The AI Boom Could Make Your Next iPhone Upgrade More Challenging

Vista Wei

Vista Wei

Toggle Dark Mode

Apple CEO Tim Cook has put together a supply chain that’s the envy of the technology industry, but even Apple’s mighty and efficient logistical powerhouse is facing a new constraint: a surge in AI-driven demand for a single key component made by a lone supplier.

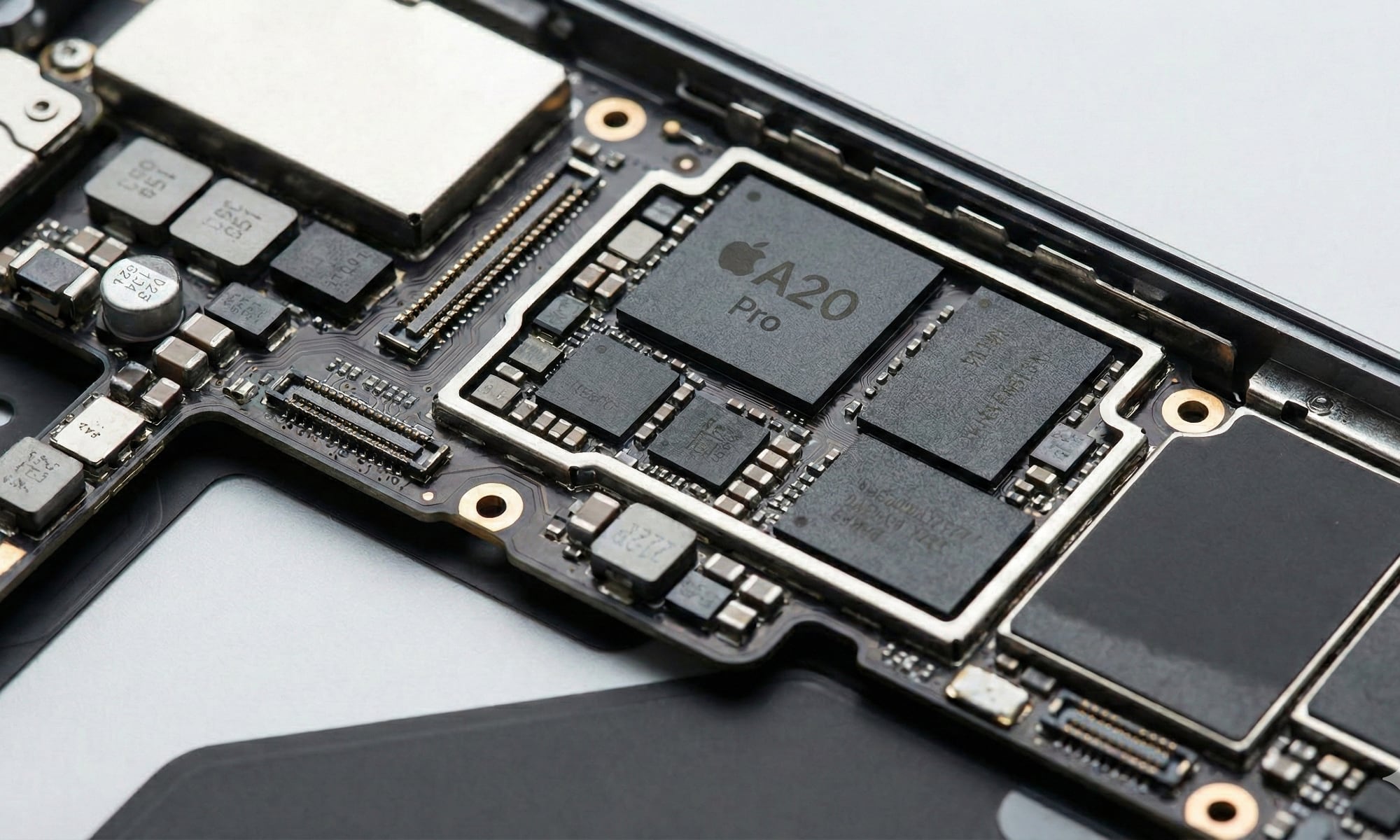

Despite coming through the COVID-19 pandemic and the unpredictable trade tariffs of 2025 relatively unscathed, the artificial intelligence boom may be the inflection point that pushes Apple’s supply chain to its limit. Nikkei Asia reports that Nitto Boseki (Nittobo) — the sole supplier of high-quality glass cloth used in printed circuit boards (PCBs) — is facing an unsustainable increase in demand. While the company is working to increase production capacity, it can’t do that overnight; new lines aren’t expected to go online until late 2027, leaving a critical gap for Apple in the interim.

Apple has faced little in the way of supply issues as it’s advanced an ever-increasing lineup of Apple silicon systems-on-a-chip. As one of the largest consumers in this sector, Apple essentially had “front-of-the-line” status when it came to components, including Nittobo’s glass cloth — but then AI happened.

Now, deep-pocketed tech giants like Google and Nvidia are competing for the same high-performance PCBs to power their AI servers, which can only be manufactured using Nittobo’s glass cloth. This leaves Apple and other tech firms like Qualcomm in a more crowded line, facing a genuine risk of supply shortages for the first time.

The Nikkei Asia report cites multiple industry insiders calling this “one of the biggest bottlenecks for the electronics-making and AI industry for 2026.” While Apple is considering contracting with other manufacturers for alternative materials or lower-quality glass cloth, it may not be enough to offset the shortage at Nittobo.

Apple is also facing rising PCB development costs, which are going up like everything else these days. Tooling costs are also increasing as AI server boards get thicker and harder, requiring drill bits to be replaced more frequently as they wear out from the additional strain.

If Apple and other firms like Qualcomm are feeling the pressure of rising demand and limited supply, consumers may find empty shelves when searching for a new iPhone, iPad, or Mac in 2026.

The industry isn’t simply sitting around waiting for production to grind to a halt. Manufacturers are developing improved processes and searching for alternative suppliers to ease the bottleneck, but for now, the race is on to see who gets the components they need to stay on schedule.