Rising Costs Could Push iPhone Prices Up in 2026

appshunter.io / Unsplash

appshunter.io / Unsplash

Toggle Dark Mode

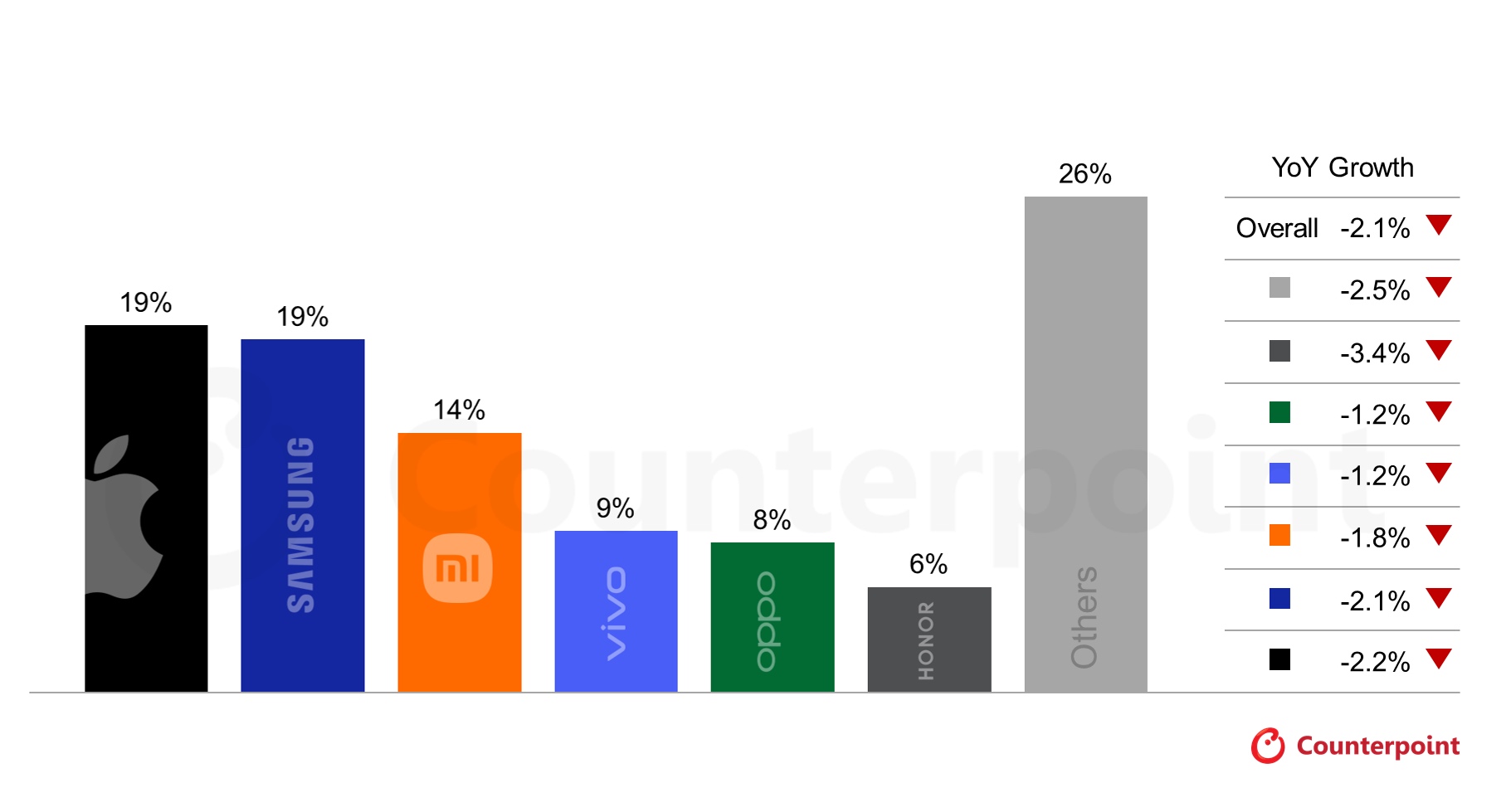

Market intelligence company Counterpoint Research predicts that Apple will see iPhone sales numbers fall next year, experiencing a 2.2% year-on-year slip as substantially higher manufacturing costs force prices upward.

Global smartphone shipments are expected to fall 2.1% overall in 2026 as rapidly rising component costs impact smartphone demand, according to Counterpoint Research’s latest Global Smartphone Shipment Tracker and Forecast. Apple stands to see a heavier dip in overall iPhone sales than most of its rivals, although that’s unlikely to make a huge dent in its bottom line.

Counterpoint analysts believe Apple will see a 2.2% year-on-year fall in iPhone sales, taking a harder hit than several other smartphone makers, including Mi, Oppo, Samsung, and Vivo.

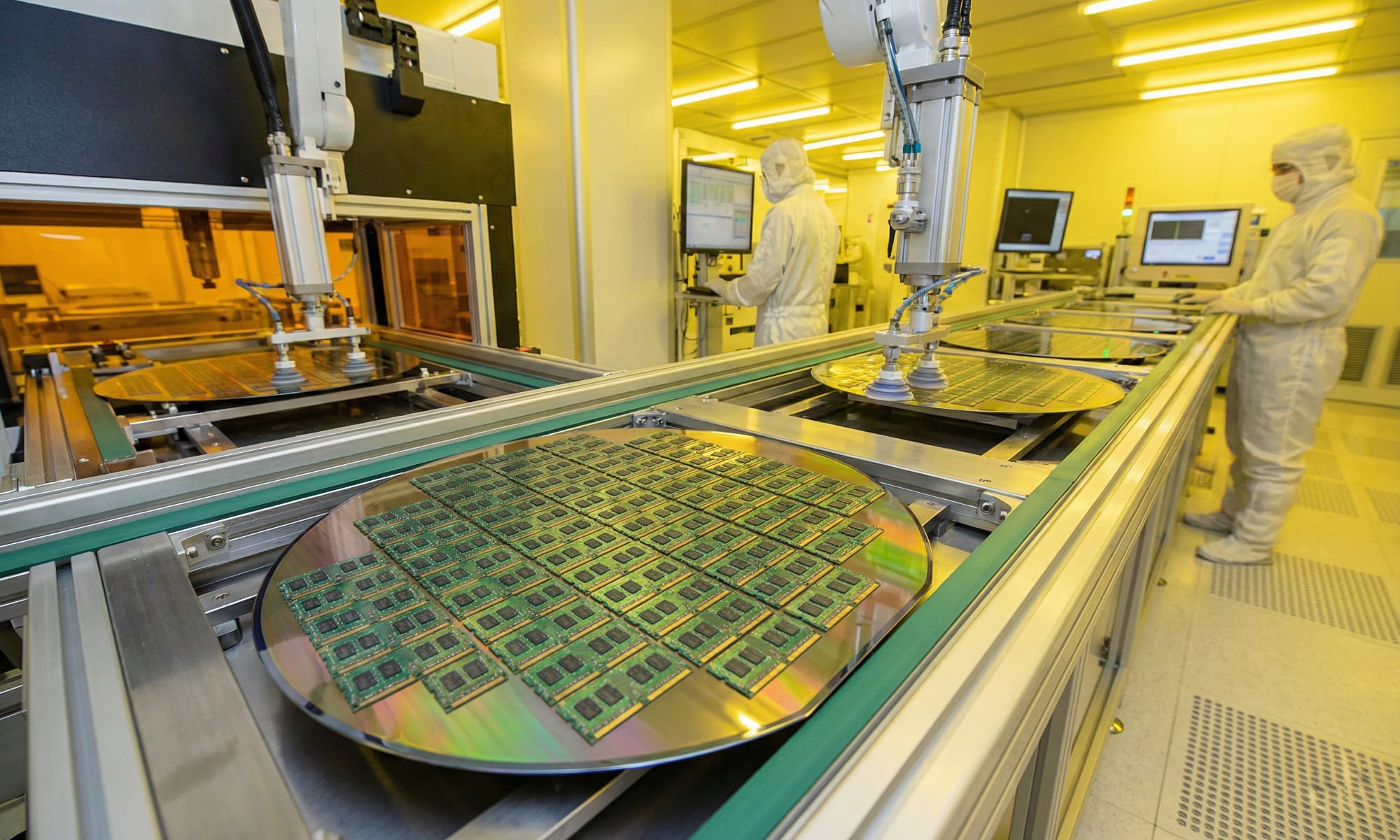

Analysts at the research firm expect to see significantly higher manufacturing expenses next year, thanks to the rising cost of components, particularly memory.

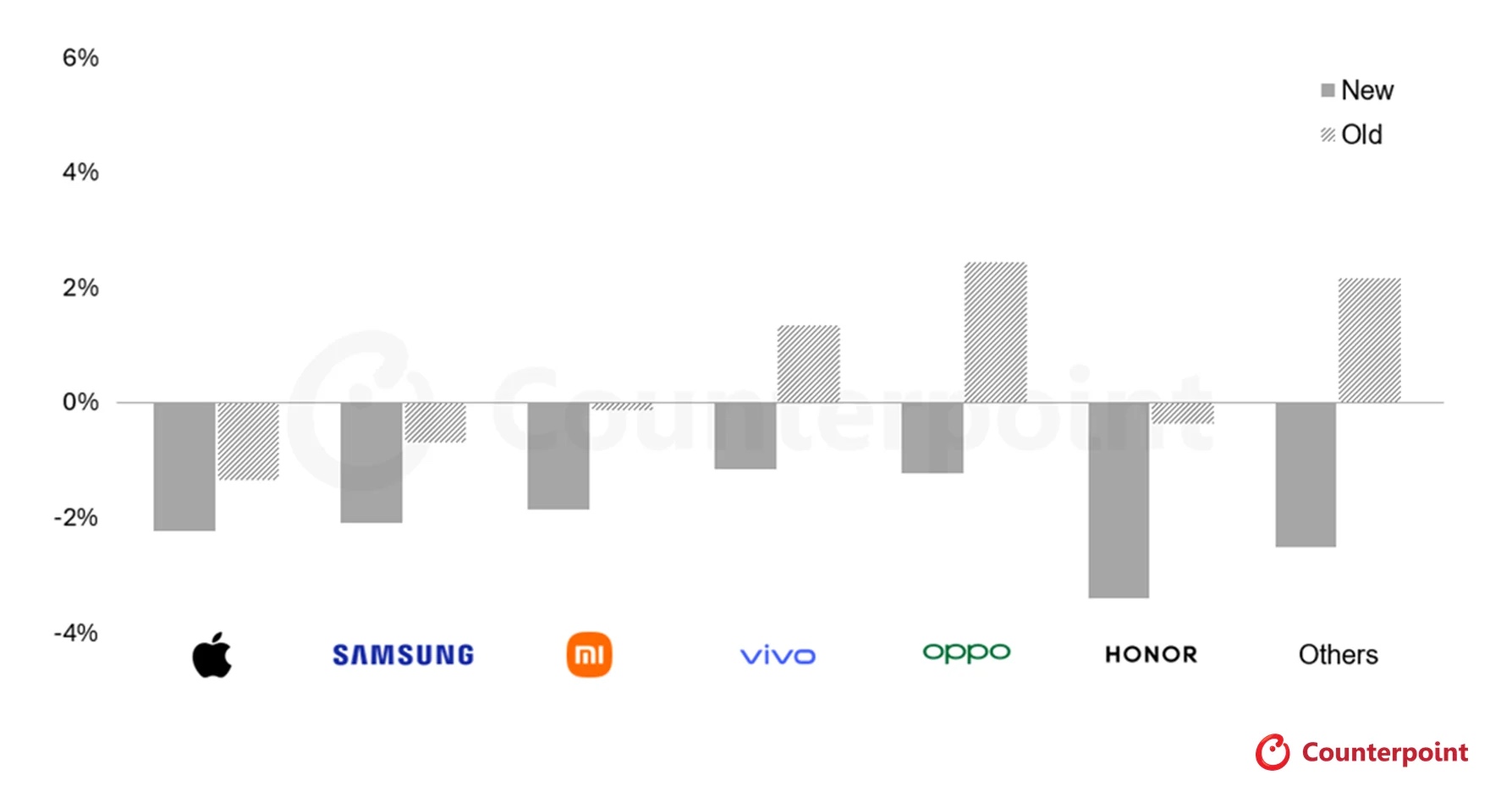

As a result, Counterpoint expects the average selling price of smartphones to increase next year by 6.9% as companies — including Apple — pass these higher costs onto consumers. That’s up from 3.9% in its previous forecast that was released in September 2025.

“What we are seeing now is the low end of the market (below $200) being impacted most severely, with BoM (bill of materials) costs increasing by 20%-30% since the beginning of the year,” said Research Director MS Hwang. “The market’s mid- and high-end segments have seen 10%-15% price increases.”

While rising component costs will hit all smartphone makers next year, these will be especially challenging for companies that sell lower-end smartphones. Those vendors may cut back on their entry-level models, reuse older components, or raise prices to stay in business. This could have a significant impact on smartphone sales, as lower-end Android handsets make up a large part of global smartphone sales.

According to Counterpoint Research, memory prices could rise another 40% through Q2 2026, resulting in costs anywhere between 8% and over 15% higher than current elevated price levels.

However, Counterpoint says Apple and Samsung should be able to handle these expected price increases without too much trouble thanks to healthy profit margins and long-term supply deals that limit their exposure to volatile component pricing, such as the recent sharp increase in RAM prices. Under Tim Cook, Apple has long-managed costs by locking in supply deals well in advance.

“Apple and Samsung are best positioned to weather the next few quarters,” said Senior Analyst Yang Wang. “But it will be tough for others that don’t have as much wiggle room to manage market share versus profit margins. We will see this play out especially with the Chinese OEMs as the year progresses.”

Lower-end Android phone makers like Honor and Vivo may suffer the most from these increased costs due to their already razor-thin margins in the price-sensitive low-end phone market served by these companies.

While Apple’s higher price points allow the company to more easily absorb cost increases, no such elbow room exists for smaller companies. This could result in changes like smaller memory configurations, lower camera and display specs, and possibly some consolidation among model lineups.

“In the lower price bands, steep price increases on smartphones are not sustainable,” continued Wang. “And if cost pass-through isn’t possible, OEMs will start pruning parts of their portfolios – that’s actually what we are starting to see with significantly reduced volumes of low-end SKUs.”