The Top 8 Budgeting Apps for iPhone and iPad

Atlantic Money

Atlantic Money

When it comes to finances, most of us have a hard time keeping track of our income and expenses.

And unfortunately for us, that's one of the most important parts of the life of any adult. If you want to have some money to invest or save, or you just want to pay off your debt, you need to keep track of all the money that goes in and out every month, especially if you're someone with a variable income.

The good news is that you're not alone. Sure, you can try to keep track of your finances in a spreadsheet or a notebook, but you can make things so much easier with the help of an iPhone app.

Sadly, one of the most popular iPhone budgeting apps is being shut down at the end of this year. Intuit announced this week that Mint will be sunset at the end of 2023, transitioning users to its Credit Karma service instead, which is arguably more of an investment and credit monitoring tool with no meaningful budget tracking features.

However, the good news is that there are hundreds of other budgeting apps on the App Store, many of which are just as feature-rich as Mint — and some of them you can even start using for free.

All of these apps offer a ton of valuable features and guides to help you stay on track with your financial goals. Even if you've never budgeted in your life, these apps will make it super easy and accessible on all your devices.

If you want to take control of your finances, read on for the 8 best budgeting iPhone apps to help you get started.

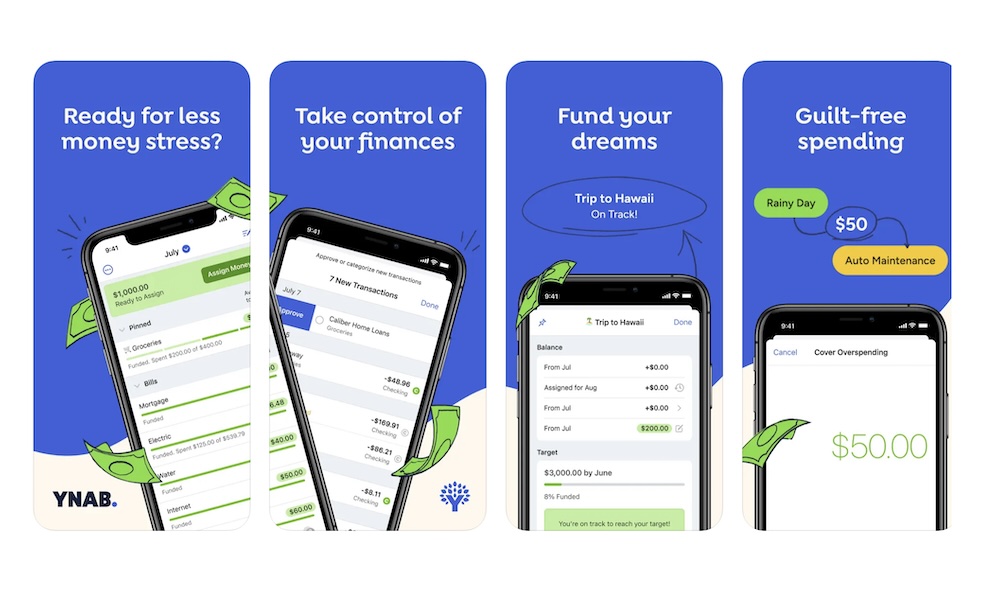

YNAB: Budgeting and Finance

YNAB is becoming a really popular budgeting app on the App Store, and for a good reason.

As the platform says, this app will "change your relationship with money." It will help you change the way you look at your money so you can make every dollar count.

YNAB is based on a "zero-based" budgeting strategy, which basically means you assign all your income to a specific category in the app — the folks at YNAB call this "giving every dollar a job." This will help you know exactly how much money you have for the rest of your month, and it'll help you think about other non-recurring payments you'll still need to take care of.

While the app might not offer as many features as other options on the list, it's still a pretty complete app that will help you track your budget, your debt, and how long you can live with your current net worth.

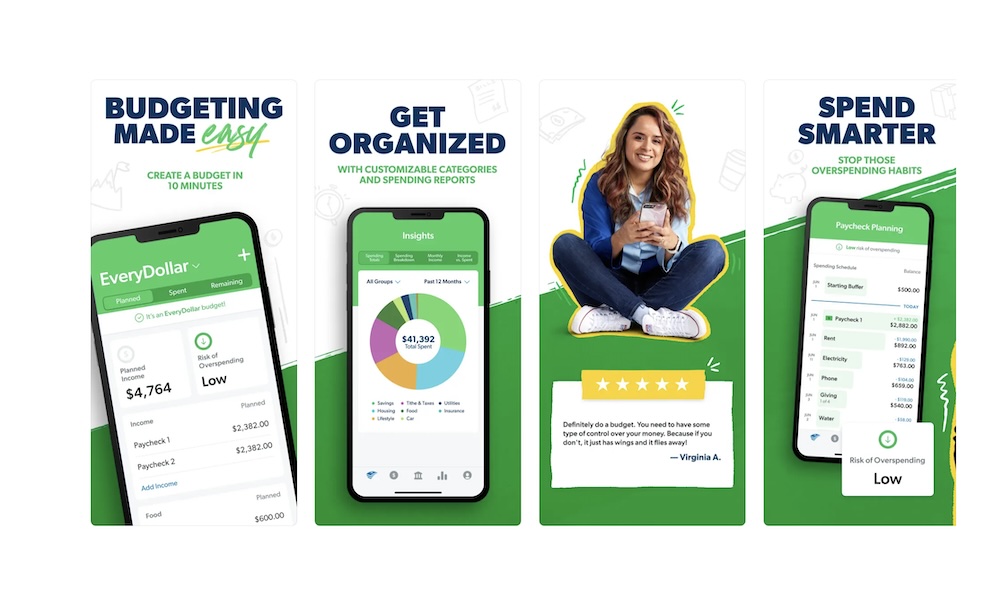

EveryDollar: Budget Your Money

If you're familiar with Dave Ramsay, you've probably heard of EveryDollar before. This is the app behind his team, and it's said to have helped thousands of people improve their finances.

Overall, this app is pretty easy to use, and it also uses a zero-based budgeting plan like YNAB. With that said, unlike YNAB, this app also offers a lot of features for free.

That's right; you can start using this app at no cost, and if you like it, you can subscribe to its premium version.

However, to get started, the free version has pretty much everything you need. For instance, you can create your budgets and sync them across all your devices, set different categories, and split all your bigger expenses if you need to.

EveryDollar's free version also lets you set and track your funds and all your transactions. Of course, if you want the app to automatically connect to your bank so you can track all your expenses without doing anything, you'll need to go for the premium version.

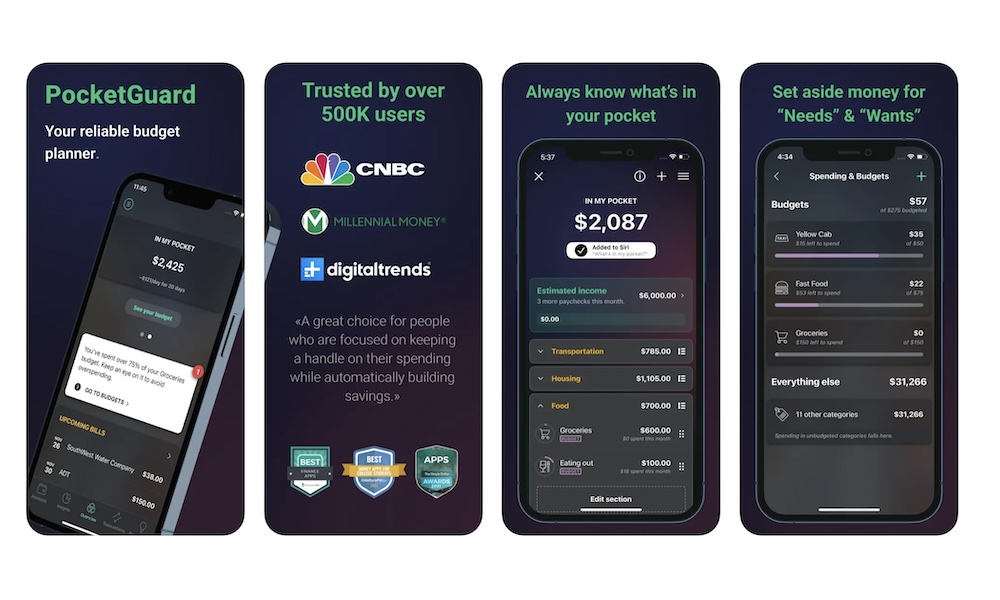

PocketGuard: Budget App & Bill

Another really popular app you can use to start budgeting is PocketGuard. This app has been featured on many huge platforms like CNBC, and there's a reason for that.

Just like other options on the list, you can start using PocketGuard completely for free, and you'll still get access to a bunch of useful features to see where your money is going every month.

One of its cooler features is called "in my pocket," which basically lets you know how much disposable income you have every month. Of course, to get an accurate estimate, you'll have to set your monthly expenses and your financial goals first.

Besides tracking your budget, you can also track your bills and subscriptions. You can easily organize these expenses and set reminders to never forget about paying again.

PocketGuard's bill organizer can also give you tips to negotiate better rates with your provider and save some money without losing your usual services. And if the app finds a service you don't use anymore, it'll suggest that you cancel it.

If that isn't enough for you, there are plenty more premium features to help you with your budget, although you'll need to subscribe to one of PocketGuard's subscription plans to get access to them.

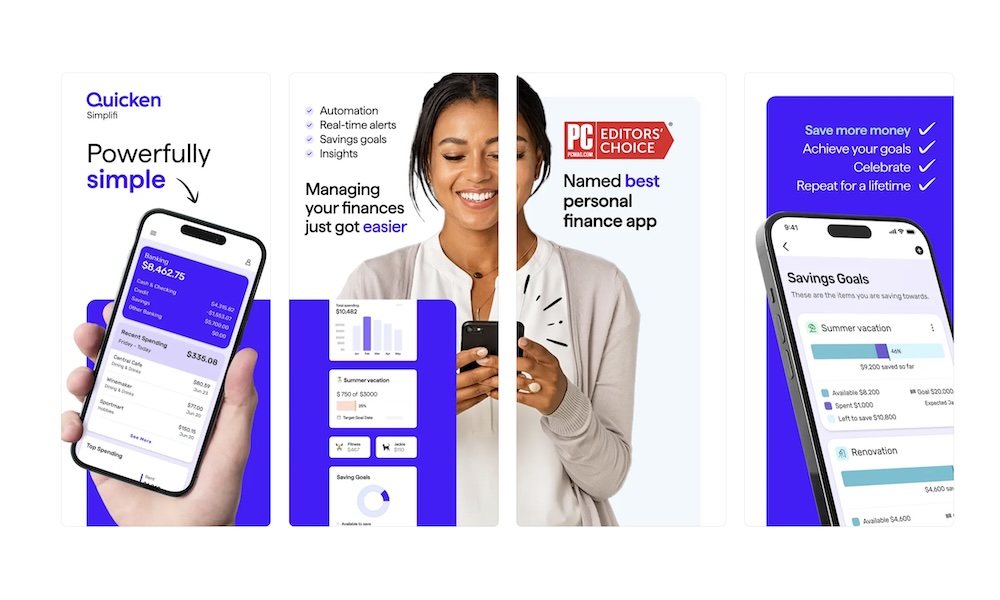

Quicken Simplifi: Budget Smart

As you can guess by the name, Simplifi aims to be a really easy-to-use budgeting app.

Because of this, the app is pretty straightforward. You can quickly connect your bank accounts, and the app will automatically register all your transactions for you. That way, you only have to worry about learning where your money is going and what you can do to save more money.

Besides that, you can also track your debt, your investments, and your monthly bills and subscriptions. And if you feel you're spending too much on specific categories, you can create different watchlists to track them.

You'll also find many popular features like creating alerts for when your bills are due, a dashboard so you can see how much money and debt you have, and financial reports so you learn different ways to save more money for your financial goals.

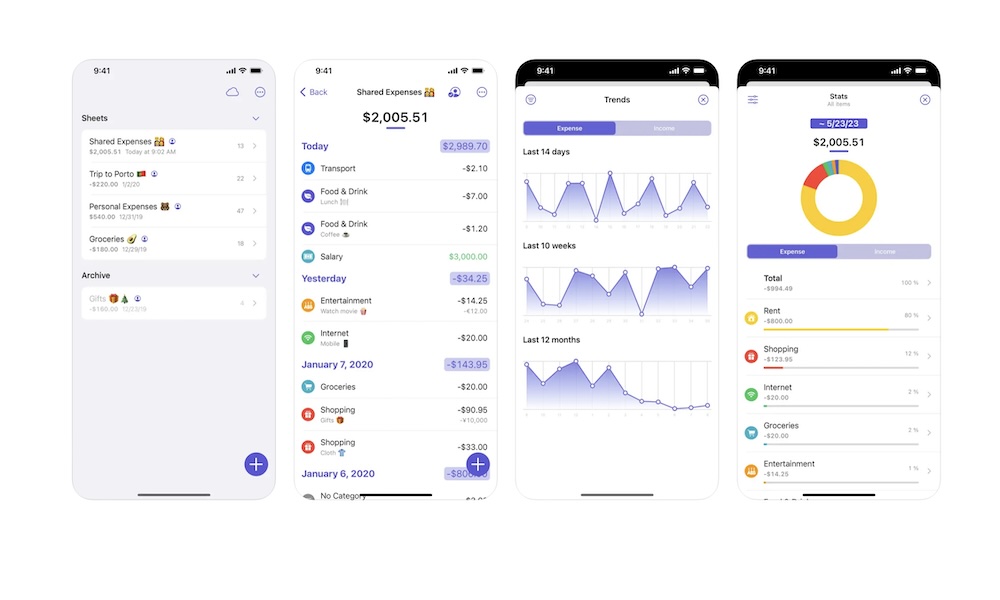

Expenses: Spending Tracker

The Expenses app isn't the most popular app on the list, but it does offer a lot of features to track your expenses and create a budget that works for you.

Even though Expenses isn't the most feature-rich budgeting app, you can do all the most basic things to track all your expenses and understand where your money is going. Plus, it also comes with extra features like a widget, the ability to sync your data via iCloud, and stats to get an overview of your spending.

While this isn't a complete budgeting app, it can help you reach your financial goals by understanding your expenses.

Plus, you can start using this app for free. And if you want to use all of its premium features, you only need to pay for the Expenses Pro in-app purchase once.

So, unlike the other apps on the list, which require a monthly or yearly subscription, you can get all of Expenses' premium features for a single payment, making it a more affordable option for those with simple needs.

Granted, the app is pretty basic, and it won't guide you in your financial journey the way other apps do. With that said, if you aren't looking for all the extra features other budgeting apps offer, this is a solid choice.

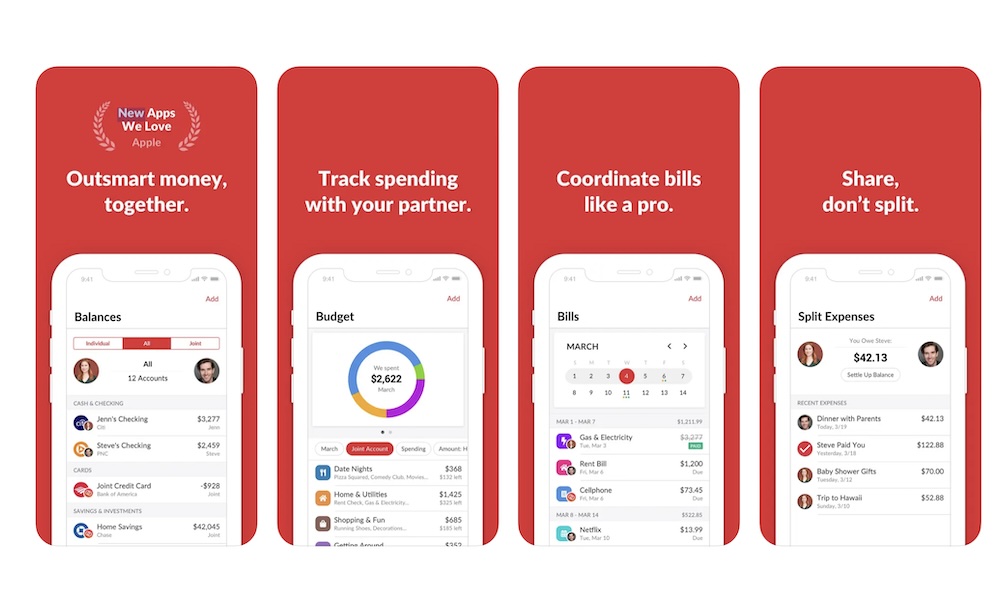

Honeydue: Couples Finance

As you can probably guess by its name, Honeydue is the perfect app for couples looking to build or improve their future together.

While you can use other apps on the list to track your money as a couple, Honeydue was specifically built to help you and your partner track your spending, tackle payments and debts, and share your finances together.

And if you still want to keep some secrets to yourself, Honeydue lets you choose how much information you want to share with your significant other.

Money is a big issue in some relationships, but this app is meant to make these conversations easier and help couples understand each other's spending habits and financial goals. Plus, you can talk and send emojis in the app to encourage your partner and let them know they're doing a great job.

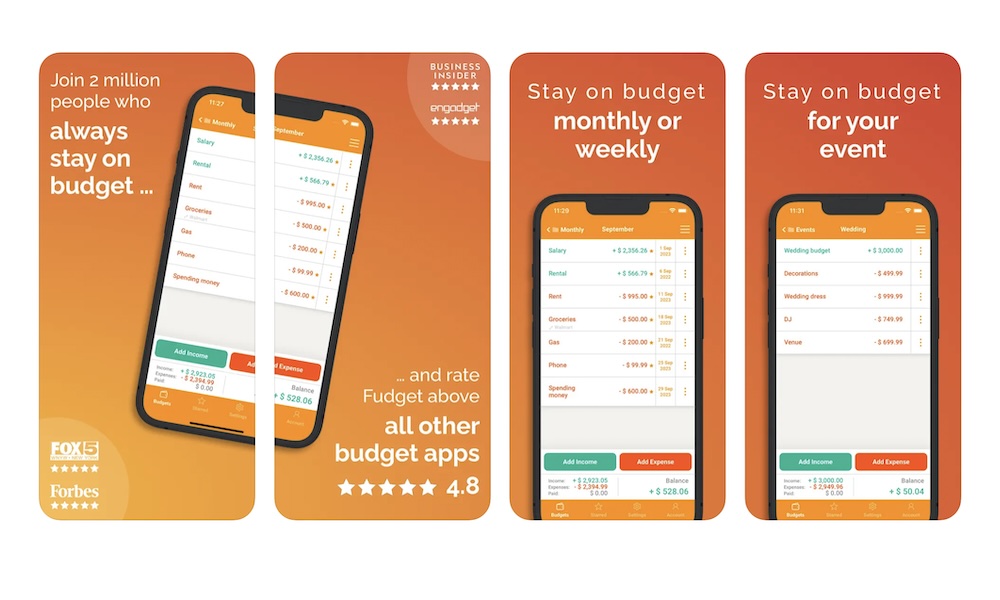

Fudget 2: Budget Planner

Another great app that's helped millions of people with their finances is Fudget 2. The goal of this app is to help you always stay on budget, no matter what you're doing.

Whether you just want to budget your income or have a big event coming, Fudget will help you manage your entries properly.

You can create entries for pretty much all your expenses. You can organize them and filter them so they're easier to find. Likewise, you can always check each entry's current balance so you know if you can afford to eat out tonight or not.

Overall, Fudget is pretty easy to start using, but it also offers some pretty great features if you decide to go for its premium subscription plan. For instance, you can better organize, export, and sync your budgets across multiple devices.

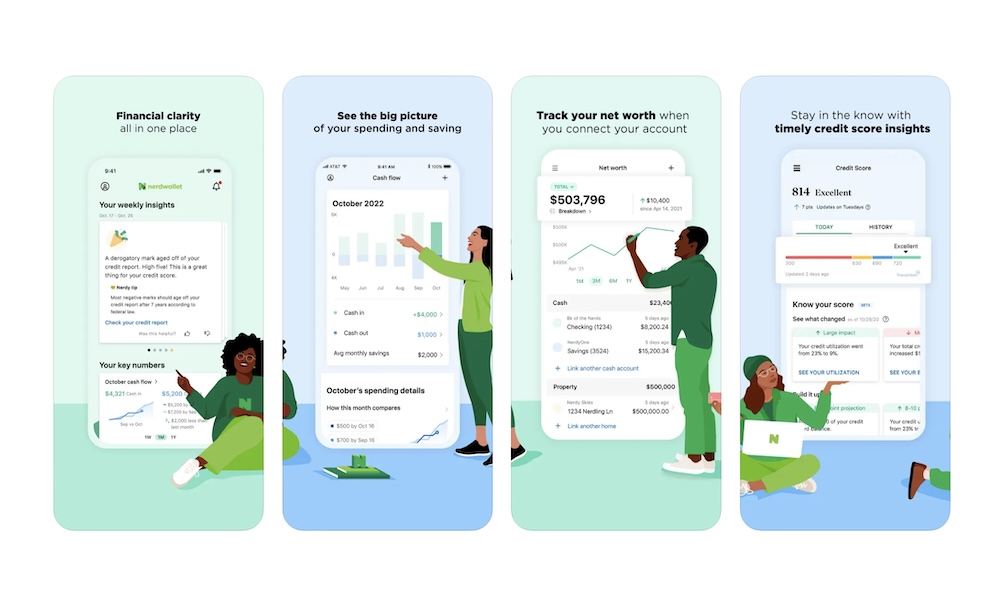

NerdWallet: Manage Your Money

You've probably heard of NerdWallet before. It's only one of the most popular financial platforms online. But did you know that they also have an app that'll help you keep track of your budget?

Granted, the NerdWallet app is a bit bare-bones, especially when compared to other options on the list. However, it's still got all the features you need to track your spending and your budget across all your devices.

Plus, the app also offers some nifty features that not every budgeting app has. For instance, besides tracking your regular accounts, debts, and investments, you can also keep track of your current home value, your net worth, and even your credit score.

But by far, the best part about this app is that it's free. You can use any of these features without spending a dime. Granted, the app has a marketplace where you can "find the right product for your money goals." But if you're not looking for another credit card or loan, you can completely dismiss this tab and focus on your finances.