Why Your Next iPhone Might Cost Apple a Fortune (But Not You)

Toggle Dark Mode

As Apple enters 2026, it continues to grapple with rapidly escalating component costs, particularly for chips and memory, as it strives to keep its product pricing under control.

If you’ve been awake the past few years, you know that the rising price of raw materials and finished components has a direct effect on the price you pay at retail. For Apple, this inflation manifests across the board, impacting Macs, iPhones, iPads, and beyond. In the case of the Mac, base configurations and higher-tier storage and RAM options are getting increasingly expensive to source, increasing pressure for Apple to raise its prices.

In a recent Morgan Stanley note to investors, originally shared by AppleInsider, analysts reported on recent conversations with supply chain sources and supply chain checks with Taiwanese suppliers that reveal how tightening supply of components are resulting in higher costs across everything from smartphones to desktop PCs and servers.

Memory costs began rising sharply in late 2025, as demand for memory has grown much faster than the supply can keep up. Reports indicate that DDR5 module prices have surged by 120 to 200% compared to early 2025, while broader DRAM price indexes have climbed nearly 50% year-to-date. These spikes have forced nearly all hardware manufacturers to at least consider significant retail price hikes.

While Apple is certainly not immune to that strain, it holds a distinct advantage over nearly all of its competitors. Thanks to its massive purchasing power and the long-term supply agreements it already secured in 2025, the company has been able to insulate itself against these price shocks — for now.

Apple was able to build its NAND inventory into 2026, with relatively attractive pricing terms from its suppliers. However, those contracts will likely reset to higher numbers once the current agreements are carried out and are renewed.

While this will help Apple absorb some of the higher costs, this will continue to squeeze its bottom line.

Morgan Stanley notes that Apple is still in negotiations for its 2026 DRAM needs, and it could still see sharply higher prices, as memory vendors are pushing for 50% increases and beyond for Q1 2026 contracts to move prices closer to market levels.

Any higher costs would put pressure on Apple’s iPhone storage options, as well as on memory configurations for Mac models. Again, while Apple’s economies of scale might put it in a better place to absorb costs than its competitors, concerns over pricing will only grow if retail pricing stays flat.

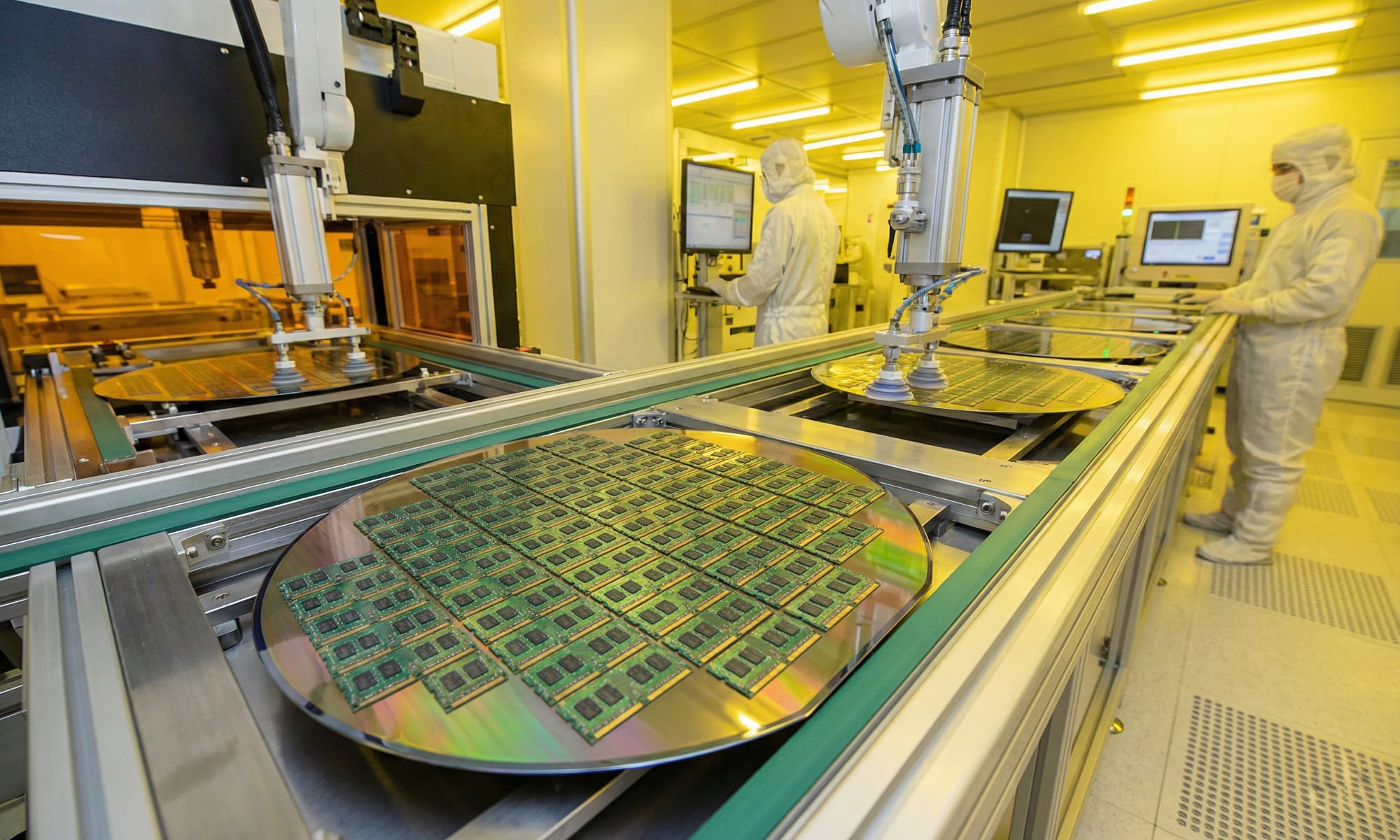

Memory price hikes aren’t the only thing that is causing concern in the industry, as Morgan Stanley notes that “leading-edge” wafer prices are on the rise. While Apple is seeing smaller price hikes than other firms, thanks to its size and position as chipmaker TSMC’s main customer, it will still be affected by rising prices, particularly for its next generation of Apple Silicon-based chips.

The financial firm expects a larger step up in the price of next-generation nodes versus the current processes. While Apple can offset part of that higher price through die-size efficiency — 2 nm and 3 nm processes allow for more chips per wafer — the cost to manufacture its custom Apple silicon is included in the costs of nearly all of its product lines and the “per-wafer” cost is rising so fast that efficiency alone can no longer bridge the gap. TSMC’s 2 nm wafers are now priced at nearly $30,000 — a massive jump from the $20,000 seen for 3 nm.

Ultimately, these rising costs will force vendors to choose between hiking prices, lowering hardware specs, or accepting reduced profit margins. Apple has more breathing room thanks to its high industry margins and premium product mix, but that comfort zone is narrowing.

The main question for 2026 is no longer if component costs will bite, but when — how long Apple can use its massive cash reserves to shield consumers from the reality of the global silicon squeeze.