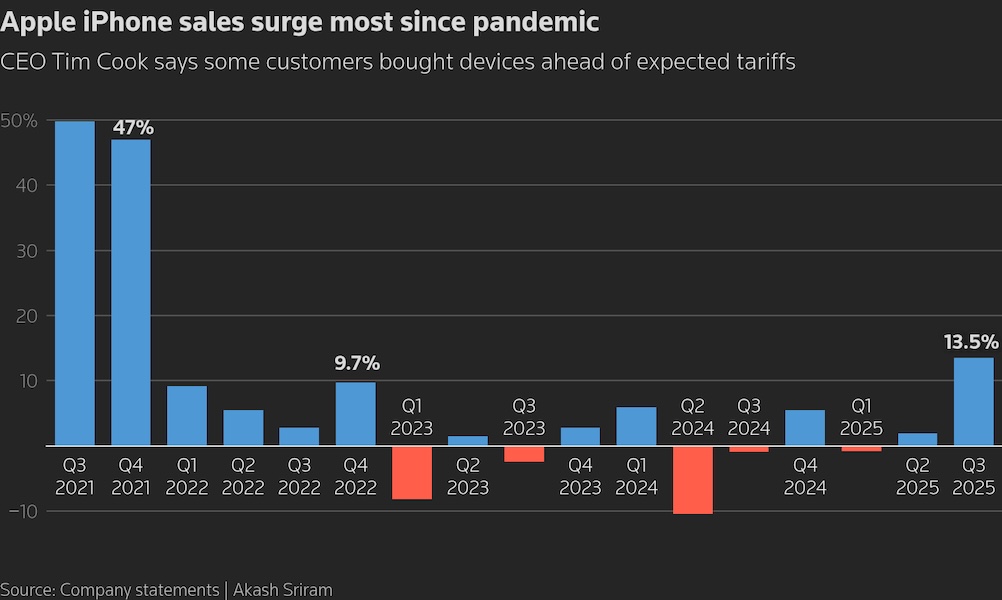

This $94.04 billion quarter is up almost 10% from the same quarter last year. In addition to overall revenue growth, Apple saw its highest quarterly iPhone sales growth since the pandemic in 2021. As it turns out, there likely was some panic buying in response to the news of tariffs and potential iPhone price hikes. Cook said, “We saw evidence in the early part of the quarter, specifically, of some pull-ahead related to the tariff announcements.”

In even better news, Apple’s Chief Financial Officer Keven Parekh expects growth for the current quarter to be “mid to high single digits,” predicting to beat Wall Street’s projected 3.27% growth yet again. While Cook acknowledged the increase in purchases in connection with earlier tariff drama, he also told analysts that tariffs cost Apple $800 million in the past quarter, and might amount to as much as $1.1 billion this quarter.

We’re happy to see Apple’s resiliency on display. However, it’s far from out of the woods in terms of the big financial picture and future political and economic uncertainty. According to Yahoo Finance, Apple shares are down around 17% on the year. In contrast, Nvidia, Microsoft, and Meta (Facebook) have all gained at least 20% year to date. In addition to meeting investor expectations and the unpredictable tariff threats forcing Apple to reimagine its supply chain, Apple has to contend with disappointments with Siri, adverse regulatory environments at home and abroad, and rivals like Samsung in the smartphone market. Would you bet against Apple?