10 Things You Should Know About Bitcoin

If you've been following the news lately, you've probably noticed a slew of coverage on Bitcoin, and its associated buzzwords — decentralized, blockchain, wallet, etc. But even if you've skimmed over that coverage, bitcoin and its mechanisms can still be confusing. To be fair, it's a fairly complicated topic. To get you started, press the right arrow to learn 10 things you need to know about Bitcoin.

10 What Are Bitcoins?

Put simply, a bitcoin is a type of digital currency. More specifically, it’s a type of cryptocurrency. We’ll cover more of the specifics later on, but in essence, a bitcoin is a unit of real money that exists solely in the digital realm. On another note, if you see Bitcoin capitalized, it more often than not refers to the Bitcoin Network, or the Bitcoin software that’s used to “mine” bitcoin — rather than a single unit of the currency itself.

It’s hard to know how many people are using bitcoin, but some estimates indicate that there are at least 12.77 million bitcoin wallets (though many bitcoin users have multiple). And while bitcoin used to be worth just pennies, the current exchange rate — in U.S. dollars — is $17,898.99 to 1 bitcoin.

9 Who Invented Bitcoin?

The concept of bitcoin was created by an individual (or a group of people) under the pseudonym Satoshi Nakamoto, who published a paper in 2008 describing the ins and outs of digital currency — a paper that contained a proof of concept for bitcoin.

Nakamoto later launch the mining software that led to the development of the first Bitcoin network in 2009. Mysteriously, Nakamoto left the project in 2010 and promptly disappeared. To this day, Nakamoto’s identity has never really been confirmed.

8 Digital Currency vs. Cryptocurrency

Now is a good time to talk about digital currencies and cryptocurrencies. Bitcoin is a digital currency, meaning that it’s created and stored online. And unlike traditional currency, it has no physical form.

But bitcoin is also a cryptocurrency. Put simply, a cryptocurrency is a digital currency that uses electronic encryption for security purposes. The security features of cryptocurrencies like bitcoin are also mean that they are extremely difficult to counterfeit.

7 Who’s In Charge of It?

In two words: no one. Bitcoin is a decentralized currency, that means that it’s not backed or controlled by any single government or entity. That means that it’s not limited by geographical boundaries. It also means that the value bitcoin is determined, essentially, by how much people are willing to pay for it.

On a similar note, bitcoin is also a peer-to-peer payment system. That means that it doesn’t need a third party, like a bank or a payment processor, to verify transactions. It’s worth noting that this doesn’t mean that Bitcoin is untraceable, as you’ll see in a bit.

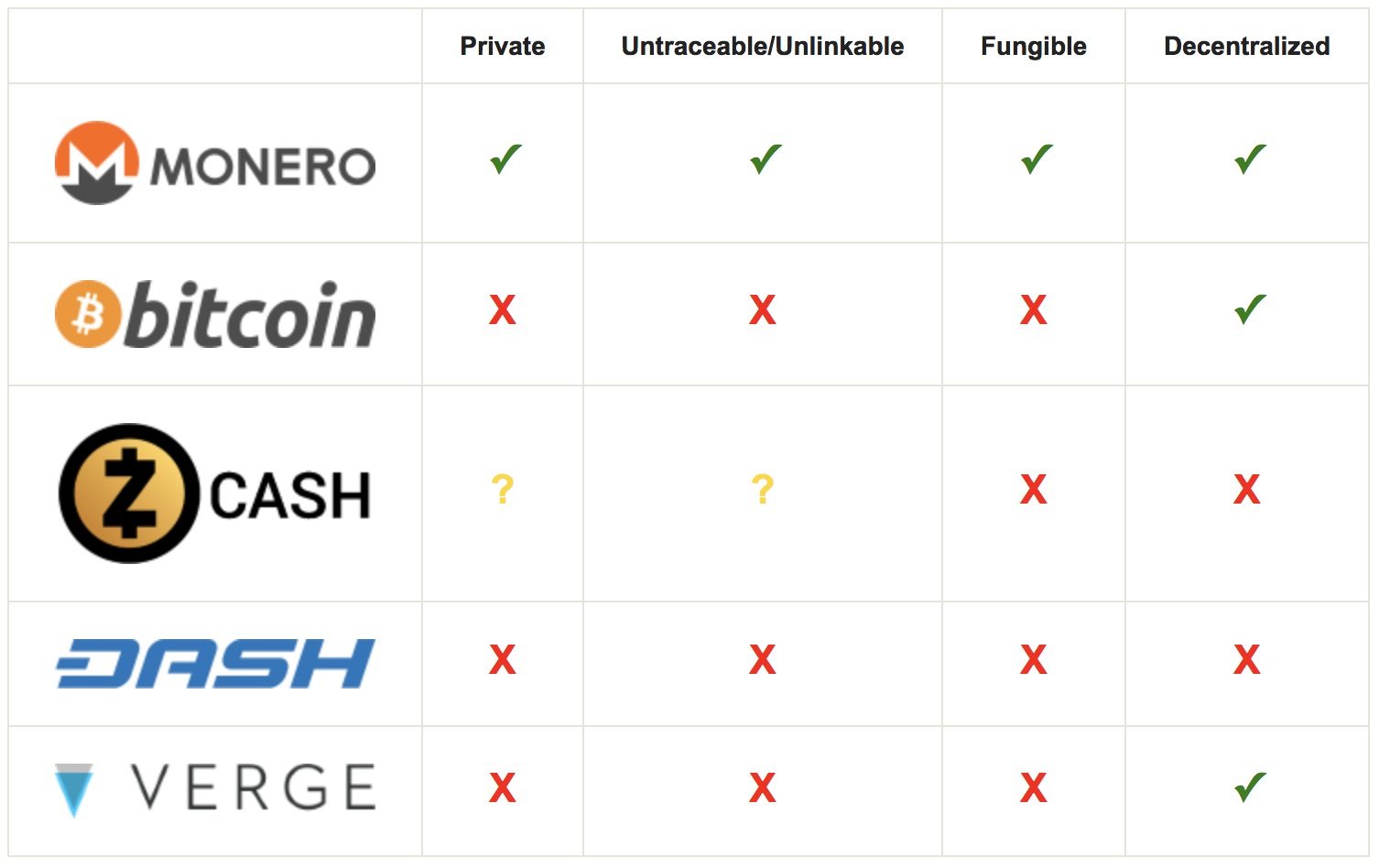

6 Is Bitcoin Untraceable?

Bitcoin is not anonymous, contrary to popular belief. And it’s even less so now that many bitcoin providers are implementing anti-money laundering measures. Many wallets and bitcoin providers are starting to require users to submit proof of identity and proof of residence to buy and store bitcoins.

Every bitcoin transaction is also recorded in a public ledger called the blockchain. These transaction records are permanent and not editable. While this acts as proof of transaction and protects against double-spending, it also means that it’s possible to trace where a bitcoin came from. Bitcoin's reputation for anonymous criminal spending is largely a myth.

5 Is Bitcoin Safe?

This is a complicated question to tackle, and the simplest way to answer it is: it depends. In general, bitcoin can be stolen fairly easily and, because it’s decentralized, a user’s security is solely their own responsibility. Because bitcoin is not considered legal tender in most countries, you’ll have no way to get your bitcoins back if they’re stolen.

In addition, it can be hard to know which bitcoin wallets and providers are actually legitimate, and which are scams. Because of that, it’s highly recommended that users exercise caution, and have moderate digital expertise and security knowledge before delving into the currency.

4 How to Get Bitcoins

The simplest way to get bitcoins is to simply buy them. You can easily Google bitcoin exchanges and find an option that will let you purchase bitcoin in your region’s currency. In addition, there are outlets that allow you to buy bitcoin from other individuals. You can also accept bitcoin as payment for products or services rendered.

Lastly, you can “mine” for bitcoin. Bitcoin mining involves using a computer with special software that solves complex math problems. In exchange, a certain and often small number of bitcoin is issued to the computer’s owner. While once a lucrative option, bitcoin mining is becoming less so as its price goes up.

3 What Can You Do with Bitcoins?

Hypothetically, you can buy just about anything with bitcoin. In practice, however, you’ll only be able to purchase goods and services from merchants and individuals who accept bitcoin as currency. Currently, the amount of vendors that do is fairly limited. There’s a site called SpendBitcoins that lists places that accept the currency.

Similarly, some people use bitcoin as an investment, which would have been a smart prior to its meteoric rise in value. If you bought $5 worth of bitcoin seven years ago, it would equal out to about $4.4 million today, for example. Whether or not it’s a smart move to invest in bitcoin now is up for debate. Lastly, bitcoin is also a good way to easily make international money transfers, as it foregoes the exchange rate.

2 What’s the Point?

What’s the point of bitcoin? Well, for many of the reasons listed above. It’s an elegant and simple way to make peer-to-peer transfers (particularly for international transactions), it’s decentralized, and it’s outside of state control — which is more important to some people than others.

Again, many people invest in bitcoin because of its steadily growing value (there’s a cap on how many bitcoins can be mined). Others probably just want in on whatever the next trend is, and there’s nothing wrong with that. As long as you’re careful and exercise caution, you can get into bitcoin for whatever reason you so choose.

1 Where’s Bitcoin Going?

No one knows what’s going to happen to bitcoin in the future. The cryptocurrency is obviously seeing a spike in attention and popularity right now, which might bode well for the near future. But its longevity as a long-term investment option or means of transactions is totally up in the air.

That’s especially true since it’s decentralized — and isn’t protected by any one body or government. If people start selling off their bitcoin or lose interest in the cryptocurrency, its value will plummet. While that makes investing and buying bitcoin a gamble, it also means that it could be incredibly profitable depending on its future.