With Brand Loyalty at a Low, Is This Apple’s Moment in China and India?

Koshiro K / Adobe Stock

Koshiro K / Adobe Stock

Toggle Dark Mode

China has been Apple’s primary manufacturing hub for over 20 years. The country’s extensive supply chain infrastructure, including companies like Foxconn, skilled labor force, and government support, has made it uniquely suited to meet Apple’s demands. By the mid-2000s, most iPhones, iPads, and Macs were being manufactured in China.

Recently, Apple has committed to moving more manufacturing to India and investing at least $600 billion domestically to bring more production home to the US. Although most iPhones are assembled in China and India, it’s not the most popular smartphone brand in either country. Recent data suggests the door is open for Apple to capture more of these massive markets.

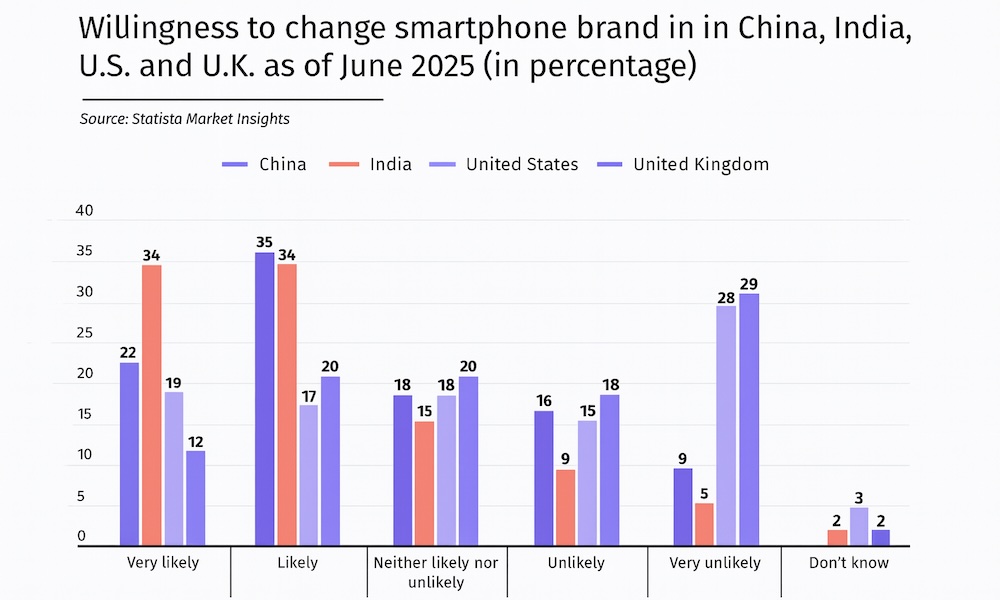

According to global data business intelligence provider Statista, a large share of smartphone customers in both China and India may want to change brands. As of June of this year, a combined 57% of smartphone users in China were either “very likely” or “likely” to switch brands. In India, 68% indicated the same sentiments.

Meanwhile, consumer smartphone loyalty is much stronger in the US and UK, where Apple enjoys the top spot in market share. Only 36% of US smartphone owners were either “very likely” or “likely” to change phone brands, while 32% of UK users were open to making a change.

Here’s where things get interesting. Apple is the second most popular smartphone brand in both China and India. Statista data shows Huawei is China’s leading smartphone manufacturer, with 37% of the market using one of its smartphones. Apple is right on Huawei’s heels in China with 28%. In India, Samsung dominates the market with 28% of consumers compared to Apple’s 13%.

This information may be especially troubling for Samsung, but it’s a clear opportunity for Apple. China’s market alone is projected to reach $111.86 billion in 2025, while India’s is estimated to hit $48.22 billion. Both of these markets are growing at rates ahead of the US market, which could climb as high as $61.37 billion this year. If all of these consumers in India and China actually make a switch, it’s a $12–$13 billion opportunity.

Smartphone brand loyalty is 50% stronger in the US than in India, and 20% greater than in China. British people are even more faithful to their current smartphones. There are undoubtedly many factors at play here. Still, it’s possible that we will start to see some shifts in these two markets, where the current leaders may face significant customer retention challenges in the coming years. Apple will likely seek to take advantage of this opportunity. We all know that once you’re immersed in the Apple ecosystem with multiple devices and iCloud, you’re hooked, and it’s hard to switch.