The Numbers

Apple didn’t just leave Wall Street’s expectations in the dust. It also posted massive gains of 10 percent over its year-ago quarter, with revenue of $94 billion overall, compared to $85.8 billion at this time last year. That falls slightly short of the $95.4 billion that Apple pulled in during Q2, but that’s also why financials are more about year-over-year comparisons.

Apple’s third quarter has shown more consistent improvement over the years, with the only notable exception being a 1.4 percent drop between 2022 and 2023. However, it skyrocketed in 2021, undoubtedly aided by the global health pandemic, when it jumped by 36.4 percent over 2021, with revenue growing from $59.7 billion to $81.4 billion. It’s been on a steady rise ever since, with that 2023 blip easily eclipsed by 4.9 percent growth in Q3 2024 and this year’s staggering 9.6 percent.

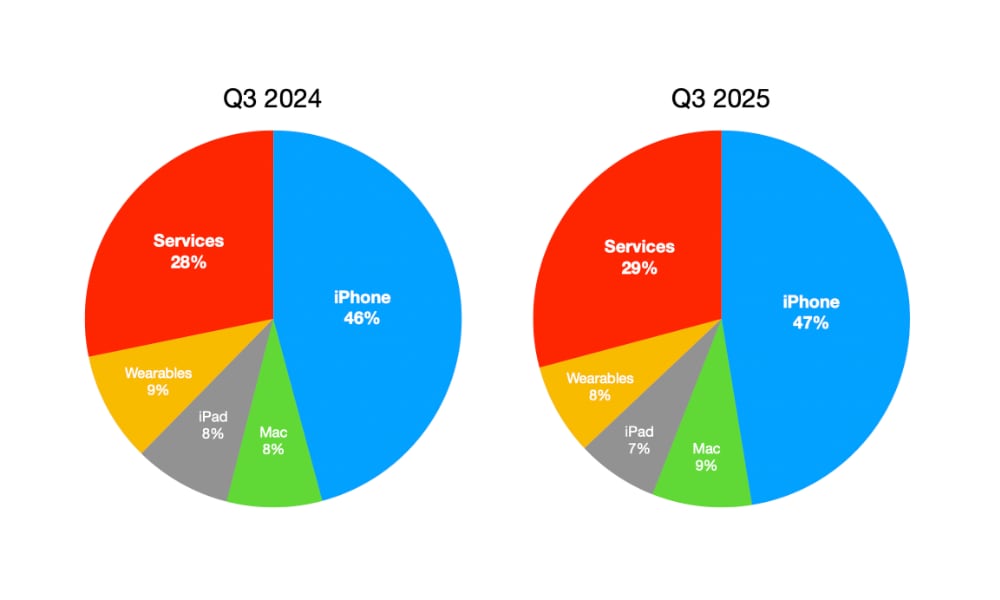

As usual, Apple’s services have seen a healthy increase, but this time they came slightly behind both iPhone and Mac growth. Meanwhile, iPad and Wearables both shrank compared to the last quarter. Here’s the breakdown by category:

- iPhone: $44.58 billion (up 13.5%)

- Mac: $8.05 billion (up 14.8%)

- iPad: $6.58 billion (down 8.1%)

- Wearables: $7.4 billion (down 8.6%)

- Services: $27.42 billion (up 13.3%)

While the decline in wearables is a bit harder to figure out, the drop in iPad sales isn’t all that surprising. The iPad had a banner third quarter in 2024 thanks to the release of the new M4 iPad Pro and M2 iPad Air, both of which came after an 18-month dry spell during which no new iPads were released. Pent-up demand meant that record sales were inevitable, and the iPad category jumped by 23.7 percent, a level not seen since folks were buying tablets to endure pandemic lockdowns. This year’s $6.58 billion in sales is 13.64 percent higher than the Q3 2023 numbers, so this year is more of a levelling off.

“We are very pleased with our record business performance for the June quarter, which generated EPS growth of 12 percent,” said Kevan Parekh, Apple’s CFO. “Our installed base of active devices also reached a new all-time high across all product categories and geographic segments, thanks to our very high levels of customer satisfaction and loyalty.”