Apple TV+ Ranks Low Even Among Apple Fans

Bastian Riccardi

Bastian Riccardi

Toggle Dark Mode

Despite the critical acclaim many of Apple’s original productions have received, Apple TV+ remains the least popular streaming service, even among Apple fans.

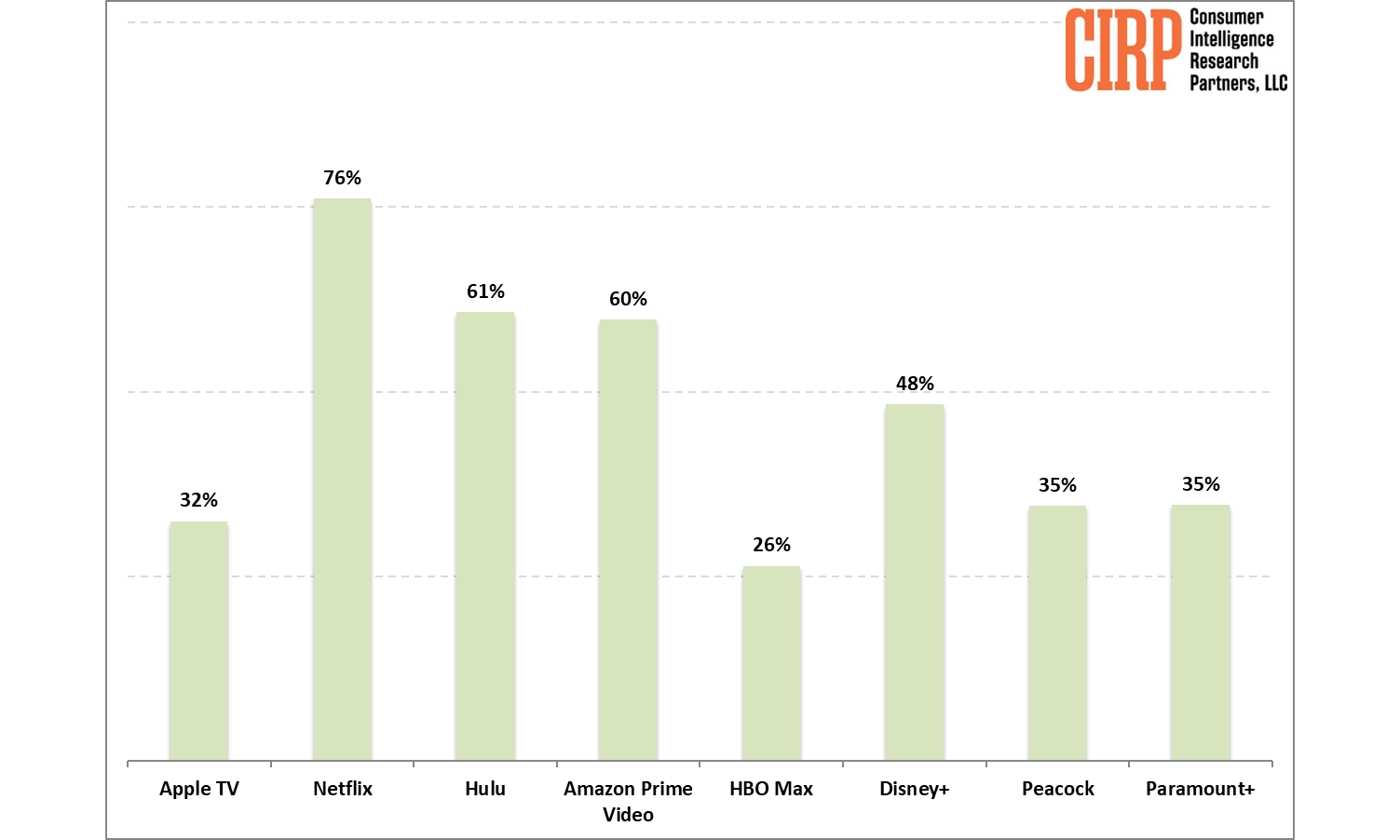

At least, that’s what a new study by Consumer Intelligence Research Partners (CIRP) reveals. While the numbers shouldn’t come as too much of a surprise — Netflix remains the behemoth among US viewers — what’s interesting is that CIRP looked exclusively at recent buyers of Apple products.

Specifically, CIRP says it surveyed US adults who bought an iPhone, iPad, Mac, or Apple Watch in the preceding three months to ask them which streaming services they use. Within that group, Apple TV+ has “a decent but by no means significant streaming video share,” ranking seventh out of the eight biggest streaming services in the United States.

Unsurprisingly, Netflix leads the pack, with 76% of those surveyed saying they subscribe to that service. Hulu and Amazon Prime Video were neck-and-neck for second place, at 61% and 60%, respectively, and Disney+ came in with 48%.

The numbers fell considerably from there, but Peacock and Paramount+ still beat out Apple TV+, tying for 35% versus Apple’s 32%. Only Max trailed behind Apple, coming in at 26%, or about one-quarter of the Apple users surveyed.

The results are slightly skewed as CIRP only surveyed those who recently purchased an Apple device. That leaves out a much larger group of Apple fans who may have chosen to skip this year’s iPhone 16, Apple Watch Series 10, or M4 Mac lineup but are still loyal Apple TV+ subscribers. Still, CIRP notes that the results haven’t changed much from previous years.

It’s also worth mentioning that CIRP asked participants which streaming services they “use,” which presumably means watching regularly. Some Apple fans may have Apple TV+ as part of an Apple One bundle, so the actual subscriber numbers may be higher. Still, it’s arguable how much that matters if they’re not actively watching Apple’s programming — at least for anything other than Apple’s balance sheet (Apple doesn’t report specific subscriber numbers for most of its services, so there aren’t any bragging rights to be had here).

The same can be said for Amazon Prime Video, which many folks have as part of an Amazon Prime subscription that they’ve taken out for unrelated purposes, such as fast and cheap shipping of Amazon products. Actual subscriber numbers may be higher, but CIRP’s study seemingly focuses on those who actually watch the service rather than merely having it.

Of course, Apple TV+ and Amazon Prime Video are essentially side businesses to the two tech giants, who make the lion’s share of their money elsewhere. That’s a stark contrast to Netflix, which counts streaming as its only meaningful revenue stream. Even the others on the list are only a piece of larger media conglomerates. When you consider that Disney owns both Disney+ and Hulu, it’s definitely not hurting, although Disney’s bundles suggest there’s likely quite a bit of overlap between those subscriber numbers.

With Apple’s focus on quality over quantity, the biggest challenge faced by Apple TV+ is subscriber retention. Many consumers have moved to a seasonal approach toward streaming services, signing up to binge any new and interesting shows and then cancelling until something else interesting appears. Netflix stays on top thanks to a large enough catalog that folks can nearly always find something on deck, whereas Apple TV+ has many more ebbs and flows. Apple One bundles help to keep Apple’s most loyal customers subscribed, but more casual viewers are likely to go for the a la carte package and hop on and off as the seasons change.

Although Apple’s Services revenue has grown to over half of iPhone sales, reaching $24.97 billion in the last quarter, that number has always had a big asterisk beside it. The Services category encompasses much more than Apple’s user-facing subscriptions like Apple TV+ and Apple Music. That’s also where Apple reports the 15–30% cut it gets from all App Store sales and the lucrative search deal it has with Google, which is around $20 billion per year by itself. Apple won’t say how much Apple TV+ makes, but it has to be a drop in the bucket compared to those other areas, which are believed to collectively account for at least half of its overall Services revenue.