6 Reasons Why You Might Want the Apple Card

Credit: 9to5Mac

Credit: 9to5Mac

Now that the Apple Card is launching for select users and Apple is preparing for a full rollout, it's time to get serious about the Apple Card. Sure, it's a credit card from Apple – but what does that mean? Are the extra services really worth it, depending on your lifestyle and financial situation?

To simplify things a little, we're going to go over the top reasons to think about switching to the Apple Card from your current payment plans. Continue reading to learn 6 Reasons to Consider Using the Apple Card.

You Prefer to Pay by Phone

While you do receive a physical titanium Apple Card (and it looks great), you aren't required to use it when paying with your Apple Card. Your iPhone and Apple Wallet can work together to allow you to use the Card easily at any Apple Pay point of sale. Just pay as you normally would with Apple Pay and make sure your payment method is set to the Apple Card.

As with other credit cards, you can also use it via your Apple Wallet online without needing to dig the Card out. It's a nice change if you're tired of getting out a card every time you want to pay, and don't really have a credit card that you currently use in Apple Wallet.

You Want Better Security Features

Apple worked hard to give the Apple Card enough security and privacy to make people comfortable, and it shows. You can view your charges and flag any as fraudulent within the Apple Wallet app. You need Touch ID or Face ID (based on your iPhone) to authorize purchases when paying with your phone

The physical card itself won't help a thief who might try to steal it and use it online. There's no card number or security code on it – that's all digital, and managed by your Wallet app. Goldman Sachs, which manages the credit part of the card, is not allowed to share or sell data to third parties for any type of marketing purposes.

You Aren't a Fan of Fees

Many no-fee credit cards are tied to specific programs or accounts, which can make them more difficult to get. By comparison, the Apple Card is much easier to get – and every bank in the world should note just how easy Apple's application process is. Even better yet, it's also almost entirely fee-free. There's no annual fee, no late payment fees (except interest, of course), no cash advance fees, no international transaction fees, and no over-limit fees. That makes it pretty rare among credit card options and may help you save money over your current credit cards if you're paying fees right now.

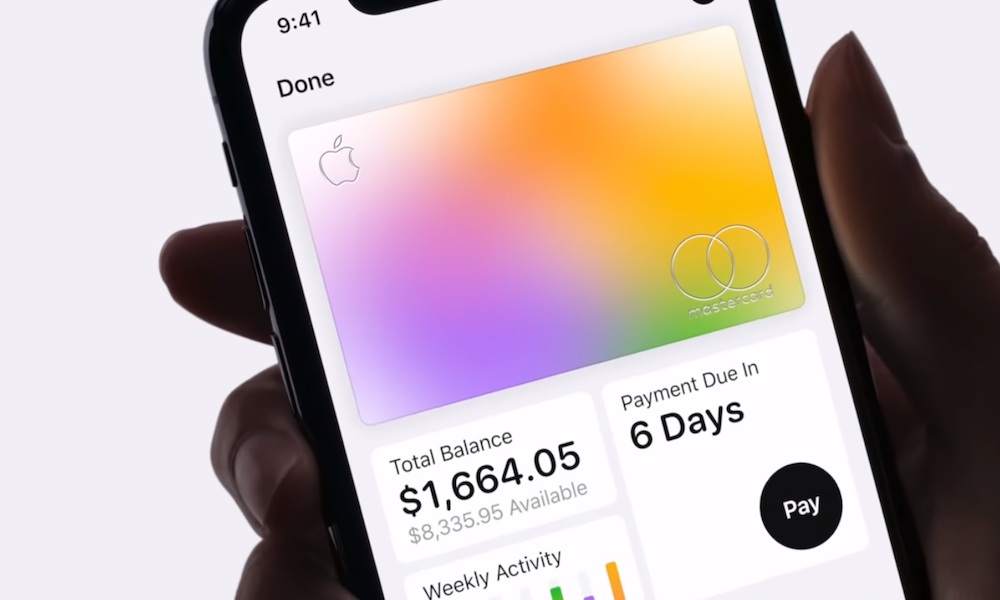

You Want an Easy Way to Track Expenses

The Card is created to automatically categorize your expenses. It collects and color-codes each purchase based on what it is, along with creating physical maps of your purchases and charts of how you use the card by day, week, or month. This makes it a lot easier to watch and manage your expenses, especially if you haven't had much success with other financial management apps and would like an easier way to see basic information about your expenses.

Unfortunately, at this time the Apple Card won't sync

with budgeting apps such as Mint, although we hope that will change in the near

future. So if you depend on something like Mint to track all your finances, the

Card may not be a great choice for you...yet.

You Want Apple-Focused Rewards

Yes, Apple's credit card offers rewards! And they're not bad! You get 3% cash-back on purchases from Apple itself, and 2% back when you use Apple Pay for anything. All other purchases get 1% back. This cash is granted every day, and you can choose whether to use it for your balance or your bank account.

Credit cards offer all kinds of specialized rewards for students, business owners, certain types of professionals, mortgage holders and others – some of them may be better for you than these Apple Card rewards. But for a general credit card, Apple's rewards are strong. Compare the rewards with any cards you use or could qualify for to get a better idea.

You Don't Have a Problem Paying Off Your Balance

The variable interest rate on the Apple Card can go as high as 24%, and doesn't fall below 13% (it will vary based on your credit score and history). That's okay for a credit card, but it's not great. The Apple Card is best suited for users who don't have a problem paying off their monthly balance so they won't let interest accrue. However, if you only pay off a portion of your balance, the Apple Wallet app is good about showing you exactly how much interest this choice will create, so you'll be aware of the costs.