5 Interesting Highlights from Apple’s Q2 2024 Earnings Call

AppleInsider

AppleInsider

Yesterday afternoon, Apple reported its quarterly earnings for the first three months of 2024, handily beating analyst’s expectations but still falling short of how well it did last year in key areas.

The first few months of the calendar year represent Apple’s second fiscal quarter, with the all-important “holiday quarter” being fiscal Q1. Those bleak wintery January-March months are always tricky. They’re often thin on new products and even thinner on major holidays and other events that encourage folks to buy Apple gear.

Nevertheless, this year was more significant than most in some ways. Apple released its highly anticipated Vision Pro spatial computing headset, which made a big splash in appearance if not in raw numbers, and also unveiled a new M3 MacBook Air lineup in both 13- and 15-inch versions, marking the first time Apple’s most popular consumer MacBooks have made an early-year appearance.

So, how does this translate to Apple’s bottom line, and what else can we glean from comments made by Apple’s CEO and Chief Financial Officer (CFO)? Let’s dig in and find out. Read on for 5 exciting things that came out of yesterday’s earnings call.

The Numbers

First, the numbers. Apple reported $90.8 billion in revenue over the quarter, blazing past Wall Street, whose most optimistic expectations had pegged the company’s earnings at $89.1 billion. That number was an outlier from JP Morgan, which showed a relatively bullish take compared to the rest of the industry’s $84.4 billion average estimate.

That represents a 4.3% drop from last year’s $94.8 billion in revenue, but that’s still comfortably shy of the 5% that analysts were predicting. It may not sound like much, but 0.7% is significant when we’re talking about billions of dollars.

Here’s how the numbers break down for this quarter:

- iPhone: $45.96 billion (-10.5% growth)

- Mac: $7.45 billion (3.9% growth)

- iPad: $5.56 billion (-16.7% growth)

- Wearables: $7.91 billion (-9.6% growth)

- Services: $23.87 billion (14.2% growth)

Apple is still doing considerably better than it was four years ago when it was coasting along just under the $60 billion revenue mark. That shot up to $89.6 billion in Q2 2021, and while some of that was undoubtedly fueled by the pandemic, nearly $19 billion of that increase came from iPhone sales, suggesting there was a lot to be said for the popularity of the iPhone 12 with its new design and 5G capabilities.

Apple peaked at $97.3 billion in Q2 2022, seeing increases in every category except for the iPad, which, to be fair, had shot up by a staggering 78% the year before as many more folks found themselves working and studying from home.

Apple’s Services Saved the Day

As usual, Apple’s Services revenue continues to skyrocket. It now accounts for over a quarter of the company’s overall revenue and fully eclipses every other product category, save for the still-dominant iPhone.

The Services category includes everything from consumer-facing services like Apple Music and Apple TV+ to App Store commissions and the billions of dollars Google kicks into the pot to be the default search engine on the iPhone.

The latest reports suggest that’s about $20 billion per year, which means that about a fifth of Apple’s $23.87 billion in Services revenue came from Google. The lion’s share is believed to stem from the 15/30% commission that Apple takes in from App Store sales, with many analysts estimating that at about half.

The rest comes from the obvious services, such as Apple Music and Apple One bundles, iCloud+ storage plans, and AppleCare+ coverage.

For the most part, Apple’s Services category has enjoyed double-digit year-over-year growth since Apple first began breaking it out several years ago, and it’s showing no sign of slowing down, proving that Tim Cook’s bet on a post-iPhone era was the right one.

iPhone Sales Shrunk for the First Time Since 2020

Services revenue growth is even more noticeable this year, as iPhone sales have actually dropped for the first time in this quarter since Q2 2020. That saw a 6.7% decrease in iPhone sales to $29 billion, down from $31 billion in Q2 2019.

At the time, several analysts believed that was due to the softer demand for the iPhone 11 lineup as many anticipated Apple’s release of its first 5G models later that same year.

It’s less clear what’s caused iPhone 15 sales to fall by 10.5% this time around, but it’s also possible fewer folks waited to upgrade last fall. The Q1 2024 “holiday quarter” saw a strong 6% growth compared to -8.2% in Q1 2023. Beyond North American shores, weak demand in China also didn’t help.

Still, Tim Cook told CNBC he feels good about China as Apple still beat expectations in that market by over $1 billion in iPhone sales, which became even more competitive in 2023. In a live segment on CNBC, Cook said that iPhone sales actually grew in China during the quarter, adding that “may come as a surprise to some people.”

New iPads Are Overdue

If it wasn’t already obvious enough, Apple’s shrinking iPad revenue makes it abundantly clear that the 18-month iPad drought is affecting its balance sheet.

With only $5.56 billion in iPad sales, that category dropped by 16.7% to its lowest since 2020, when the iPad accounted for only $4.4 billion in revenue.

That follows a 12.8% drop in Q2 2023, and while some of that can be explained by a return to normalcy after the COVID-19 surge in iPad purchases, when sales skyrocketed to $7.8 billion, a lack of new models isn’t likely helping things much.

Of course, with a whole new slate of iPads Pro and Air expected to make their debut next Tuesday, Apple is undoubtedly expecting its Q3 2024 iPad numbers to take a significant turn for the better.

Apple Is About to Reveal ‘Big Plans’ for the iPad and AI

Speaking of the new iPads, several rumors have suggested that Apple plans to unveil its next-generation M4 Apple silicon chip in the iPad Pro lineup next week as part of a big push into AI.

While there’s room for some skepticism about whether this will be an M4 chip — it would be very unusual for an iPad to get Apple’s latest flagship silicon first with M3 MacBooks on the market that are barely two months old — there’s solid evidence pointing to some kind of new chip. Perhaps an M3X or something similar to the days when Apple scaled up iPhone A-series chips in its high-end tablets. This might not even be a more powerful M3, but rather one specifically adapted to the unique needs of iPad users.

One of those “unique needs” may be art-related with a dash of generative AI. The stylus-focused marketing around Apple’s event suggests that’s going to be a big angle for next week’s “Let Loose” event, as does the tagline itself.

More significantly, Apple’s CEO continued to tease Apple’s work on generative AI in the earnings call, saying that Apple has some “advantages” in generative AI that will help to make it stand out from the pack and plans to share some “very exciting things” in the near future. While that’s undoubtedly at least partially referring to this year’s Worldwide Developers Conference (WWDC) in June, Cook also told CNBC that the company has “big plans to announce” during its iPad launch event on Tuesday.

Vision Pro Making Inroads in the Enterprise

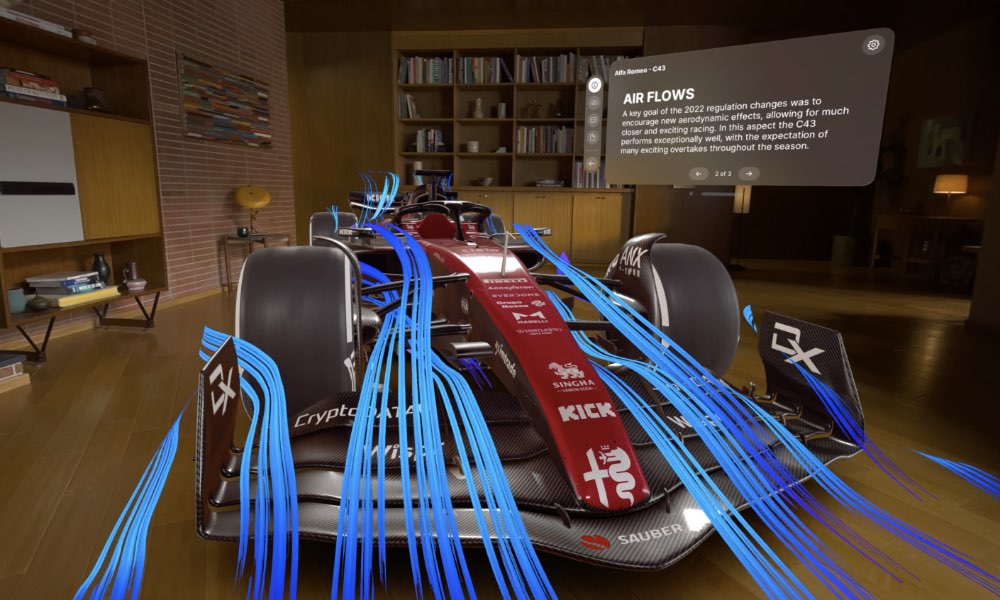

While the Vision Pro may not have been a big hit with consumers — and Apple’s “Wearables” category seems to prove this — it’s seeing widespread adoption by some of the biggest companies in the world.

During the earnings calls, Cook said that half of Fortune 100 companies have purchased at least one Apple Vision Pro, while CFO Luca Maestri briefly shared how it’s being used for “aircraft engine maintenance training at KLM Airlines, real-time team collaboration for racing at Porsche, [and] immersive kitchen design at Lowe’s.”

When asked about the top use cases for enterprise, Cook responded that he’s “hearing about so many of them” that it’s impossible to pin down any single one as the “top right now, and encompasses “an enormous number” of things “from field service, to training, to health care related things like preparing a doctor for pre-op surgery or advanced imaging, [and] control centers.”