5 Highlights from Apple’s Q3 2025 Earnings Call

Tada Images / Adobe Stock

Tada Images / Adobe Stock

Apple blew away analyst expectations this week when it posted the highest gains over analyst estimates in four years. While the company typically surpasses predictions by analysts, the margin this time around hit a record-setting level of nearly five percent.

That’s especially surprising in the light of the challenges the company has been facing with increasing tariffs. Still, it’s also fair to say that those same issues may have left analysts tempering their expectations. In other words, it’s not clear if the markets were setting a lower bar, but Apple outperformed those expectations either way.

Apple’s third fiscal quarter is also typically a more awkward one for the company. It runs from April to June, straddling the annual Worldwide Developers Conference (WWDC), and while it rarely features any significant new hardware releases, the fact that these do sometimes appear can skew the year-over-year numbers.

This quarter brought us no new products, which means that sales would have been coasting on momentum from the iPhone 16e, refreshed iPads, and the new M4 MacBook Air that debuted in February and March, which was toward the end of Apple’s second fiscal quarter. Nevertheless, that was likely enough, as Apple saw significant global growth in key areas.

Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services and growth around the world, in every geographic segment. At WWDC25, we were excited to introduce a beautiful new software design that extends across all of our platforms, and we announced even more great Apple Intelligence features.

Tim Cook, Apple’s CEO

Beyond the formal announcement of earnings and revenue, the call that follows with investors and analysts often provides some interesting insights into Apple’s strategic direction and future plans, and this week was no exception. Read on for 5 interesting things that came out of yesterday’s earnings call.

The Numbers

Apple didn’t just leave Wall Street’s expectations in the dust. It also posted massive gains of 10 percent over its year-ago quarter, with revenue of $94 billion overall, compared to $85.8 billion at this time last year. That falls slightly short of the $95.4 billion that Apple pulled in during Q2, but that’s also why financials are more about year-over-year comparisons.

Apple’s third quarter has shown more consistent improvement over the years, with the only notable exception being a 1.4 percent drop between 2022 and 2023. However, it skyrocketed in 2021, undoubtedly aided by the global health pandemic, when it jumped by 36.4 percent over 2021, with revenue growing from $59.7 billion to $81.4 billion. It’s been on a steady rise ever since, with that 2023 blip easily eclipsed by 4.9 percent growth in Q3 2024 and this year’s staggering 9.6 percent.

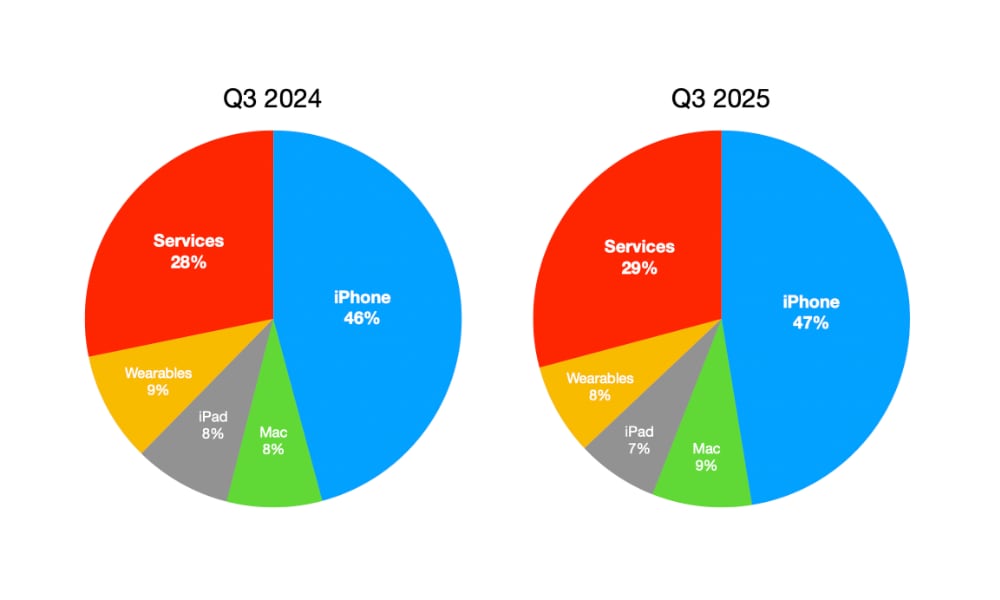

As usual, Apple’s services have seen a healthy increase, but this time they came slightly behind both iPhone and Mac growth. Meanwhile, iPad and Wearables both shrank compared to the last quarter. Here’s the breakdown by category:

- iPhone: $44.58 billion (up 13.5%)

- Mac: $8.05 billion (up 14.8%)

- iPad: $6.58 billion (down 8.1%)

- Wearables: $7.4 billion (down 8.6%)

- Services: $27.42 billion (up 13.3%)

While the decline in wearables is a bit harder to figure out, the drop in iPad sales isn't all that surprising. The iPad had a banner third quarter in 2024 thanks to the release of the new M4 iPad Pro and M2 iPad Air, both of which came after an 18-month dry spell during which no new iPads were released. Pent-up demand meant that record sales were inevitable, and the iPad category jumped by 23.7 percent, a level not seen since folks were buying tablets to endure pandemic lockdowns. This year’s $6.58 billion in sales is 13.64 percent higher than the Q3 2023 numbers, so this year is more of a levelling off.

“We are very pleased with our record business performance for the June quarter, which generated EPS growth of 12 percent,” said Kevan Parekh, Apple’s CFO. “Our installed base of active devices also reached a new all-time high across all product categories and geographic segments, thanks to our very high levels of customer satisfaction and loyalty.”

Apple Has Sold Three Billion iPhones

One of the more interesting numerical announcements yesterday is that Apple sold its three billionth iPhone during the quarter.

We shipped the three billionth iPhone since its launch in 2007. From the Pro models with the powerhouse A18 Pro and innovative Pro camera features to the iPhone 16e with breakthrough battery life and a 2-in-1 camera system, users are finding so many reasons to love the best iPhone lineup we've ever created.

Tim Cook

Apple celebrated its one billionth iPhone milestone in 2016, about a month after its ninth birthday, and a few weeks before the iPhone 7 arrived. The launch of the original low-cost iPhone SE earlier that year may have also helped spur it on.

The two billionth iPhone sale went by unacknowledged, but analysts believe it happened in mid-2021, around the time the iPhone 13 lineup was released. Still, those were best guesses, as Apple hasn’t reported unit sales for its products since 2018, so analysts are forced to read between the lines to try and figure this out based on third-party sales figures and revenue reporting.

This year’s three billionth iPhone comes on the heels of the iPhone 16e, the spiritual successor to the iPhone SE.

Tariffs Are Still Going to Create a Storm

While many analysts expected the tariff situation to affect this quarter’s numbers adversely, Apple has been able to weather much of that storm so far. The worst of these levies were only applied to Apple’s products for a relatively brief period in April before the Trump administration hit the pause button, and Apple had enough stock in the US pipeline to avoid making a massive dent in its bottom line.

That’s not to say Apple got off scot-free. Cook revealed yesterday that Apple spent around $800 million in China-related tariffs, mainly under the International Emergency Powers Act (IEEPA). Those were the initial 20 percent tariffs levied against China in March, as opposed to the additional “retaliatory” tariffs that brought the total levy up to 145 percent in April.

When the Trump administration granted a temporary exemption on electronics that covered most Apple products, it reduced the China tariffs back down to the original 20 percent. Apple has likely been paying that one all along.

However, this reprieve on higher tariffs was never expected to last, and Cook announced yesterday that the worst of the storm is still on its way. India, where Apple has moved much of its manufacturing, was hit with a 25 percent tariff this week, and China will soon be going to 30 percent. Meanwhile, Brazil, which some analysts viewed as a possible haven for low-tariff iPhone production, has just had its tariffs dialled up to 50 percent.

"For the September quarter, assuming the current global tariff rates, policies, and applications do not change for the balance of the quarter and no new tariffs are added," Cook said, "we estimate the impact to add about $1.1 billion to our costs."

Several reports suggest that Apple is already mulling price increases for the iPhone 17 lineup, although that’s far from a certainty. Apple could choose to eat some of those costs, or find other ways to raise prices more subtly, as it did with the iPhone 15 Pro Max in 2023 when it bumped the base storage to 256 GB, eliminating the lower cost option while not technically increasing the price.

Apple Intelligence, Mergers and Acquisitions

It was no surprise that analysts on the call were interested to hear what Tim Cook had to say about Apple’s plans for artificial intelligence. That’s the hot thing in the industry right now, and Apple is still viewed as lagging behind after a lukewarm rollout of Apple Intelligence last year and its failure to deliver on its promised Siri improvements.

”We’re making good progress on a more personalized Siri, and as we've said before, we expect to release these features next year, Cook reassured folks on the call. “We are also reallocating a fair number of people to focus on AI features within the company,” he added, explaining that Apple plans to continue significantly growing its investment in Apple Intelligence and related technologies.

Cook also hinted that acquisitions may be the key to some of this growth. When asked about “big M&A” (mergers and acquisitions), the Apple CEO shared that they’ve already acquired seven companies, and are regularly looking at more, “from all walks of life, not all AI oriented.”

We're very open to M&A that accelerates our road map. We are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature. But we basically ask ourselves whether a company can help us accelerate a roadmap. If they do, then we're interested, but we don't have anything to share specifically today.

Tim Cook

So far, Apple hasn’t made any massive acquisitions, just a handful of small companies. However, rumors still abound about the possibility of Apple folding in AI giants like Perplexity to bolster its search capabilities. It’s also reportedly fostering partnerships with OpenAI and Anthropic to help build out its LLMs.

This Year’s Developer Betas Are More Popular Than Ever

The timing of Q3 earnings calls, landing between WWDC and September’s public release schedule, means that Cook nearly always has something to say about Apple’s upcoming software releases. However, in this case, he had an extra tidbit to share while touting everything that’s coming in iOS 26 and the rest.

It turns out that these have been the most popular developer betas Apple has ever released. He didn’t specify any particular platform, instead referring to the three flagship versions: iOS 26, macOS 26, and iPadOS 26, collectively. He also didn’t provide any numbers or comment on the public beta program.

It's wonderful to see great momentum building for our platforms. iOS 26, macOS 26, and iPadOS 26 are by far the most popular developer betas we've had.

Tim Cook

Notably, Cook also didn’t directly tie the adoption of developer betas to actual app development. Perhaps he felt that was implied, but after dropping the $99 cost of entry to the access developer betas two years ago, many more non-developers are downloading these early betas to kick the tires.