Apple Shatters Expectations with Record-Setting $143.8B Q1 2026

Toggle Dark Mode

Today, Apple announced its Q1 2026 “holiday quarter” earnings, once again shattering records — and blowing away Wall Street expectations — by posting the largest year-over-year increase since the COVID-19 pandemic in 2021.

Apple’s revenue for its fiscal 2026 first quarter, which ended on December 27, 2025, was a staggering $143.8 billion, up 16 percent from Q1 2025.

As we anticipated when Apple crossed the $100 billion mark for a fourth quarter last year, that was indeed just the tip of the iceberg. Apple’s Q4 ends in September, not long after the new iPhone models launch each year. In this case, Apple only had the preorders and a week of in-store sales to bolster its Q4 2025 numbers.

However, that quarter ended with incredible momentum — and Apple struggling to keep up with demand — suggesting that the holiday quarter that followed between October and December was going to be a big one — and it was.

During the December quarter, our record business performance and strong margins led to EPS growth of 19 percent, setting a new all-time EPS record. These exceptionally strong results generated nearly $54 billion in operating cash flow, allowing us to return almost $32 billion to shareholders.

Kevan Parekh, Apple CFO

The Numbers

Apple’s fiscal year ends in September, which is why the final calendar quarter of the year is actually Q1 2026. This time around, the company posted quarterly revenue of $143.76 billion — it’s highest by a long shot — with diluted earnings per share (EPS) of $2.84, up an even higher 19 percent from the year-ago quarter.

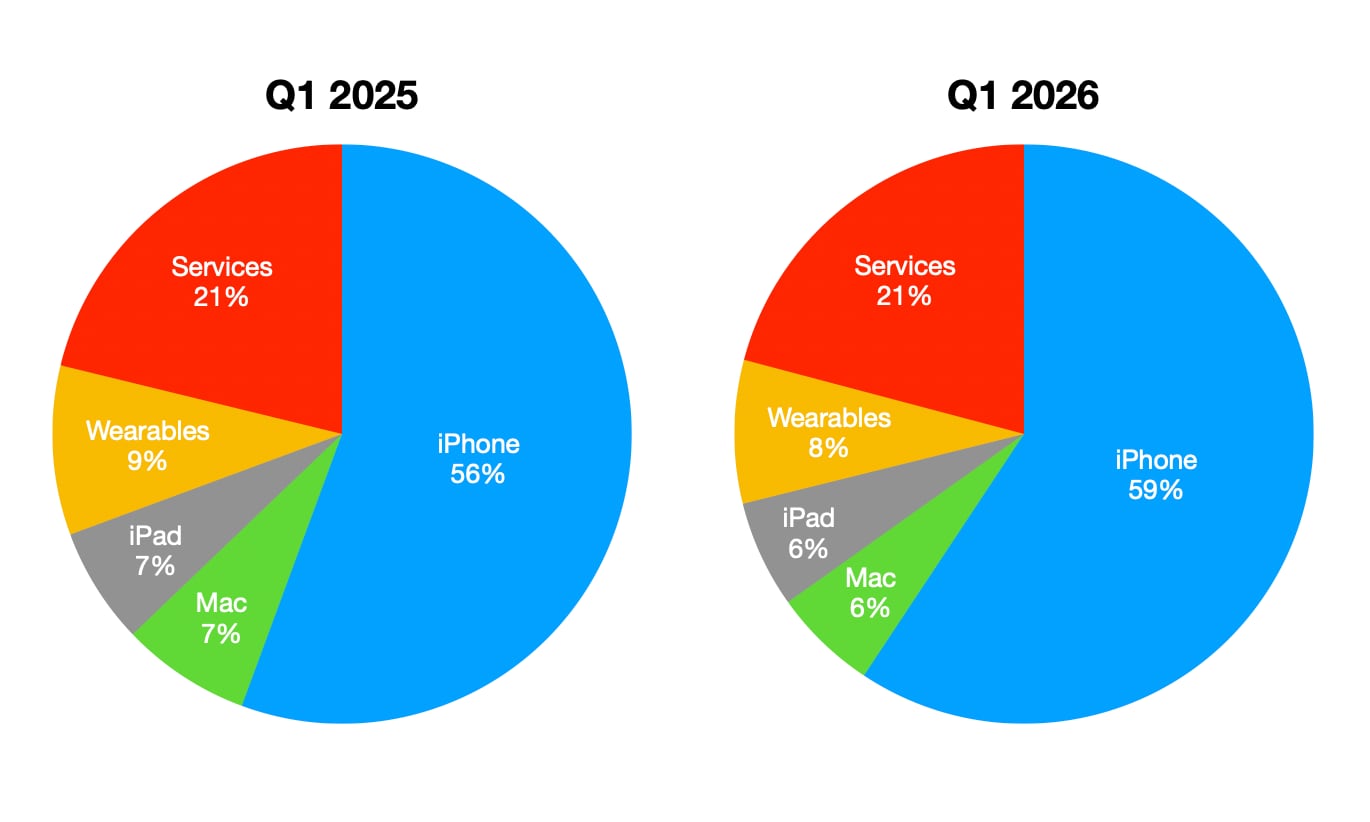

It’s no surprise that this driven by the iPhone, which accounted for just over 59% of overall revenue. As usual, Services was in second place marking its own milestone as it crossed the $30 billion threshold, leaving Apple’s remaining three categories coming in as distant runners-up. Here’s the breakdown.

| Segment | Q1 2026 Revenue | Growth (YoY) | Key Driver |

|---|---|---|---|

| iPhone | $85.3B | +23.3% | iPhone 17 & China Rebound |

| Services | $30.0B | +13.9% | Milestone $30B Mark |

| iPad | $8.6B | +6.3% | M5 iPad Pro Launch |

| Wearables | $11.5B | -2.2% | AirPods Pro 3 Constraints |

| Mac | $8.4B | -6.7% | Tough 2025 Comp |

Today, Apple is proud to report a remarkable, record-breaking quarter, with revenue of $143.8 billion, up 16 percent from a year ago and well above our expectations. iPhone had its best-ever quarter driven by unprecedented demand, with all-time records across every geographic segment, and Services also achieved an all-time revenue record, up 14 percent from a year ago. We are also excited to announce that our installed base now has more than 2.5 billion active devices, which is a testament to incredible customer satisfaction for the very best products and services in the world.

Tim Cook, Apple CEO

The iPhone Carries the Day

With its September launch schedule, the iPhone always makes up over half of Apple’s sales each holiday quarter, and while it captured a 3% larger share than last year’s iPhone 16 lineup, which came in at slightly under 56%, this year’s number is more in line with previous quarters, which have otherwise averaged 58.9% since Q1 2019.

During the earnings call that followed, Tim Cook credited much of the iPhone’s sales performance to China, where it did much better than Apple anticipated. While iPhone sales grew 23.3% globally over last year’s holiday quarter, the spike in China was much higher at 38%, creating what Cook declared “the best iPhone quarter in history in Greater China.”

It is driven by the customer enthusiasm for the iPhone 17 lineup. And I would tell you that during the quarter, traffic in our stores in China grew by strong double digits year over year. It was a terrific quarter. Our installed base reached an all-time high in both Greater China and Mainland China. And we set an all-time record for the upgraders, and we saw strong double-digit growth on switchers.

Tim Cook

There may have also been some pent-up demand in China, as the iPhone Air failed to launch there until October due to delays in getting the eSIM technology cleared by Chinese regulators. However, when it finally did launch, Apple couldn’t make them fast enough to keep up with demand.

That’s a problem Apple is still facing. Cook mentioned several times during the call that Apple has been constrained on the supply side and hasn’t been able meet consumer demand for the new models. When one analyst asked how long he expected supply challenges to impact Apple’s ability to “ship to true demand,” Cook candidly replied that “It is difficult to estimate demand when you have not met the demand,” as it effectively leaves Apple chasing a moving target.

Services Dominate the Rest of the Landscape

Apple had surprisingly little to say about its Services business this year, considering that it just grew by another 13.9%, reaching an all-time high of $30 billion.

To put that in perspective, the iPhone and Services together accounted for just over 80% of Apple’s revenue in the last quarter, dwarfing the other three product categories.

That’s not to say that the Mac, iPad, and Wearables aren’t doing well, as they still collectively accounted for $28.5 billion in revenue, but it’s also notable that the only one of those categories to grow was the iPad, and its 6.3% increase, while still quite respectable, was dwarfed by the double-digit growth in iPhone and Services.

Still, it’s worth keeping in mind that Apple only released a single new iPad during the quarter, the high-end M5 iPad Pro, so it’s likely most of the growth came from its older tablet lineup. Similarly, the only new Mac was the solitary M5 MacBook Pro.

The Wearables category is the one that we would have hoped to see the most growth in, considering the holiday quarter featured not one but three new Apple Watches, plus the AirPods Pro 3. There was also the M5 Vision Pro, but it’s hard to imagine that moving the needle much. Still, a 2.2% decline isn’t exactly good news for a category that’s already been consistently shrinking in Q1 earnings since 2023.

Still, that may not entirely be about a lukewarm reception for its producers, as Cook did add that the AirPods Pro 3 were constrained during the category and he believes it would have grown otherwise. He also added that “over half of customers purchasing an Apple Watch during the quarter” were new to the product.

Gemini: The Elephant in the Room

The hottest topic during today’s earnings call was unsurprisingly Apple’s new deal with Google to leverage Gemini technology to power Siri. During his opening comments, Cook mentioned the Google partnership only once in passing before going on to talk about the success of Pluribus and the upcoming new season of Ted Lasso.

That didn’t stop analysts from pelting Cook with questions about the deal, none of which he gave a straight answer to. Put simply, Cook didn’t really tell us anything we didn’t already know. He confirmed that Apple picked Google’s AI technology because it was the best for the job, that it would continue to run under Apple’s tight control, and that he wasn’t about to comment on anything beyond that.

We basically determined that Google’s AI technology would provide the most capable foundation for Apple Foundation Models. And we believe that we can unlock a lot of experiences and innovate in a key way due to the collaboration. We will continue to run on the device and run in private cloud compute. And maintain our industry-leading standards in doing so. In terms of the arrangement with Google, we are not releasing the details of that.

Tim Cook

There aren’t even any lines to read between here. When later pressed on the issue again about how Gemini would fit into Apple’s foundational models and if it would “evolve to a different layer in the AI software stack,” Cook replied only that “you should think of what is going to power the personalized version of Siri as a collaboration with Google.”

Looking ahead, Apple isn’t planning on slowing down; the company issued guidance for the March quarter projecting another 13-16% in year-over-year growth, signaling that the “supercycle” has plenty of runway left.