5 Key Takeaways from Apple’s Q2 2025 Earnings Call

Hans Engbers / Shutterstock

Hans Engbers / Shutterstock

Apple has just reported its earnings for the first three months of 2025, posting over $95 billion in total revenue, the bulk of which, as usual, came from the iPhone.

In financial terms, this is Apple’s second quarter (Q2 2025) since the company’s fiscal year begins on October 1. Unsurprisingly, the Q1 “holiday quarter” is where Apple always posts its best results, not just because it includes the frantic Christmas shopping season but also because its also the first full quarter during which the latest iPhones are on sale, not to mention other new products that usually appear in the fall, which included the Apple Watch Series 10, iPad mini 7, and a lineup of M4 Macs.

By comparison, things usually slow down in the January to March quarter. People are still paying off their holiday budgets, and Apple typically releases fewer new products. This quarter wasn’t a huge exception, although the atypically early release of the iPhone 16e in February, two refreshed iPads, and the new M4 MacBook Air undoubtedly helped spur some sales.

“Today Apple is reporting strong quarterly results, including double-digit growth in Services,” said Tim Cook, Apple’s CEO. “We were happy to welcome iPhone 16e to our lineup, and to introduce powerful new Macs and iPads that take advantage of the extraordinary capabilities of Apple silicon. And we were proud to announce that we’ve cut our carbon emissions by 60 percent over the past decade.”

Of course, Apple’s earnings reports aren’t just about the numbers. There’s also a call with investors and analysts where Apple CEO Tim Cook often provides new insights into what the company is up to. Read on for 5 interesting things that came out of yesterday’s earnings call.

The Numbers

Let’s start by getting the dollars out of the way. As noted earlier, Apple posted revenue of $95.36 billion, exceeding Wall Street’s most optimistic expectations, which had predicted only $94.35 billion in sales. Profit estimates were slightly closer, with analysts postulating $24.37 billion and Apple reporting $24.78 billion.

Apple’s numbers sagged in the year-ago quarter (Q2 2024), dropping 4.3% over the 2023 results; however, the company recovered nicely this year with a 5.1% increase over last year that exceeds its 2023 numbers but still falls short of its $97.3 billion peak in Q2 2022. Apple still set a new record for a March quarter, specifically for earnings per share (EPS), as Apple’s new CFO, Kevin Parekh, explains.

“Our March quarter business performance drove EPS growth of 8 percent and $24 billion in operating cash flow, allowing us to return $29 billion to shareholders,” said Kevan Parekh, Apple’s CFO.

However, that’s merely a result of fewer shares on the market; in Q2 2022, Apple reported 32,682,118 outstanding shares. That number has dropped to 30,050,215 in this latest quarter. 2.6 million fewer shares means there’s more money for each share, even though Apple’s overall profits fell by $230 million compared to Q2 2022.

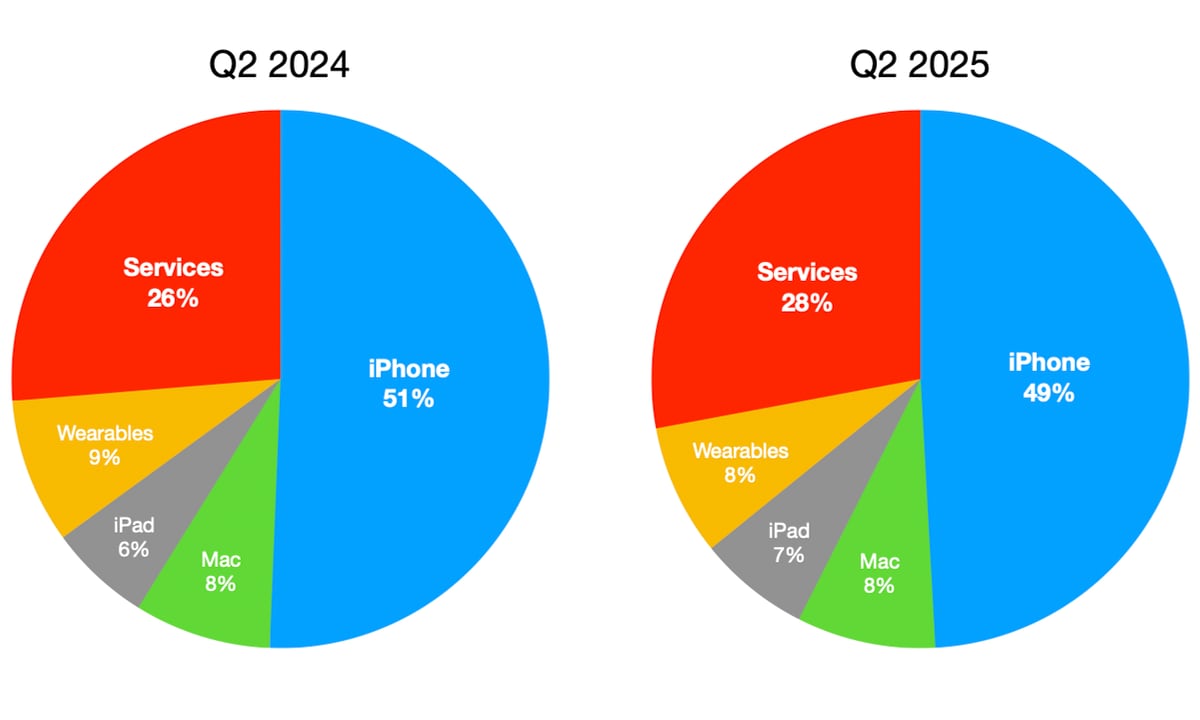

Apple grew in four of its five key product categories, with services hitting another record high of $26.65 billion, up from $23.87 billion in Q2 2024 and even gaining on the $26.34 billion from Q1 2025. Here’s the breakdown:

- iPhone: $46.84 billion (up 1.9%)

- Mac: $7.95 billion (up 6.7%)

- iPad: $6.4 billion (up 15.2%)

- Wearables: $7.52 billion (down 4.9%)

- Services: $26.65 billion (up 11.6%)

While Apple’s services accounted for 28% of the company’s revenue this quarter, growth seems to have slowed down. The services category has typically seen stronger double-digit growth, posting increases between 14.2% and 26.6% year-over-year for the past five Q2 periods; the only aberration was Q2 2023 was an aberration, when it grew by only 5.5%.

The iPhone grew at its usual steady pace, with no indication that the iPhone 16e significantly moved the needle. On the other hand, the Mac and iPad categories were likely both bolstered by the new M3 iPad Air, A16 iPad, and M4 MacBook Pro models released in early March. In fact, this is the first time since 2021 that iPad sales have grown in Q2, but we also haven’t seen an iPad released before April since the fifth-generation iPad Air came along in 2022.

Wearables, Home, and Accessories continued to lose ground. Even the holiday quarter saw a 1.7% drop over Q1 2024, despite the release of the Apple Watch Series 10 and AirPods 4. The Home part of that category continues to be stale, with nothing new since Q1 2023, when Apple released the third-generation Apple TV 4K. However, even that wasn’t a banner quarter, despite hosting the launch of the AirPods Pro 2 and three new Apple Watch models.

‘Limited Impact’ from Tariffs So Far

It’s no surprise that the biggest question on analysts’ minds (and nearly everyone else’s) was about how Apple is weathering the storm of tariffs on its products, most of which still come from China.

During the first part of the call, Cook said that Apple had “a limited impact from tariffs,” partly because they hadn’t fully kicked in, and the company was able to “optimize its supply chain and inventory” (business-speak for flying planeloads of iPhones into the US to stay ahead of the tariffs).

Cook added that Apple can’t “precisely estimate the impact of tariffs as we are uncertain of potential future actions prior to the end of the quarter.” In other words, like everyone else on Wall Street, he has no idea what the unpredictable Trump administration and its mercurial President will come up with next.

However, assuming the tariff landscape remains unchanged throughout the quarter, Cook estimates these will increase Apple’s cost by $900 million. The Apple CEO was extremely careful to say that investors and analysts should not rely on this estimate to make projections “as there are certain unique factors that benefit the June quarter.” However, he didn’t expand on those until he was asked more pointed questions later in the call.

During the Q&A session, Cook shared that Apple has managed to avoid the worst of the tariffs so far by shipping more inventory into the United States and seeing the worst of the Chinese tariffs repealed, pending a Section 232 investigation into semiconductor imports. It’s uncertain when that investigation will conclude, but it could leave Apple off the hook for most of Q3 2025 — the “June quarter.” However, the Trump administration has promised to levy a new set of tariffs on elections in the next few months, so there’s still much uncertainty as to what will happen as no one knows how much those will be or when they’ll come into effect.

More US iPhones Will Come from India

In response to another question, Cook confirmed reports that Apple will be sourcing more of its products sold in the US from places other than China to take some of the sting out of the tariffs.

For the June quarter, we do expect the majority of iPhones sold in the US will have India as their country of origin and Vietnam to be the country of origin for almost all iPad, Mac, Apple Watch, and AirPods products also sold in the US.

Apple CEO Tim Cook

Cook didn’t say whether Apple is increasing production in India to meet this demand, but he did add that the vast majority of products sold outside the US will still come from China, as those aren’t impacted by US tariffs.

When asked about supply chain changes in the US and India, Cook took the politically safe approach and focused solely on Apple’s work in the US.

We're excited about bringing more production to the US. As you know, we've been very key in the TSMC project in Arizona and are the largest and first customer getting product out of that. And that's the SoC that's coming out of there. We also have glass coming out of the US and the Face ID module and loads of chips. In fact, there are 19 billion chips coming out across 12 states. This is down to the resistor and capacitor level, obviously

Tim Cook

Apple Intelligence and Siri

During his opening remarks, Cook put a positive spin on Apple Intelligence in iOS 18, emphasizing the features that the company has already delivered, from Writing Tools and Image Playground to its groundbreaking Private Cloud Compute (PCC) infrastructure that’s “an extraordinary step forward for privacy and AI.” He also conceded that the “more personal Siri” features need more time, but that work is progressing.

With regard to the more personal Siri features we announced, we need more time to complete our work on these features so they meet our high-quality bar. We are making progress and we look forward to getting these features into customers' hands.

Tim Cook

Despite the lack of Siri improvements, Cook says the numbers reflect that Apple Intelligence is having a positive impact on iPhone 16 sales. When asked about iPhone sales, Apple’s chief executive said they saw stronger year-over-year performance in markets where Apple Intelligence was already available, suggesting that the AI feature drove more sales. He also noted that the expanded language and EUI support didn’t arrive until April, the start of Q3.

Cook evaded a more pointed question about specific reasons behind the Siri delays, refusing to address whether it was “organizational factors,” a “legacy software stack,” or “R&D spending.” Instead, Cook more or less repeated his opening comments, responding that “we just need more time to complete the work so they meet our high-quality bar. And there's not a lot of other reason for it. It's just taking a bit longer than we thought.”

App Store and Other Legal Controversies

With Apple’s earnings call taking place less than 24 hours after US Judge Yvonne-Gonzalez Rogers issued a scathing ruling against Apple’s behavior with the App Store, it’s not a big surprise that Cook was asked to comment on that and some of the other “high-profile legal cases that touch on Apple.” It’s a valid question, as investors are understandably concerned that these could hit Apple’s Services revenue. However, Cook declined to say anything beyond what an Apple spokesperson had already shared.

The case yesterday, we strongly disagree with. We've complied with the court's order and we're going to appeal. In the DOJ case that you referenced with Google, that case is ongoing and I don't really have anything to add beyond that. And so we're monitoring these closely. But, as you point out, there's risk associated with them and the outcome is unclear.

Tim Cook

In the case of the App Store ruling, Apple is now required to allow developers to use their own in-app purchasing solutions in the US that can entirely bypass Apple’s commission structure. That will potentially impact Apple’s bottom line, but it’s hard to say by how much since it comes down to how many developers take advantage of it.

The Google antitrust case referenced above doesn’t directly involve Apple. However, the company could see a significant fallout if the courts rule that the multibillion search deal between the two companies is illegal and needs to end.