Another Record-Breaking Quarter: 9 Key Takeaways from Apple’s Q1 2021 Earnings Call

Credit: Jack Skeens / Shutterstock

Credit: Jack Skeens / Shutterstock

This week Apple released its Q1 2021 earnings — the period that covers the all-important holiday quarter — and despite the ongoing global pandemic the company continues to surpass many of the most optimistic predictions put forth by analysts.

In fact, this year’s quarter was particularly significant for Apple, since for the first time in ten years the company’s flagship iPhone lineup didn’t get released until October, missing its usual contributions to bolstering late Q4 sales. Of course, that revenue hasn’t been lost — merely shifted into this latest quarter, and with skyrocketing iPhone 12 sales it was never a big surprise that this would be Apple’s best holiday quarter ever.

That said, it wasn’t just about the iPhone — Apple is showing strong performance across the board, and CEO Tim Cook had a few other interesting things to share in the process. Read on for 9 big things that Apple revealed during yesterday’s earnings call.

The Numbers

First up of course were Apple’s actual sales numbers, which just exceeded $100 billion in revenue for the first time in the company’s history.

Specifically, Apple posted all-time record revenue of $111.4 billion and profits of $28.76 billion, representing a 21 percent increase from Q1 2020 — back during a time when we’d barely heard of the coronavirus.

More significantly, Apple reported double-digit growth in every one of its product categories, with iPhone sales alone growing by $10 billion — a 17 percent increase over last year’s holiday quarter, and while the raw dollar amount increases in other categories were slightly more modest, percentage-wise they all grew by at least 20% or more.

In fact, likely fuelled primarily by the new iPad Air, the iPad category saw the largest jump, growing from just under $6 billion last year to $8.4 billion in sales this year — an increase of 41%.

Here’s the rundown for each category:

- iPhone: $65.6 billion

- Mac: $8.7 billion

- iPad: $8.4 billion

- Wearables, Home and Accessories: $13 billion

- Services: $15.8 billion

These latest results show that even though iPhone sales dropped by $2 billion in the previous quarter, since of course the new models didn’t drop until October, Apple more than made up for it in the holiday quarter, and in fact saw stronger iPhone sales overall in Q1 2021 alone than in the previous iPhone release and holiday quarters (Q4/Q1) combined.

Apple Services Continues Its Meteoric Rise

The growth in Apple’s services business continues to break records as well, growing to $15.8 billion this year, and this came even without any significant new Apple service offerings.

That said, Apple did begin offering its Apple One bundles in late October, which likely contributed to users signing up for additional services — the number of subscribers rose to 620 million worldwide, surpassing Apple’s 600 million subscriber goal — but since these bundles offer significant discounts, it’s probable that subscriber numbers increased more than revenue did; in some cases it may have even lowered revenue, in fact.

Apple Fitness+ also landed in mid-December, and early uptake of that would have contributed to Apple’s bottom line, particularly if it encouraged users to jump into an Apple One Premier bundle, but since Q1 2021 actually ended on December 31, it only had two weeks to add to Apple’s revenue stream.

Without going into detail, Apple indicated that the record-breaking areas within its Services business were the App Store, cloud services, Apple Music, AppleCare, and Apple Pay. The growth in AppleCare was lower than expected, but still surprising considering that Apple’s retail stores were largely closed during the quarter, although this was made up for by its growth in digital services, driven largely by more people being stuck at home in lockdown.

However, most of these areas are small potatoes. While Apple doesn’t break down its services category, it’s already been established that the bulk of its revenue comes from its multi-billion-dollar Google search deal and the 30% commission it takes from App Store sales. In fact, by most analyst estimates, these two line items alone account for around 50% of the entire services category.

Although Apple announced last quarter that it would be dropping the App Store commission to 15% for those developers earning under $1 million in revenue — a number that’s estimated to include around 98% of iOS app developers — this didn’t actually take effect until the very end of Q1 2021, so we won’t see the impact on Apple’s numbers until the Q2 2021 earnings call in late April.

Wearables Grew 30%

Apple once again touted how its grown wearables from nothing to a Fortune 120 business in only a few short years, and this year the category saw some of the largest growth ever, increasing by a staggering 30%, although it didn’t eclipse the Mac and iPad categories as much as it did last year, since both of those categories also grew significantly thanks to new iPads and Apple’s new M1 Macs.

Still, there was a lot going on in this category this time around, since it saw the release of not one, but two new Apple Watch models, along with a Family Setup feature that greatly expanded the market for Apple Watch sales — Apple reported that 75 percent of Apple Watch sales were to new customers.

The wearables category also includes home products and accessories, meaning the release of the HomePod mini also contributed to this growth, and while the AirPods Max came out very late in the quarter, they would have added to the mix as well.

Then there’s the fact that AirPods and Beats headphones of all flavours are always popular holiday gifts, and the new $50 Beats Flex undoubtedly made a great stocking stuffer this year with its W1 chip making it an ideal choice for any iPhone user.

Notably, however, Apple’s executives still consider the company to be in the early stages of these products, with the absolute level of sales being relatively low compared to the potential opportunities, so it’s likely that the wearables category is going to continue to skyrocket in the years to come.

iPad Sales Boom

Surprisingly, the category that saw the most growth this time around was the iPad, and while the new 11-inch iPad Air was quite likely the biggest contributor to this, Cook noted that Apple is also seeing a lot more people picking up the iPad as a complementary device to a Mac, as opposed to a replacement, and of course as more people have been working and learning from home during the pandemic, the iPad has become even more indispensable.

Further, while the new iPad Air was announced in September, it didn’t actually go on sale until October, meaning that, much like the iPhone 12, all the new iPad Air sales were concentrated in Q1 2021.

Cook also added that Apple is still seeing about half of iPad sales coming from those who are entirely new to the tablet, rather than simply those replacing older models, which has also been holding true for Mac sales, showing even more growth potential in these categories.

Over 1 Billion Active iPhones

Although Apple sold its billionth iPhone almost four years ago, this quarter marks the first time that there are actually over 1 billion iPhones in active use.

Naturally, sales of iPhones don’t translate to how many are currently being used by customers, since of course not everybody who buys an iPhone is a new iPhone user, so having a billion devices actually being actively in use is a huge milestone — since very few people have more than one active iPhone, that means it’s safe to say that over 1/8th of the population of the planet are iPhone users.

The last time Apple reported the number of active iPhones was back in 2019, when it surpassed 900 million active iPhone users. Factoring in Apple’s entire device ecosystem, the company also hit a new overall record, reaching 1.65 billion active devices worldwide, although in this case, there’s likely quite a bit of overlap between iPhone, iPad, Mac, and Apple Watch users.

iPhone 12 Drove Massive Upgrades

Each year Apple reports a fairly even balance of users buying new iPhones for the first time versus those upgrading from older models. This year, however, Cook added that while both types of customers increased over the last quarter, Apple saw “the largest number of upgrades that we’ve ever seen” in a single quarter.

The obvious reason for this seems to be pent-up demand for the iPhone 12 lineup, which of course added the 5G support that many users were waiting for, along with a new design, and a smaller iPhone 12 mini that at least some had also been holding out for.

A Turnaround in China

Two years ago, Apple was having serious problems in China — enough to prompt the company to revise its revenue forecast for the first time in two decades.

However, while Apple struggled through most of 2019 to gain traction in that country with its iPhone XS/XR lineup, things began to turnaround in early 2020 thanks to the iPhone 11, and this was bolstered even further by the iPhone SE.

Today, however, it’s hard to believe that Apple ever had a problem in China, as during this last quarter, it saw a staggering 57% rise in iPhone sales in that country. In fact, the Chinese market accounted for almost a third of the Q1 2021 iPhone sales, at $21.3 billion.

In an interview with Reuters, Tim Cook revealed that two of the top three selling smartphones in urban China were iPhones, and that upgraders actually set an all-time record in that country, confirming reports last week that Apple has been significantly eating into Huawei's sales with the iPhone 12 Pro, which has turned out to be overwhelmingly popular in China.

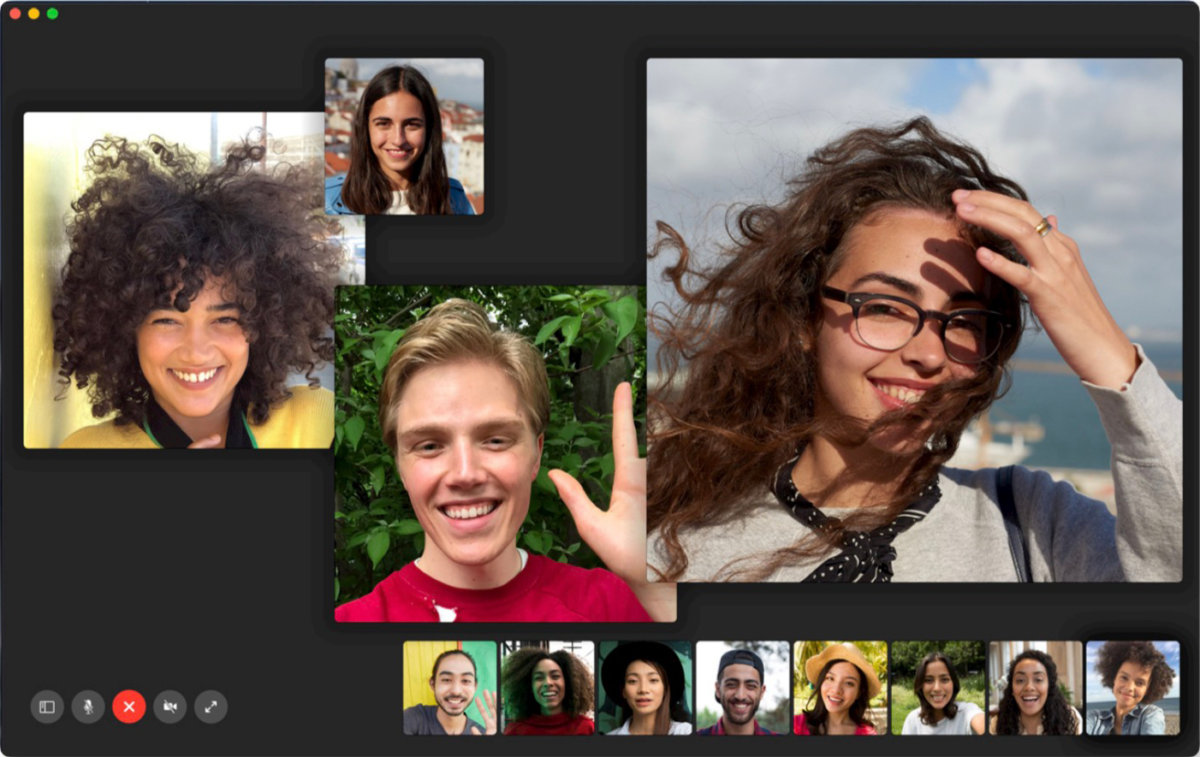

Record FaceTime Calls

As an aside, Tim Cook noted that Apple also recorded the highest ever volume of FaceTime calls over Christmas, and while he didn’t share an actual number of how many calls were placed, he suggested was that this was at least partially driven by a record number of iPhone activations.

While online video calling services have naturally seen massive growth over the past year in the midst of social distancing and lockdowns, one of the biggest winners from this has been Zoom. Despite this, however, it’s clear that many iPhone users are still much more comfortable using FaceTime, which of course also reflects iPhone, iPad, and Mac sales since Apple’s video calling service is exclusive to Apple devices.

AirPods Max Will Continue to Be Scarce

While discussing Apple’s wearables business with Reuters, Cook also implied that Apple wasn’t really prepared for the incredible uptake on its new AirPods Max, which of course saw shipment dates stretching into March within hours of the product’s December launch.

Unfortunately, Cook also said that’s not going to be changing in the near future, and the short supplies of the premium over-ear headphones will likely continue into the next quarter, which begins in April.