Streaming Shake-Up: Netflix Buys Warner Bros. for $83 Billion

Toggle Dark Mode

In a seismic shift that could change the landscape of streaming, Netflix has entered into a definitive agreement to acquire Warner Bros. — a deal that includes HBO and HBO Max.

As we reported in October, the sprawling Warner Bros. Discovery has been planning a breakup for some time, with reports that the cable networks and streaming/studio businesses would be split up to go their own separate ways. Paramount Skydance reportedly made several bids to try and acquire the entire conglomerate, but it failed to sway the media empire’s Board of Directors from their chosen path of divvying up the company.

At the time, several suitors had expressed interest in picking up the streaming and studio sides, a list that reportedly included all the usual suspects: Netflix, Amazon, Comcast, and Apple. It’s unclear how many of these entered the bidding war, but in any case it seems that Netflix has come out on top.

Netflix announced today that it has entered into a “definitive agreement” with Warner Bros. Discovery, Inc. (WBD), in which it will “acquire Warner Bros., including its film and television studios, HBO Max and HBO.”

The deal is valued at a cool $82.7 billion, making it one of the largest acquisitions ever — and possibly the largest in the modern streaming era. The deal won’t go through right away, as it not only has to clear the necessary regulatory hurdles but also wait for Discovery Global — the cable network division — to be spun off into a new publicly traded company, which won’t happen until the second half of next year.

However, once it does close, Netflix will become indisputably the largest streaming provider on the planet, since its own original content will be joined by a staggering collection of WB’s properties and originals, including The Big Bang Theory, The Sopranos, Game of Thrones, The Wizard of Oz and the DC Universe.

“Our mission has always been to entertain the world,” said Ted Sarandos, co-CEO of Netflix. “By combining Warner Bros.’ incredible library of shows and movies—from timeless classics like Casablanca and Citizen Kane to modern favorites like Harry Potter and Friends — with our culture-defining titles like Stranger Things, KPop Demon Hunters and Squid Game, we’ll be able to do that even better. Together, we can give audiences more of what they love and help define the next century of storytelling.”

Netflix will also be acquiring Warner Bros. studios as part of the deal, which could pose a problem as it currently produces several hit shows for Apple TV, including Ted Lasso and Shrinking. Contractual deals would likely prevent Netflix from simply picking those up and running them as its own, but it may also have little interest in continuing to produce content for what is now effectively a rival streaming service. While Warner Bros. also owned HBO Max, it was run as a distinct business unit, and Warner Bros. Studios had been creating original content long before the company got into the streaming business.

For now, Netflix says it “expects to maintain Warner Bros.’ current operations and build on its strengths, including theatrical releases for films,” so independent productions may continue as usual, but it’s less clear if HBO Max will remain a separate service; while Netflix says “HBO and HBO Max … provide a compelling, complementary offering for consumers,” it also says it plans to add “the deep film and TV libraries and HBO and HBO Max programming” to expand its content catalog for Netflix members.

Still, the deal is far from done, as US regulators don’t appear to be particularly warm to the idea on either side of the aisle. Earlier this week, the New York Post reported that the Trump administration is concerned about giving Netflix, which already has market dominance, even more control over Hollywood, and that the Justice Department is already preparing to launch a sweeping, multiyear investigation.

Netflix seems keenly aware of these risks. According to a regulatory filing reported by The Washington Post, the company has agreed to pay a massive $5.8 billion breakup fee if the deal is blocked by regulators — a signal that they are either extremely confident or willing to pay a premium to prove they are serious.

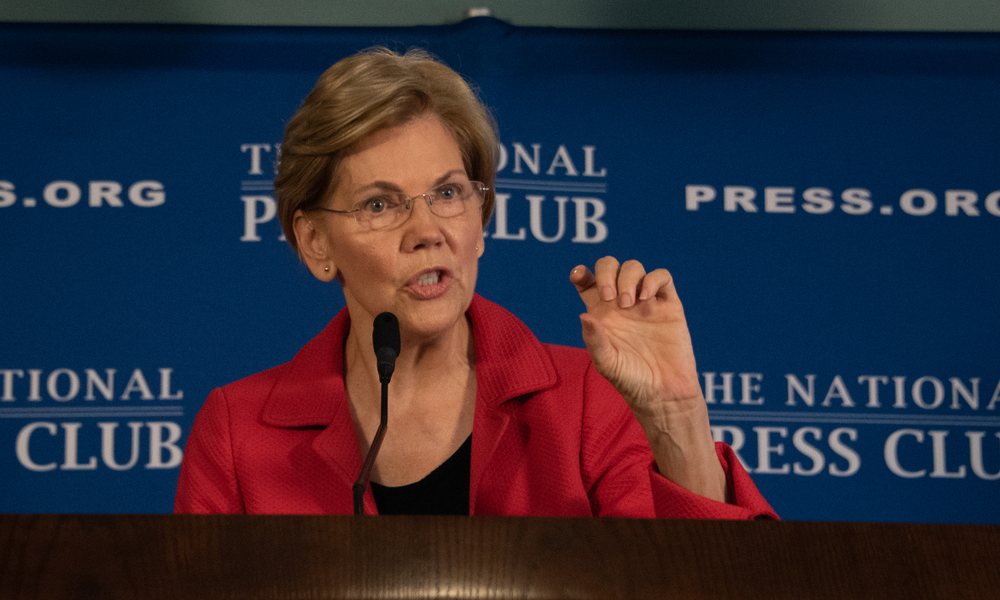

Meanwhile, Deadline published a statement from Senator Elizabeth Warren, a Democrat who has often expressed vocal opposition to large conglomerates, calling the deal “an anti-monopoly nightmare” that would put control of half the US streaming market in the hands of one company.

“Netflix has been running around Washington trying to convince everyone that their deal is fine from an antitrust standpoint,” one former government official with firsthand knowledge of the Trump administration’s thinking told the Post, while adding that “No one is buying what they’re saying either at senior levels of the White House or DOJ antitrust.”

HBO Max is already the number 3 streaming service in the US, with 100 million subscribers, placing it behind Disney+ and Netflix, which has 300 million subscribers. A merger of Netflix and HBO Max would create a single entity with 400 million subscribers, making it twice as large as Disney+ and creating a potentially unstoppable force in streaming, especially when you factor in the studio side, which could lead to Netflix having significant control over the gates of Hollywood.