9 Hidden Details You Didn’t Know About the Apple Card

Credit: Apple

Credit: Apple

You know about the sleek design, the daily cash rewards, and the fact that it’s packed with budgeting and security tools. But you still may not know everything about the Apple Card.

Largely, that’s because Apple has been fairly quiet about some of the finer details of its first credit card offering. But while Apple has been giving most of its attention to the Apple Card’s flagship features, a slew of other details have emerged during its rollout. Continue reading to learn nine things about the Apple Card you may not have heard about.

It Doesn’t Support Authorized Users

Adding an authorized user to a credit card is a fairly common practice. Unfortunately, you won’t be able to do that with the Apple Card. Every Apple Card user will need to apply for and have their own Apple Card — you won’t be able to add a spouse or family member to an existing card.

On a similar note, the Apple Card doesn’t come in a business variant. It’s strictly a personal card that, as we mentioned, only a single person (or rather, a single iCloud account) can actually use. Small business and startup owners looking for a card for multiple employees to use should look elsewhere.

It Can Only Be Linked to a Single iCloud Account

You’ll be able to use your Apple Card across all of your devices — as long as they are logged into the same iCloud account. According to anecdotal user reports, the Apple Card is actually tied to a person’s iCloud credentials. That doesn’t sound like a big deal, but it could cause complications for some users.

For example, if you have multiple iCloud accounts, you will only be able to use the Apple Card on the account that you used to apply for it. If you’d like to create a new iCloud account for any reason, you’ll need to cancel your Apple Card and go through the application process again (which includes another hard credit pull).

You Won’t Need Great Credit

Goldman Sachs is a name often associated with the rich and powerful. Apple, for its part, is often called a premium device maker. Both of these facts make it weird that the Apple Card doesn’t appear to be all that exclusive — at least when it comes to creditworthiness.

In fact, some users report applying and getting accepted for the Apple Card with a FICO score as low as 620. Sure, the credit limits won’t be all that great. But it does certainly suggest that Apple doesn’t want its first branded credit card to be too exclusionary (although you’ll need an iPhone to use it, sorry Android users).

Note that your mileage may vary. One iDrop News reader stated that even with a ~750 FICO score, they were declined.

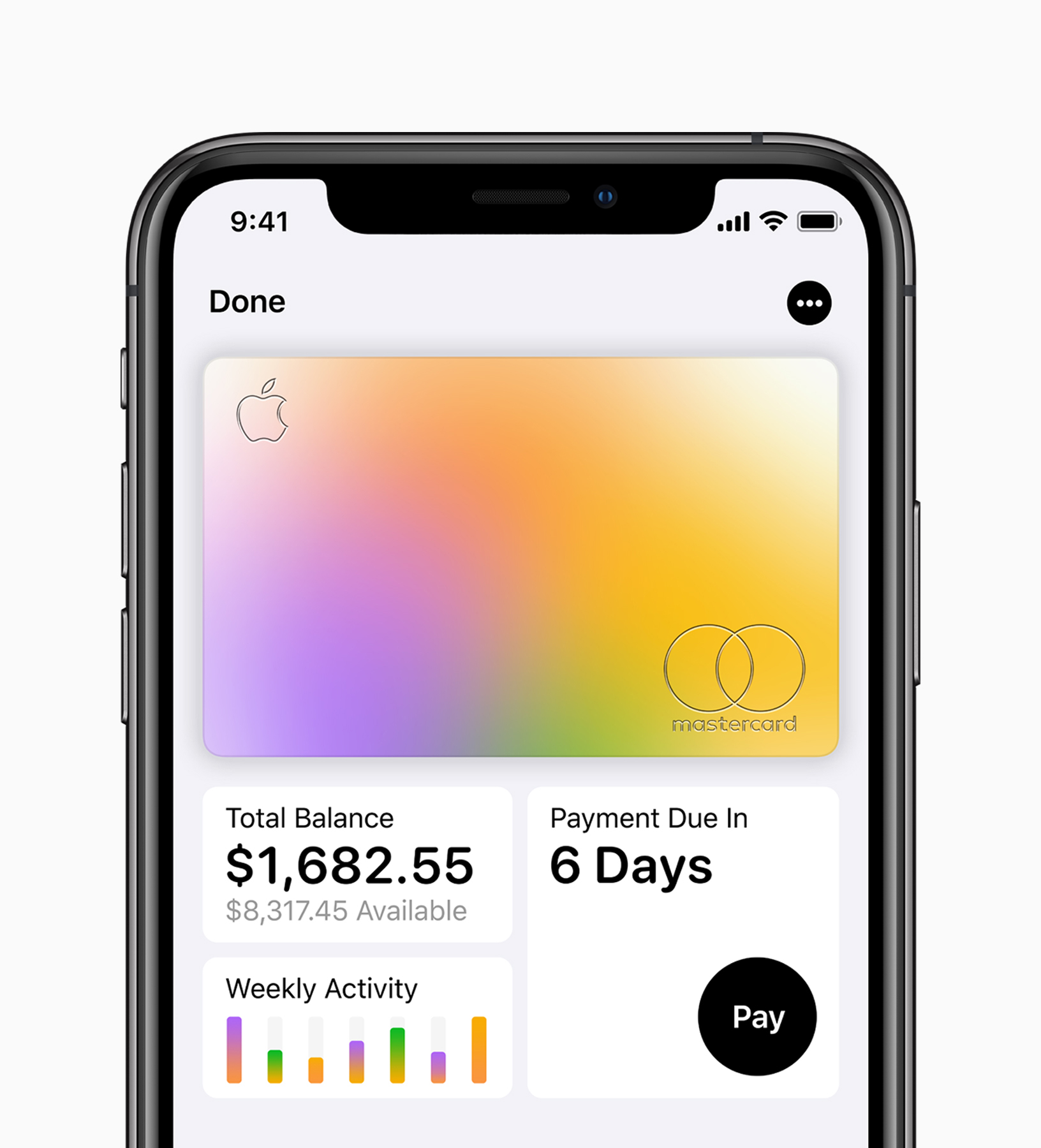

It’ll Come with Some MasterCard Benefits

The Apple Card doesn’t come with any introductory offers or other special perks. But because it’s on the MasterCard network, it actually comes with some of the standard benefits offered to cardholders.

Some of the MasterCard benefits offered to Apple

… But It Might Not Come with All of Them

While the Apple Card comes with a handful of MasterCard benefits that weren’t originally announced, it’s becoming clear that it won’t come with every MasterCard benefit. In fact, some common perks offered on the majority of MasterCards won’t be bundled with the Apple Card.

For example, MasterCard has stated that the Apple Card will not come with rental car collision damage waiver insurance. Similarly, it doesn’t offer any extended warranties or purchase protections for products bought with it. Because of that, you may want to use one of your other credit cards in these scenarios.

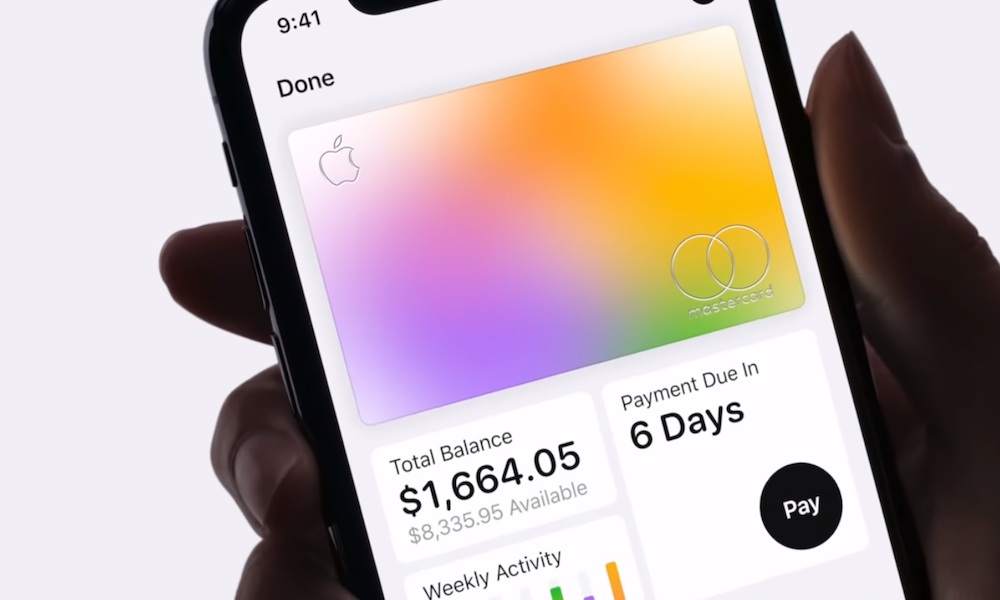

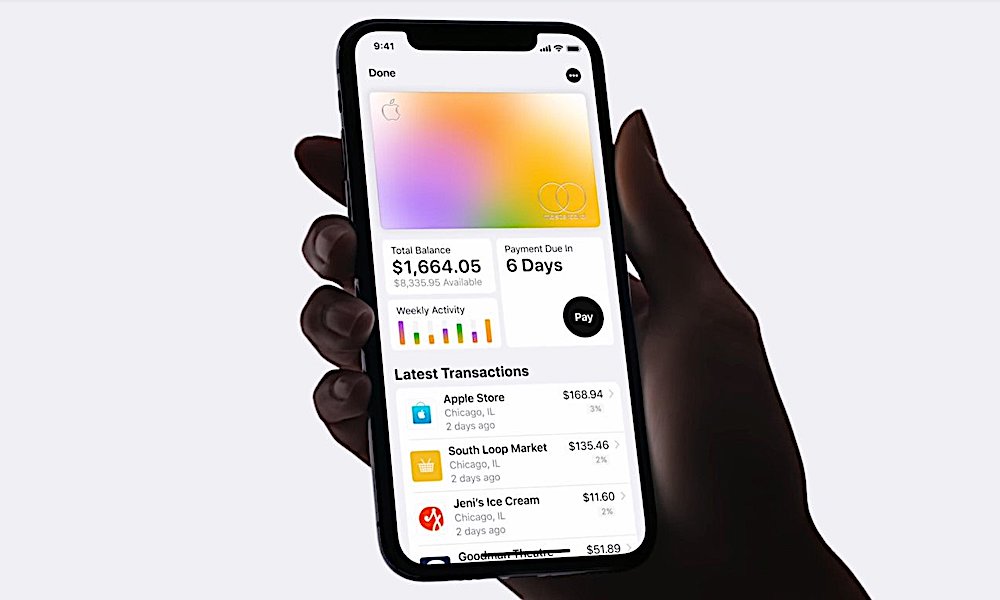

You’ll Need to Use Apple’s Management App

The Apple Card comes out-of-the-box with a suite of budgeting and financial tracking tools. Those tools will be baked into the Wallet app and should offer Apple Card holders a birds-eye view of their spending.

That’s a good

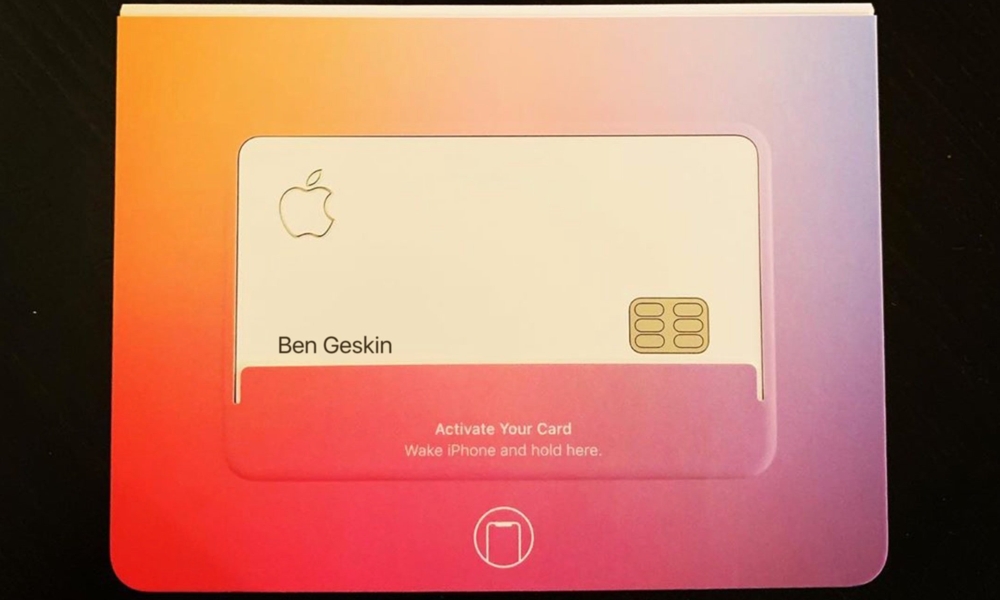

Apple’s Attention to Detail

The Apple Card, although not a tech product like an iPhone, still manages to look exactly like something Apple would make. The physical Apple Card practically bleeds Cupertino, from the fact that it’s extremely minimalist to the way that it’s crafted from a single piece of titanium.

Apple’s attention to detail is here, too. According to TechCrunch editor-in-chief Matthew Panzarino, Apple actually went to the trouble of making a notch in the titanium so that the magnetic strip sits flush with the rest of the card. Panzarino contrasted that to his Amex Platinum card, which simply has a piece of clear laminate backing sealing the mag strip in.

The Physical Apple Card Isn’t Contactless

It’s a small detail, but it’s still worth noting. The physical titanium Apple Card is not contactless. That means you’ll be left to use the mag strip or the chip for transactions at contactless payment terminals.

Of course, the Apple Card is tightly integrated with Apple Pay, meaning that you shouldn’t have a problem using your iPhone to make payments at those terminals. On the other hand, there are still plenty of contactless payment terminals that don’t currently support Apple Pay. Just food for thought.

You May Not Have to Wait to Get One

As of the writing of this article, Apple is in the process of slowly rolling out the Apple Card by sending invites to users who signed up for notifications about the launch. That’s likely a way to avoid overwhelming Goldman Sachs, given the anticipation and demand for the Apple credit card.

Apple has already sent out the first batch of Apple Cards, and it looks like the company is preparing to send out the second batch. All of this is to say that you may still be able to sign up for Apple Card notifications and get one early. Of course, anyone will be able to apply for the Apple Card later this month.