Apple’s ‘Polyamorous’ Chip Strategy: Why It’s Time to See Other People

Apple

Apple

Toggle Dark Mode

Apple and TSMC have long had a relationship that most device manufacturers would envy, with the Taiwanese chipmaker serving as the exclusive supplier of Apple’s systems-on-a-chip since 2016. The relationship actually began two years earlier, but Apple also used Samsung for some of its chip supply in 2015.

Now, Apple is looking to open up that decade-long exclusive relationship by having another company supply some of its processor needs, according to The Wall Street Journal (Apple News+):

Now that TSMC is doing more business with Nvidia and other AI companies, people with knowledge of the chip supply chain said Apple was exploring whether some lower-end processors could be made by someone other than TSMC.

Rolfe Winkler and Yang Jie

Intel Inside… Again?

While the WSJ report didn’t mention any suitors by name, we reported in December that Apple may already be in talks with Intel to assume some of its lower-end processor needs by 2027 or 2028.

At that time, well-connected supply chain analyst Ming-Chi Kuo said that Intel will “begin shipping Apple’s lowest-end M processor as early as 2027,” suggesting we could see Intel provide the chips for some Mac and iPad models.

While Kuo didn’t mention the iPhone in his comments, GF Securities analyst Jeff Pu chimed in soon after that, saying the chipmaker will also likely supply some chips for non-Pro iPhone models in 2028.

Such a deal would possibly see Intel fabricating the A22 or A23 for Apple, depending on when production kicked off. This means the iPhone 20 or iPhone 21 could have “Intel inside.”

While analysts may see Intel manufacturing chips for Apple, no one expects Intel to assist with the design phase of the chips. In other words, Apple will continue to use its own designs, relying on Intel simply to fabricate the silicon. That’s a bit different from the years when Apple’s Mac lineup was powered by Intel chips, which all used Intel’s in-house designed X86 processors. Apple began transitioning to its own Apple silicon platform for the Mac in 2020.

In 2021, Intel pivoted its focus to becoming a “Foundry Services” business that would not design chips, but would instead manufacture other people’s chip designs. Pat Gelsinger, Intel’s CEO at the time, admitted that he was hoping to lure Apple into his company’s fold of customers to manufacture its A-series and M-series chips.

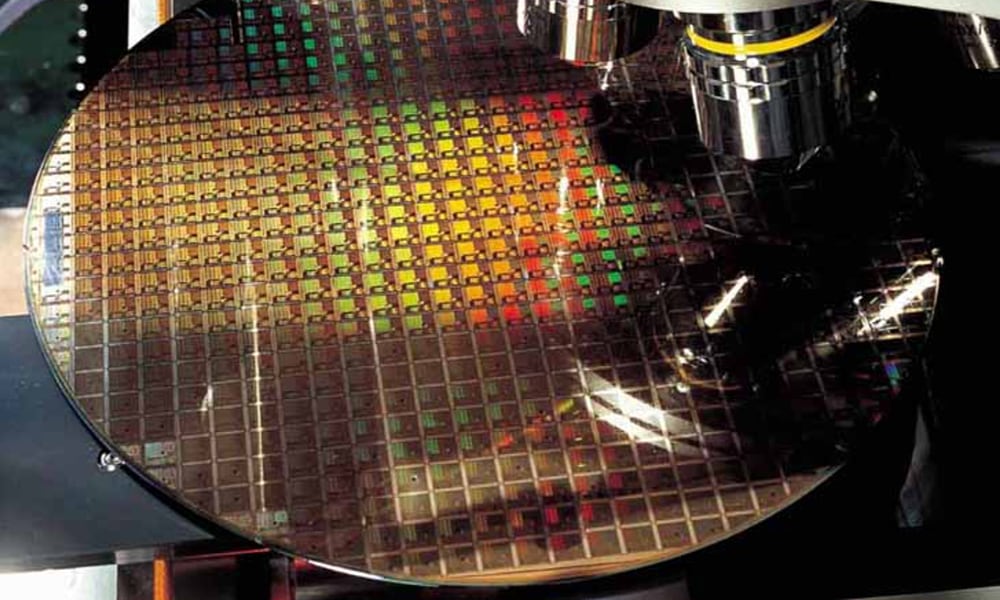

The AI Tax: Beyond Processors

In the age of artificial intelligence, Apple is beginning to feel a growing need to diversify its supply chain. Nvidia has reportedly just surpassed Apple as TSMC’s biggest customer overall. Although Apple still has the lead when it comes to wafer volume for TSMC’s most advanced 2nm and 1.4nm nodes, it’s finding itself actively competing with the other chip giant for capacity and priority.

Meanwhile, processors aren’t the only area where Apple’s margins are feeling the squeeze; the broader component market is also tightening, and Apple faces ever-increasing competition for the RAM chips and NAND memory.

This means Apple not only must deal with TSMC’s ever-widening polyamorous relationship with other tech firms, but also rising costs from Samsung and SK Hynix, who both supply RAM chips to the Cupertino firm.

During last week’s earnings call, Apple CEO Tim Cook commented on how fast-rising price of RAM and SSD storage chips have impacted Apple in the fiscal first quarter, and how those rising costs might affect the company’s bottom line in the future.

Cook told call participants that while rising RAM and storage chip prices had a “minimal impact” on the company’s gross margin in the fiscal first quarter of 2026, he does expect them to have a “bit more of an impact” on Apple’s gross margin in the current quarter, adding that Apple “will look at a range of options to deal with that” over the long term, if needed.