Chase Launching “Chase Pay” Service to Compete with Apple Pay

Toggle Dark Mode

Apple Pay has been acquiring new partners in both the retail and financial services sectors by leaps and bounds lately, even despite the rollout of the company’s mobile payments service having taken over a year to achieve its current level of adoption and support.

To that end, Apple continues to entice and acquire additional support from partners in both the banking and retail realm around the globe. However, so it seems, the #7 largest global banking firm, by asset volume, may be going down its own route.

As initially reported by Re/code, JP Morgan & Co will soon be launching its own mobile payments service, ingeniously dubbed “Chase Pay,” in an effort to compete with Apple’s own payments platform.

Chase’s CEO of Consumer and Community Banking, Gordon Smith, reportedly announced the news at this years’ Money20/20 payments conference in Las Vegas, Nevada.

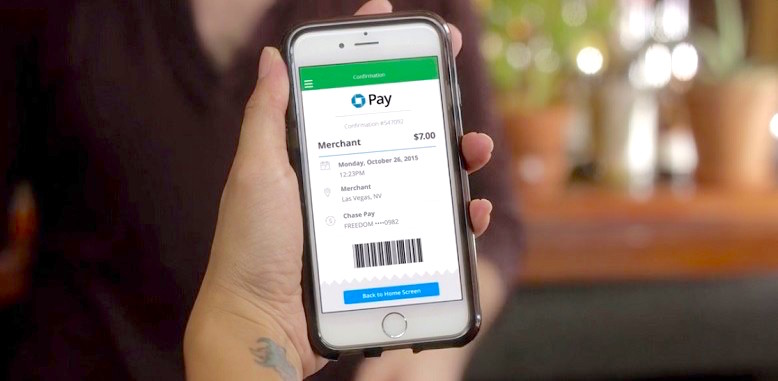

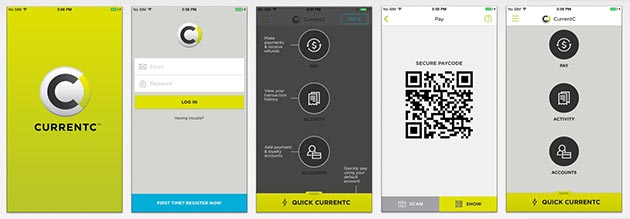

In a nutshell, Chase Pay will work via QR code in lieu of NFC, enabling customers to make purchases with their smartphones by showing the code to a cashier. Chase stated that it’s partnering with MCX, utilizing the firm’s own CurrentC platform to facilitate the banking behemoth’s endeavors.

The “MCX Consortium,” as it’s known, promotes the QR-based CurrentC payments service at a collection of merchants like Walmart, Target, Sunoco, Kohl’s, Best Buy, Rite Aid, CVS, Lowe’s, Sears, Shell, Michaels, 7-Eleven, and more. Once it’s officially launched, sometime in 2016, the CurrentC platform — in conjunction with Chase Pay — will be available as a payment option in all of these retail locations.

“In some of these stores, customers will be able to pay by showing a QR code within the Chase Pay app. In others, Chase customers will have to use Chase Pay inside MCX’s own CurrentC app. It’s not clear which of the MCX member retailers will support which method.”

Having been in development for several years, as it stands, CurrentC actually gives Apple Pay an impressive edge, primarily considering its earlier release timeline. Most MCX merchant members were once subject to an exclusivity agreement, however that has since expired, opening the door for several MCX merchants to also accept Apple Pay.

It’s not expected that Chase is going to in any way overtake or undermine the Apple Pay platform. Especially considering the fact that Chase also supports Apple Pay, with its own branded credit cards and debit cards eligible to be used with Apple’s payments service, as well.