iPhone ‘Undisputed Leader’ in Record 2023 Smartphone Sales

Credit: Thai Nguyen

Credit: Thai NguyenToggle Dark Mode

Although overall sales of smartphones are on the decline around the globe, premium smartphone models, like the iPhone 15 Pro and iPhone 15 Pro Max have hit a new year-over-year growth record of 6% — and the iPhone 15 Pro lineup accounts for the lion’s share of these premium smartphone shipments, handily beating out rivals like Samsung.

Over the last few years, we’ve seen global sales of smartphones in general continue to fall. However, sales of the iPhone 15 have bucked the trend, with Apple’s market share continuing to expand. However, that’s a different story for the premium smartphone market, as Counterpoint Research’s figures show.

The research firm’s 2023 figures, including its preliminary estimates for the fourth quarter, contain encouraging news for sellers of premium handsets.

“The global premium smartphone (wholesale price $600) market’s sales are likely to grow 6% YoY in 2023 to hit a new record,” Counterpoint Research said in a statement. “The premium segment is likely to capture close to one-fourth of the global smartphone market sales and 60% of the revenues in 2023.”

While the firm reports global growth, the new record is due to sales in China, India, Latin America, and the Middle East and Africa. Of these countries, India is reported to be the fastest-growing premium market in the world.

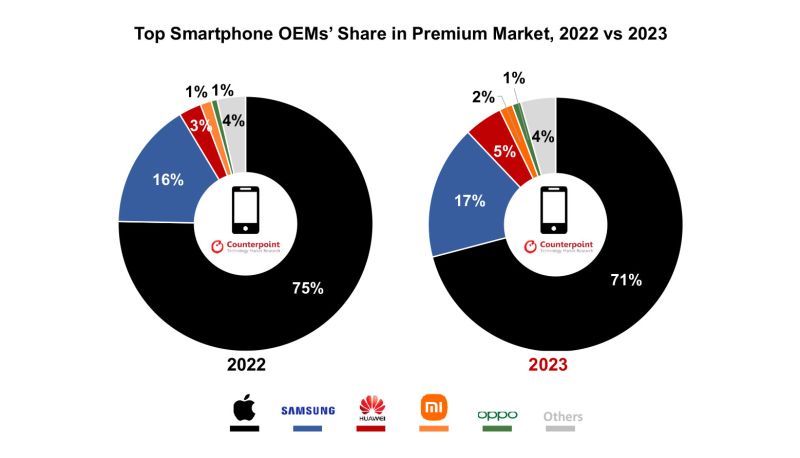

While Apple held a 71% share of the 2023 premium smartphone market, that’s actually down from 2022’s 75% share of the pie. Counterpoint says Samsung has gained with its Galaxy S23 series and its foldable Galaxy Z Series phones (up 1% from the 2022 figure), while Huawei has “seen a resurrection in China,” driven by the company’s Mate 60 series.

The research firm also says foldable smartphones have emerged as a differentiator in the premium market. The global foldable smartphone market expanded 10% year-over-year in the second quarter of 2023, reaching 2.1 million units.

During the second quarter of 2023, shipments in the overall Chinese smartphone market were hurt by the current economic challenges facing the country and a reduction in spending by consumers, slipping 4% year-over-year to 61.9 million units. However, the foldable smartphone market in China surged 64% year-over-year to reach 1.2 million units. China now holds the largest share of the global foldable smartphone market, with a 58.6% share.

“There has been a shift in consumer buying patterns in the smartphone market,” noted Counterpoint senior analyst Varun Mishra. “Considering the importance a smartphone holds, consumers are willing to spend more to get a high-quality device that they can use for a longer period.”

“Owning the latest and greatest flagships has also become a status symbol for many consumers, especially in emerging markets where they are jumping directly from the mid-price band to the premium band,” continues Mishra. “Further, these devices are increasingly becoming more affordable due to promotion seasons and financing options.”

Counterpoint says that “it is the ultra-premium segment” that is driving premium smartphone sales growth, with smartphones costing $1,000 or more capturing more than one-third of the total premium market sales during 2023.

The 6% premium smartphone market’s growth during 2023 contrasts with the mere 1% increase in the previous year, 2022.