Global Smartphone Market Grows in Q1 2025, iPhone Led the Way

8th / Adobe Stock

8th / Adobe Stock

Toggle Dark Mode

According to market research firm Counterpoint, the global smartphone market increased by 3% in the first quarter of 2025. While the jury is still out as to whether this growth will continue with the full impact of tariffs yet to be realized, Apple scored a notable achievement for the first time in company history.

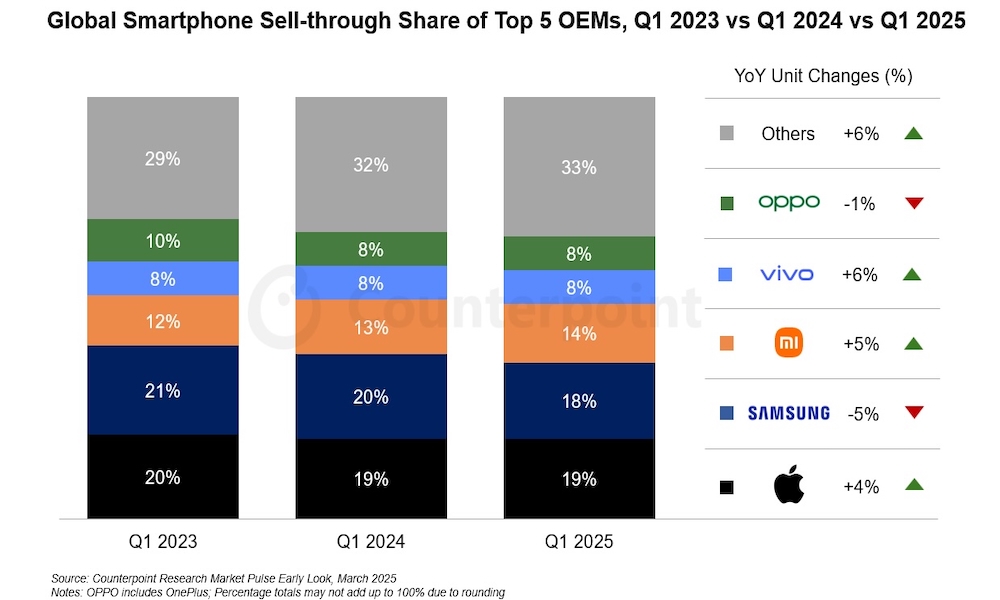

The iPhone was the number one smartphone in sales for the first time ever in a Q1 reporting period, achieving 19% of the market share. This represents a 4% increase in iPhone sales from Q1 2024. It’s hard to imagine that a company consistently ranking as one of the most valuable in the world (and has since about 2011) has not previously achieved this position. Despite the various headwinds, Apple somehow continues to find a way to do more than just tread water.

Apple typically announces new iPhones every year in the fall, and they’re available for sale shortly after. This year, Apple launched the new iPhone 16e in February. The iPhone 16e is the most budget-friendly iPhone, and it’s also capable of running Apple Intelligence. This move undoubtedly helped sales figures, even though the $599 iPhone 16e significantly exceeded the $429 starting price of the iPhone SE, the model it effectively replaced.

Another reason credited for the iPhone’s 2025 Q1 growth is its sales momentum in growing markets like Japan and India. iPhone sales in Apple’s biggest markets, such as the US, Europe, and China, have declined or flattened. However, this slide was offset by double-digit growth in Japan, India, the Middle East and Africa, and Southeast Asia. While Counterpoint predicts an overall decline in smartphone sales in 2025, this may fail to account for factors like the Trump administration including the iPhone on its official list of tariff exemptions (at least for the near term).

Clearly global markets remain in the shadows of unusual economic uncertainty. So far, Apple has managed to power through the headwinds with timely product releases and some political pull. Can Apple continue defying the odds as consumers feel significant financial challenges? We don’t know yet. One key takeaway is not only Apple’s 4% increase in year-over-year Q1 iPhone sales but Samsung’s 5% decrease. Another determining factor may be the extent to which Apple can mitigate price increases if (or when) tariffs eventually hit.