Apple Card Coming in August + More Key Takeaways from Apple’s Q3 2019 Earnings Call

Apple

Apple

Apple on Tuesday officially announced the financial results for its third fiscal quarter of 2019 (which correlates with Q2 2019 for other companies).

In addition to the financial results, there were some other interesting highlights from Apple’s report and its 2 p.m. earnings call with investors. Continue reading to learn the six key takeaways.

The Numbers

Apple says that this its best June quarter ever as far as revenue, as the company reported $10 billion of profit on $53.8 billion in total revenue. (Although the profit margins dipped a bit compared to last year.)

Here’s how the quarter’s revenue and growth breaks down by category.

- iPhone: revenue of $26 billion, down 12 percent year-over-year.

- Mac: revenue of $5.8 billion, growth of 11 percent year-over-year.

- iPad: revenue of $5 billion, growth of 8 percent year-over-year.

- Services: revenue of $11.5 billion, growth of 13 percent year-over-year.

- Wearables, Home, and Accessories: revenue of $5.2 billion, growth of 48 percent year-over-year.

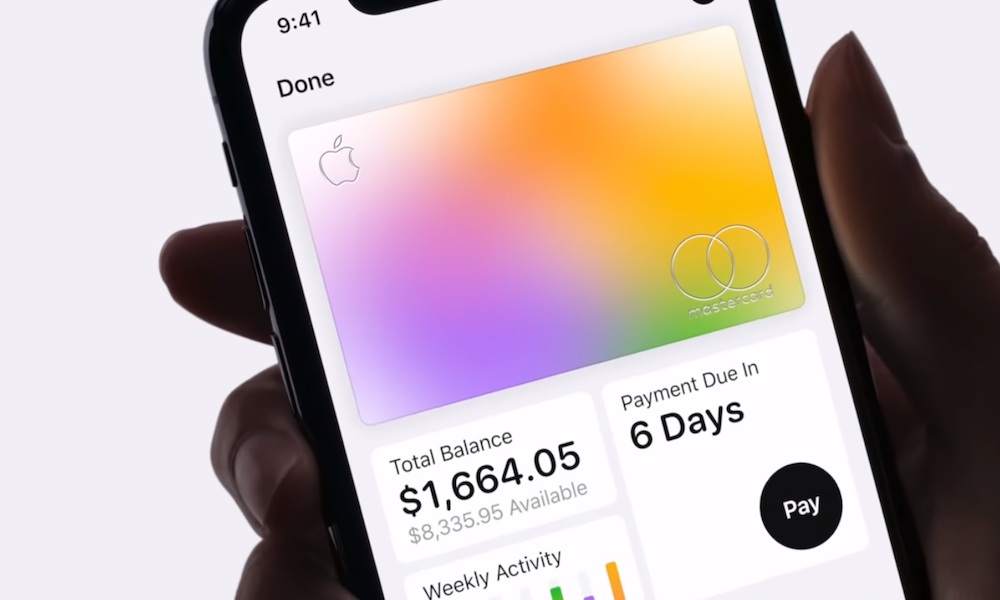

Apple Card Dropping in August

One of the most highly anticipated services that Apple has yet to drop is Apple Card. And while we didn’t expect any substantial information about its release date, Apple CFO Luca Maestri revealed that the card is coming next month.

In addition to confirming that “thousands” of Apple staff members are currently testing the Apple Card, the company also said that the rollout will begin in August for the general public. Of course, that still doesn’t pinpoint a firm release date. But at least we know it’s coming in August.

Hardware Isn’t Doomed

While the iPhone’s sales are starting to wane, that doesn’t necessarily mean that Apple’s hardware days are over. Even though the company is adding services into the mix as a strong revenue driver, Apples’ other hardware products appear to be doing really well.

While Apple tracked strong performance and growth in both the Mac and iPad categories, Apple’s wearables grew a staggering 48 percent year-over-year. Driven by Apple Watch and AirPods, the firm says that it expects the growth to accelerate to “well over” 50 percent. Revenues from that category are topping 60 percent of Fortune 500 companies.

Services May Be the New iPhone

Broken down by category, the iPhone still rakes in about 48 percent of revenue for Apple. But Services is in second place and appears to be slowly catching up. Services revenue grew 13 percent year-over-year to hit an all-time record of $11.5 billion during the quarter. And that’s just one metric.

Apple notes that it saw double-digit growth for the App Store, Apple Music, cloud services, and triple-digit growth for the App Store Search Ads business. Third-party subscription revenue grew by more than 40 percent. Apple also surpassed 420 million paid subscribers — and says it’s on track to hit its goal of doubling

Apple’s Trade-In Program

The iPhone’s influence is waning. According to Apple, total iPhone revenue is down about 12 percent year-over-year. And the company actually marked that as an improvement over the 17 percent year-over-year revenue decline last quarter. The iPhone also now makes up less than half of the company’s total revenue (48 percent).

But, interestingly, the iPhone is actually helping to bolster Apple’s trade-in program (which allows users to trade older devices for credit toward a new one). Apple says it saw 5x the number of iPhones traded in compared to this time last year. Tim Cook says the company “feels good about the trajectory” of the program and that it will advocate them more widely going forward.

Apple May Not Move Production out of China

In response to a question about Apple moving its hardware production out of China, Tim Cook said there has been a lot of “speculation” about the potential move. But he noted that he “wouldn’t put much stock in it” — adding that “parts come from everywhere, including the U.S.”

There was another interesting production-related comment. Cook mentioned that Apple currently makes the Mac Pro in the U.S. and the company “would like” to continue to do so. That’s pretty much contrary to recent reports suggesting that Apple is moving Mac Pro production to China, but it could hint that it may bring that product back to the U.S. eventually.