5 Massive Tech Companies Apple Should Acquire

Apple acquisitions are a popular topic for market analysts and Wall Street types. Apple certainly has the means and the clout to acquire quite a few high-profile companies, but so far has focused on smaller buys — its acquisition of Beats By Dre was its largest at $3 billion. While some analysts have floated unlikely targets in recent years, like Sony or Disney, there are more probable companies that could be within Apple’s sights. Press the right arrow to learn about 5 massive tech companies Apple could actually buy.

5 GoPro - $1.16 Billion

Apple has managed to make some of the best cameras on the market, without being a camera company at all. That means that, while the iPhone has revolutionized photography, Apple could benefit from acquiring other companies in the market.

One of those companies could be GoPro. An FBR analyst said in 2015 that GoPro’s lineup “would fit like a glove into the Apple product portfolio.” Indeed, Apple has shown interest in action-style cameras before (as hinted by several granted patents from 2015) With its increasing focus on health and activity, a portable cam that’s controllable via iPhone or Apple Watch could make sense for the company. And it'd be a bargain buy for the company, costing less than even Beats.

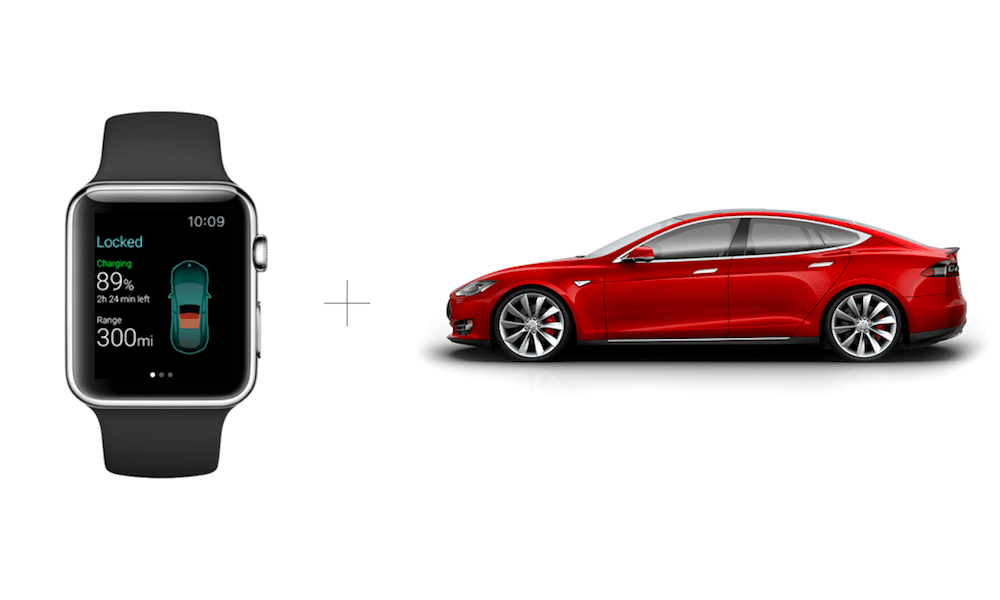

4 Tesla - $52.6 Billion

The fact that Apple has been working on an automobile system has been a poorly kept secret for years. But while the Apple car might not see the light of day, Apple’s car project is still alive and kicking.

Buying Tesla could be an extremely quick way for Apple to break into the car business with a high-end brand that matches its own, and Tesla's commitment to green energy lines up with Apple's own environment endeavors. But the two companies have been sparring and poaching each other's talent for years, and Tesla is tightly connected to its CEO, Elon Musk. While such a deal would be good for Apple, its likelihood is probably a bit far-fetched.

3 PayPal - $87.9 Billion

Apple has been steadily encroaching into PayPal’s territory since 2014, when it launched its proprietary Apple Pay system — and particularly since it launched its PayPal-like, peer-to-peer payment system, Apple Pay Cash.

If it manages to be approved by antitrust regulators, acquiring PayPal could give Apple an edge in convincing consumers to adopt its payment system. And, perhaps more importantly, it would give Apple some extra clout in convincing merchants to add support for it, too.

2 Activision Blizzard - $45.93 Billion

Apple’s products, particularly the Mac, have long had a reputation for being unfriendly to gamers. With the iPhone and the rise of mobile gaming, that’s beginning to change — albeit, slowly.

The Cupertino tech giant could speed up that process by moving into the gaming sphere with an acquisition of an established brand like Activision. While Activision doesn’t have a game console, it is a strong contender in PC, online and mobile gaming (it owns Candy Crush). Indeed, Apple has shown an increased interest in gaming across its product line, from ARKit on iOS to the Apple TV.

1 Netflix - $80.19 Billion

Apple has been making an active push into the first-party content market in recent history, as evidenced by the company’s original programming and its continuing efforts in Hollywood.

Netflix, a market leader in both content creation and distribution, would provide Apple with massive value (provided that it overcame antitrust regulations). More than that, Netflix has been singled out as a logical and probable target for an Apple acquisition by market analysts.