7 Reasons Why Apple Card Will Be the World’s Most Secure Credit Card

Apple

Apple

Apple surprised everyone last month by debuting a single hardware product at its services event: the Apple Card. But while it's a sleek physical credit card, it's just as much a digital entity — and its features go far beyond ease of use and aesthetics.

The Apple Card and its tight integration with Apple Pay also means that the entire thing is likely to be the most secure and private credit card on the market when it launches. Continue reading to learn just seven ways that the Apple Card will revolutionize credit card security.

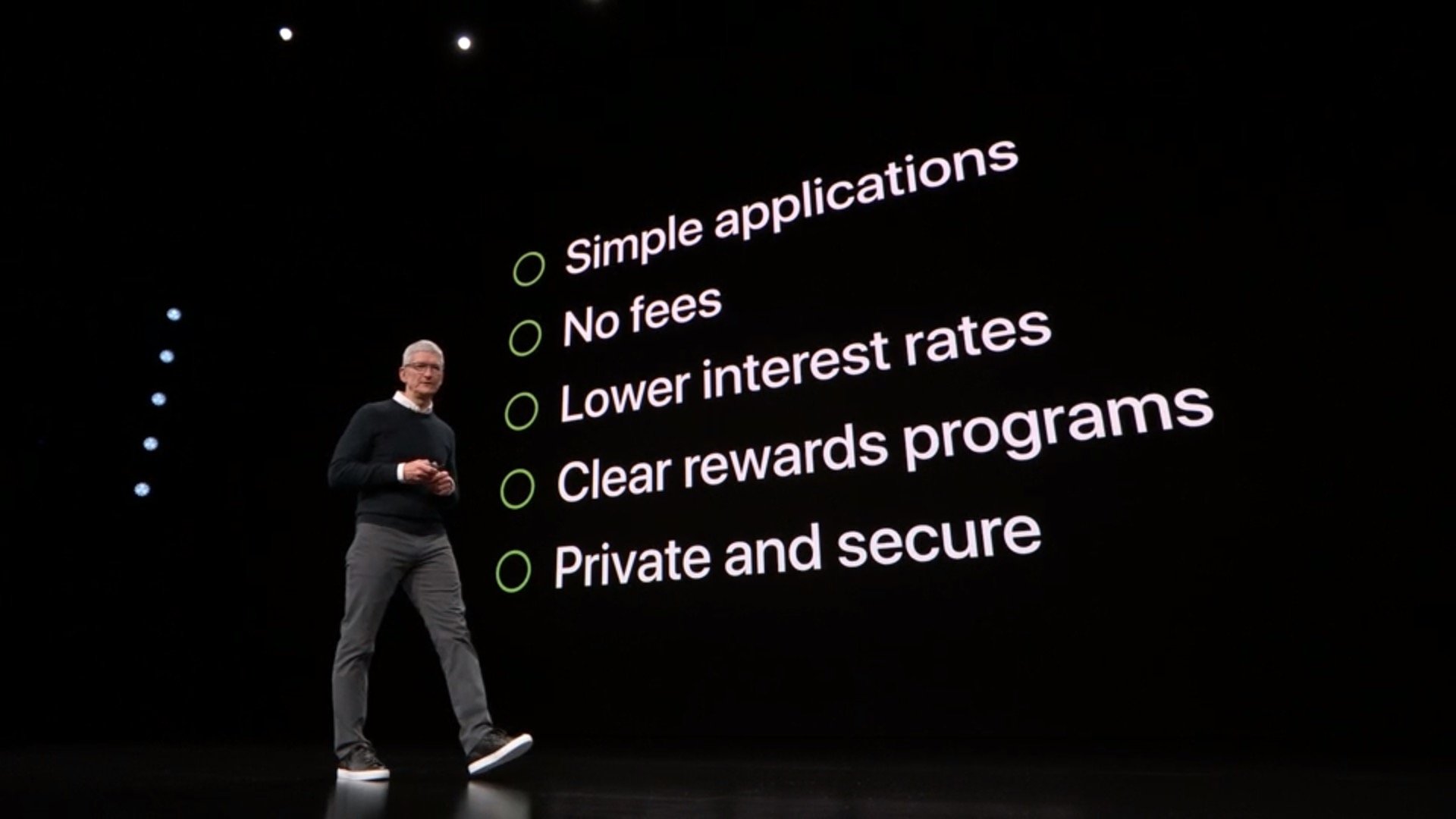

Apple’s Privacy Policies

The Apple Card and Apple Pay both have their own set of security measures. But it’s worth noting Apple’s own privacy policies, which are among the strictest and most pro-consumer of any tech firm.

Apple won’t track your purchases. That means it won’t know what you buy or where you bought it. While that may not deter a thief, it could give consumers some peace of mind that their Apple Card activity isn’t being used for other marketing purposes.

Apple Pay Security

The Apple Card, although somewhat a separate entity, will stand to benefit from the strict security measure that are already built into Apple Pay. That includes some measures we’ll get into later, but a few are worth mentioning here.

For one, Apple Pay transactions are protected by the airtight encrypted and biometric features of Apple’s devices — whether it be Touch ID, Face ID or a passcode. No one can make any sort of Apple Pay transaction without your biometrics. Even the Apple Watch, arguably the weakest link, would require a thief to steal it off your wrist and know your passcode.

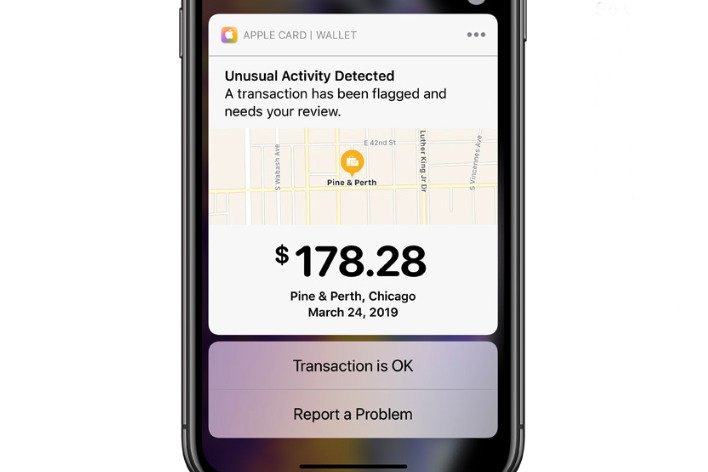

Instant Suspicious Purchase Alerts

Of course, credit card fraud can sometimes go undetected. By the looks of it, that won’t be the case for Apple Card. You’ll be notified on your iOS device every time you make a purchase, which could alert you to fraudulent activity as soon as it happens.

But Apple goes a step further, flagging suspicious spending or activity automatically. If the system comes across anything fishy, it’ll notify you and ask you to confirm that you made the purchase. That makes confirming weird transactions that you actually did make a lot easier, too.

Easy Cancellation

But what if a thief actually does manage to make off with your Apple Watch and your passcode? Apple, luckily, makes it extremely easy to cancel (or restore) access to Apple Pay or your Apple Card from any Apple device — or a standard web browser, if you don’t have another Apple product handy.

That applies to the physical Apple Card as well. Users can easily block transactions from within the Wallet app. If it turns out that an Apple Card was simply misplaced instead of lost or stolen, reinstating access is just as easy and seamless. There aren’t many hoops to jump through.

Physical Card Design

The Apple Card is a sleek thing. On the front of it, there’s only a laser-etched name, Apple logo and a chip. But its stark minimalism serves another purpose beyond aesthetics: it’s more secure.

Even if a thief were able to swipe your physical card, they wouldn’t be able to input any of its details into a website — because they aren’t there. Apple also makes it easy to cancel (or restore) a card right from the Wallet app on an iOS device.

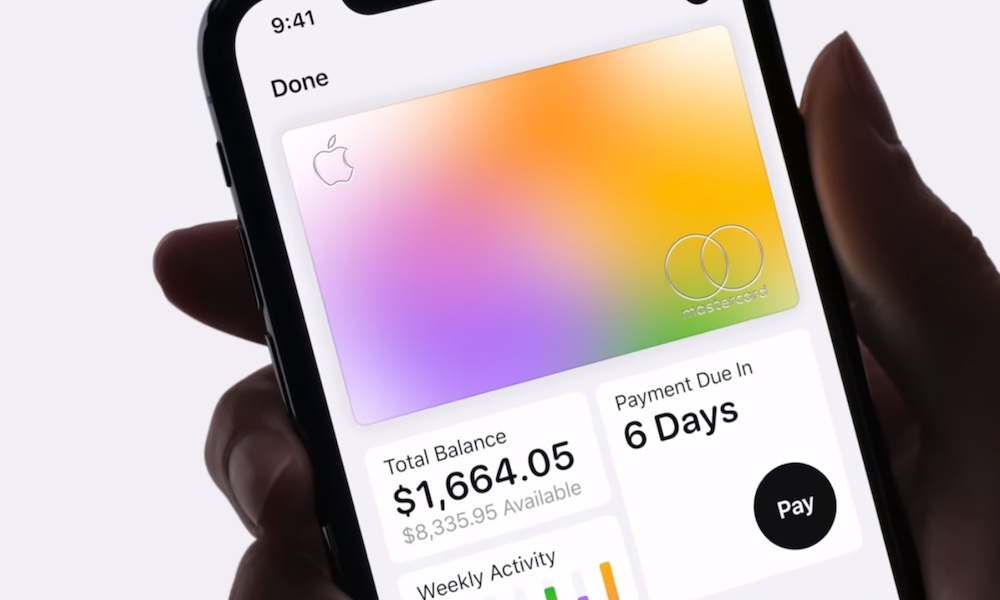

Virtual Numbers

While the physical Apple Card doesn’t contain a printed card number (or any other identity financial details), the magnetic strip encoded on it does have a card number. But Apple offers a few tools that mitigate this potential vulnerability.

That’s because the card number you’ll use for digital vendors or other transactions in the Wallet app is separate from your physical magnetic number. If you’re suspicious about it, you can always request a replacement card number — which won’t affect your physical card.

It’s All Integrated

Apple Pay is a fairly secure platform. Fraud isn’t impossible on it, but it is much harder to pull off than with standard credit or debit cards. For the most part, that’s because the weak link for most credit card or debit card fraud has been the issuing bank.

With Apple Card, the entire platform is much more integrated. Apple handles more of the actual process, effectively becoming its own bank. That should shore up any weak points on an issuer’s side, and it will make it much easier for users to deal with any actual fraudulent activity.