The Numbers

Let’s start by getting the dollars out of the way. As noted earlier, Apple posted revenue of $95.36 billion, exceeding Wall Street’s most optimistic expectations, which had predicted only $94.35 billion in sales. Profit estimates were slightly closer, with analysts postulating $24.37 billion and Apple reporting $24.78 billion.

Apple’s numbers sagged in the year-ago quarter (Q2 2024), dropping 4.3% over the 2023 results; however, the company recovered nicely this year with a 5.1% increase over last year that exceeds its 2023 numbers but still falls short of its $97.3 billion peak in Q2 2022. Apple still set a new record for a March quarter, specifically for earnings per share (EPS), as Apple’s new CFO, Kevin Parekh, explains.

“Our March quarter business performance drove EPS growth of 8 percent and $24 billion in operating cash flow, allowing us to return $29 billion to shareholders,” said Kevan Parekh, Apple’s CFO.

However, that’s merely a result of fewer shares on the market; in Q2 2022, Apple reported 32,682,118 outstanding shares. That number has dropped to 30,050,215 in this latest quarter. 2.6 million fewer shares means there’s more money for each share, even though Apple’s overall profits fell by $230 million compared to Q2 2022.

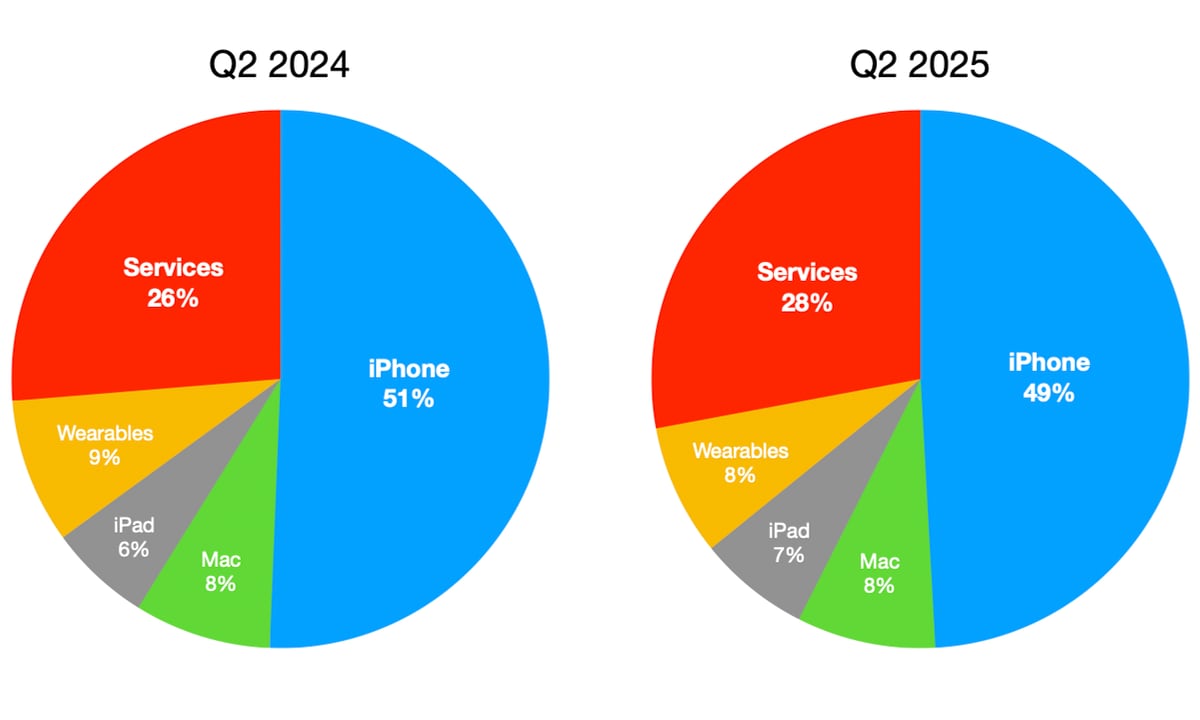

Apple grew in four of its five key product categories, with services hitting another record high of $26.65 billion, up from $23.87 billion in Q2 2024 and even gaining on the $26.34 billion from Q1 2025. Here’s the breakdown:

- iPhone: $46.84 billion (up 1.9%)

- Mac: $7.95 billion (up 6.7%)

- iPad: $6.4 billion (up 15.2%)

- Wearables: $7.52 billion (down 4.9%)

- Services: $26.65 billion (up 11.6%)

While Apple’s services accounted for 28% of the company’s revenue this quarter, growth seems to have slowed down. The services category has typically seen stronger double-digit growth, posting increases between 14.2% and 26.6% year-over-year for the past five Q2 periods; the only aberration was Q2 2023 was an aberration, when it grew by only 5.5%.

The iPhone grew at its usual steady pace, with no indication that the iPhone 16e significantly moved the needle. On the other hand, the Mac and iPad categories were likely both bolstered by the new M3 iPad Air, A16 iPad, and M4 MacBook Pro models released in early March. In fact, this is the first time since 2021 that iPad sales have grown in Q2, but we also haven’t seen an iPad released before April since the fifth-generation iPad Air came along in 2022.

Wearables, Home, and Accessories continued to lose ground. Even the holiday quarter saw a 1.7% drop over Q1 2024, despite the release of the Apple Watch Series 10 and AirPods 4. The Home part of that category continues to be stale, with nothing new since Q1 2023, when Apple released the third-generation Apple TV 4K. However, even that wasn’t a banner quarter, despite hosting the launch of the AirPods Pro 2 and three new Apple Watch models.