Invest on the Go with These Investing Apps for iPhone

Credit: Grayscale Studio / Shutterstock

Credit: Grayscale Studio / Shutterstock

Investing has never been easier or more accessible. You can literally start investing in your future even if you're in your pajamas reading this article.

The best part is that you can invest or manage your investments right from your iPhone. Granted, it's way better and easier to check your investments on a computer, but if you're on the go and don't want to miss an opportunity, your iPhone can help you out.

That said, you need to be careful when choosing an investment tool. Some of them won't meet your needs, while others just won't work where you live.

Investing might feel a bit confusing at first. While the market uses some terms that can be tricky to understand, there are apps that can help you learn what you need to know to start trading. Whether you want to try day trading or start investing for your future, you can use any of these apps to learn about the stock market while you're out and about. And when you're ready for actual trading, you can also buy and sell your stocks with just a few taps.

Read on for the 10 best investment iPhone apps to help you start investing in your future.

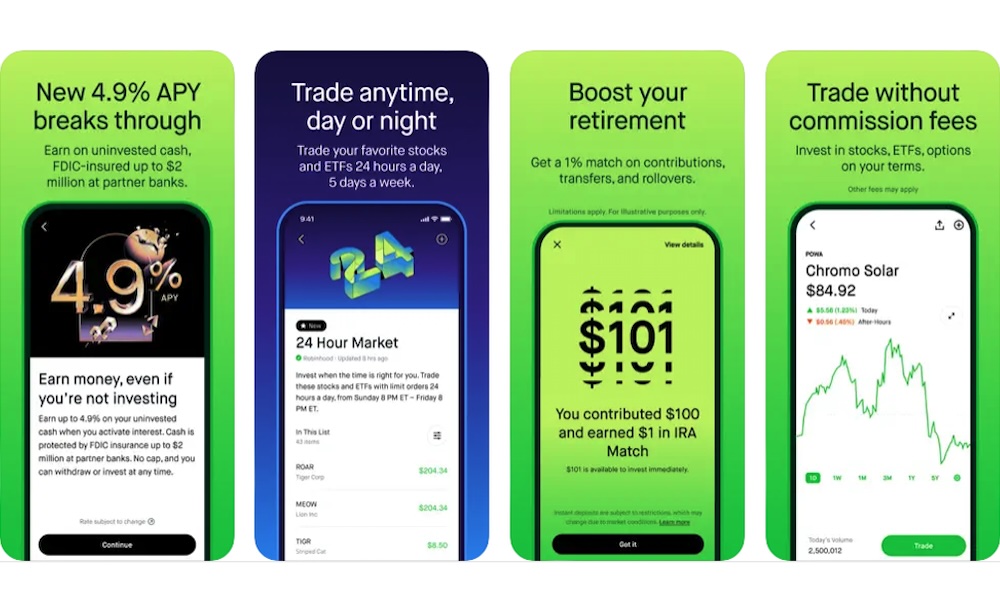

Robinhood: Investing for All

By far, one of the best investment apps you can use on your iPhone is Robinhood. Not only is it a responsive and quick app that will let you invest in a flash, but its friendly user interface will make it easy to keep track of all your assets.

There are many benefits to using Robinhood, but one of the things that makes the app stand out is that it has zero commission fees, making it a great option for everyone.

And if you want to take things to the next level, there is Robinhood Gold, a subscription service that will give you better rates, quick and accurate market data, and the ability to invest for your retirement. You can start transferring money to your retirement account, and Robinhood will give you 3% extra for every dollar you add.

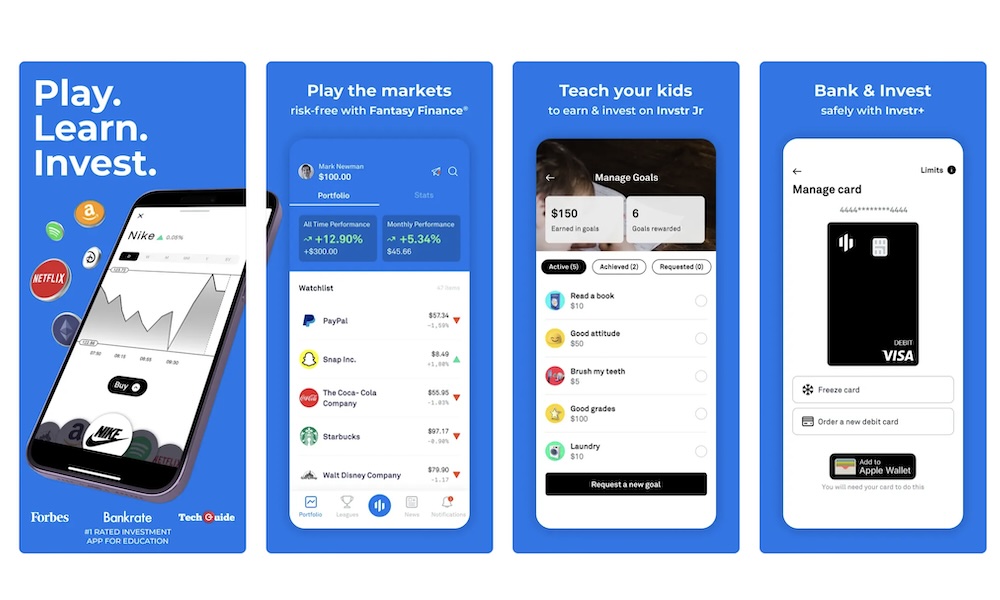

Invstr: Play.Learn.Invest

If you're just starting out and you really don't know what you should be doing in the stock market, you aren't alone. Luckily, we have apps like Invstr to help us out.

While most apps focus only on investing, Invstr focuses on playing, learning, and investing in the stock market.

You can "play" around the stock market safely and without risking your own money. You can practice and learn for yourself or help your friends and family learn about the stock market themselves. There's also an Invstr Jr. feature that helps you teach your kids about money management, investing, and saving.

And when you feel you're ready, you can use Invstr+ and invest in the stock market for real. Of course, you won't have a million-dollar account, but you'll still be able to use your own money to invest.

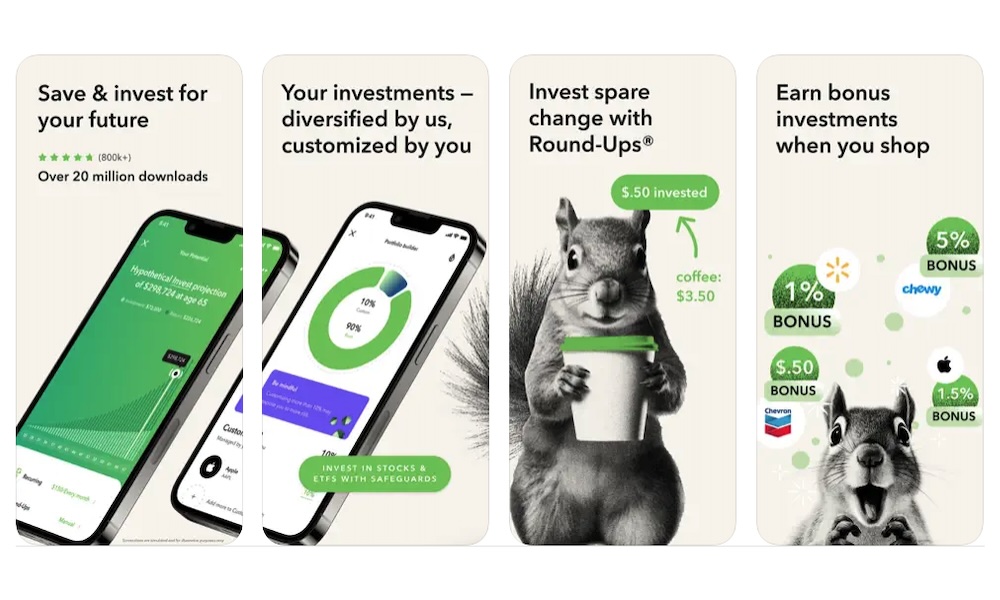

Acorns: Invest Spare Change

Acorns is a different type of investment app, but you'll love the way it works. Instead of focusing on investing, the app wants you to save money.

Rather than putting all your money into an investment account, Acorns simply rounds up the total of a purchase you made and uses the change to invest in one of its ETF portfolios, which is one of the safest and most affordable ways to save your money.

In addition to saving and investing, you can also use the app's debit card to get exclusive perks inside the app. For instance, you can get bonuses just by shopping for the same things you always buy and growing your money with your own checking or emergency fund accounts.

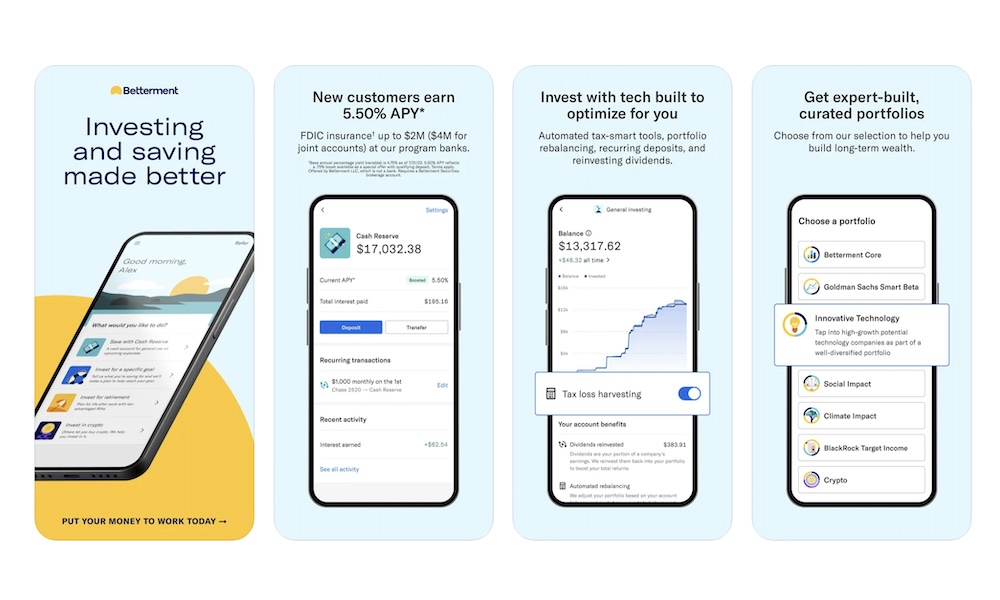

Betterment Invest & Save Money

It doesn't matter if you want to safely invest in your future or find the next big stock; Betterment can help you with all your investment plans.

Betterment is an investment app that also serves as an advisor. It comes with its own "robo advisor" that will help you get a personalized experience. That way, you can meet your investing goals without having to worry about what other people are doing.

And if you don't want to rely on a robot, the app also offers a bunch of curated portfolios to meet your needs. For instance, you'll find portfolios with stocks that have a positive impact on the climate or society.

You can also find expert-built crypto portfolios if you're feeling a bit more adventurous.

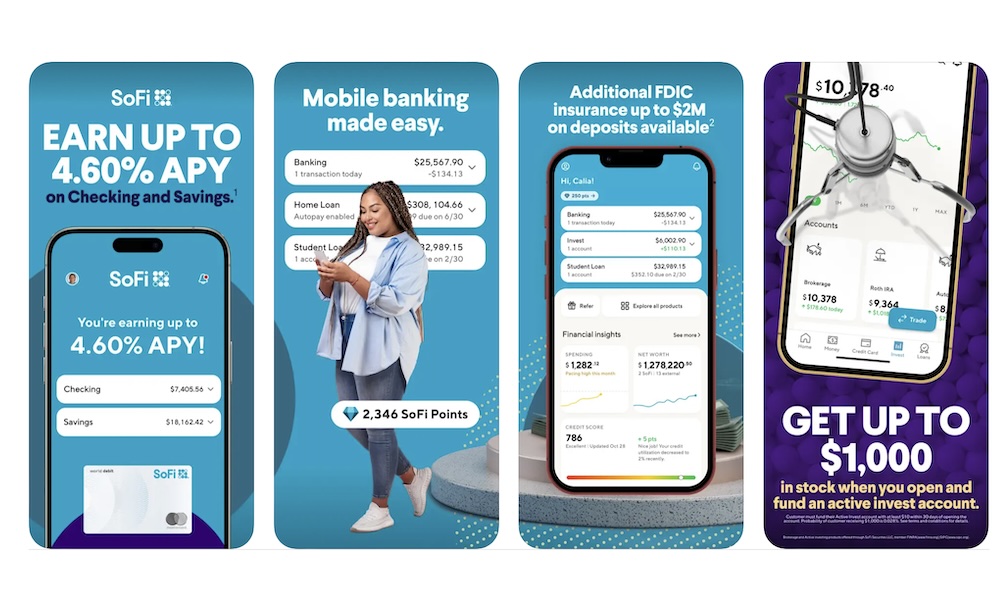

SoFi - Mobile Banking

Sofi is another great app that will help you invest and save more money. For starters, the app features a savings account with no fees that gives you more control over your money.

These accounts can earn you up to 4.60% APY, which is more than what some regular bank accounts offer.

Next, you can use some of the money you've saved to invest within the app. And when you first fund your own investment account, you can get up to $1,000 in stocks to help you get started.

Don't worry — it's not all about active investing. You can also use Sofi to plan for retirement and start thinking about your future.

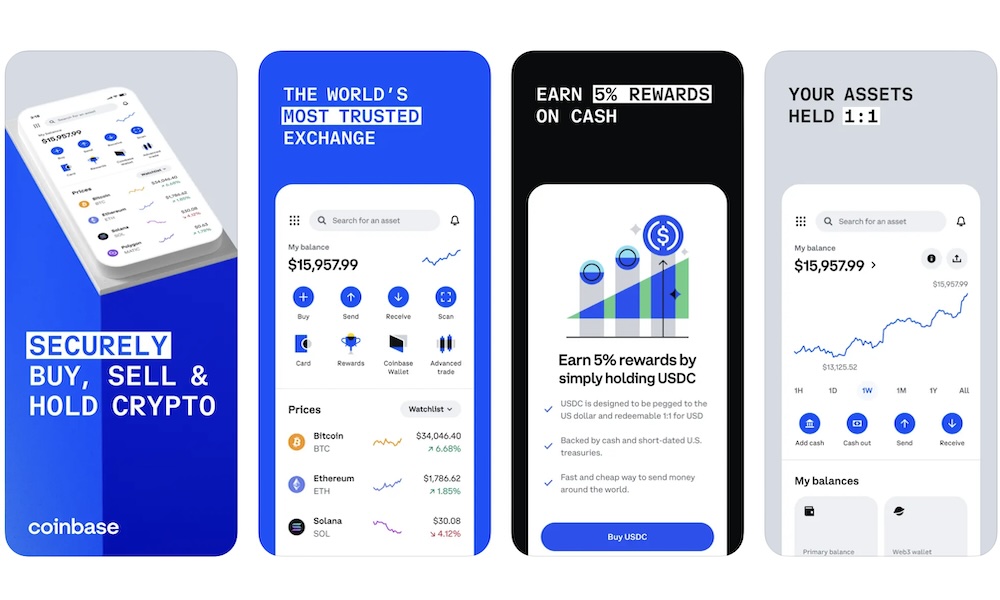

Coinbase: Buy Bitcoin & Ether

If you like investing in something other than stocks, then Coinbase is perfect for you. This app is one of the most popular apps for investing in crypto.

You can buy pretty much any crypto coin you want, including Bitcoin and Ether. Plus, you can earn cash rewards just by buying and holding specific cryptocurrencies.

If you don't want to hold anymore, you can sell or manage your crypto with just a few taps.

Yes, we know investing in crypto can be a bit risky, but the app offers several features to make it more secure.

For starters, the app offers many ways to keep your account protected and secure. Likewise, it features a lot of data about market updates. By staying up to date with the market, you can better understand crypto and make sound decisions.

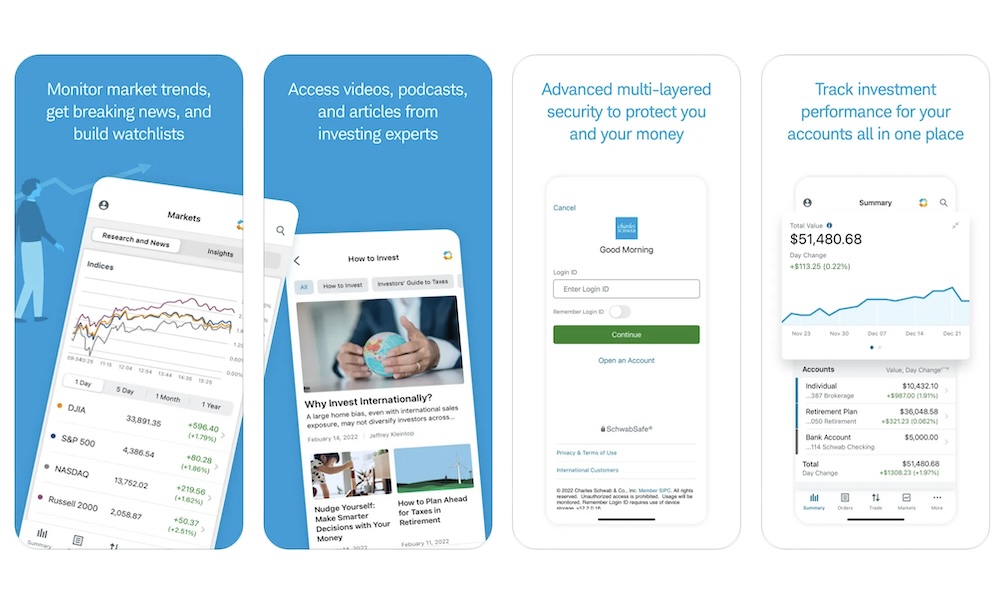

Schwab Mobile

Schwab Mobile is another great investment app if you don't know how to get started in the stock market.

This app's goal is to teach you how to manage your money and invest. To that end, it features a ton of content about the stock market. You can read articles, listen to podcasts, or watch videos that will help you understand why you should invest and what investments you should consider.

Once you feel more confident, you can start trading stocks, ETFs, and mutual funds with just a few taps. The app makes it easy to transfer money to and from the app, so you can get paid as soon as you need to. The best part is that it also offers zero commissions for trades you make in the app.

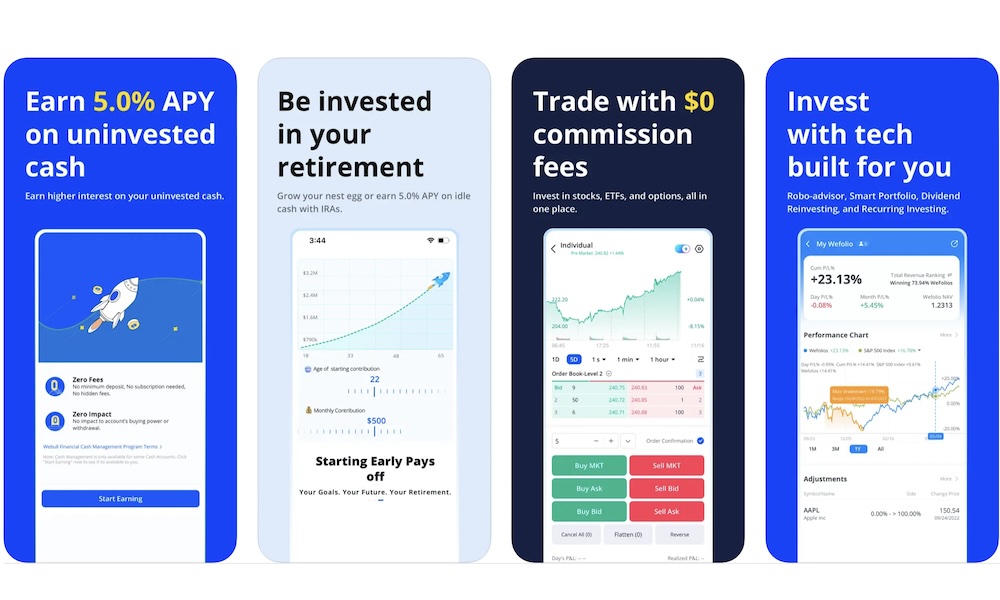

Webull: Investing & Trading

Webull is a similar app to Robinhood because it makes it so easy to set up an account and start trading.

Webull offers several features just by setting up your account. For instance, it offers zero commission fees for all trading. Plus, it features fractional shares, which are great if you don't have a lot of money.

You can start with just $5 and invest in the stocks you're most interested in — even if you can't afford the full stock.

The app also lets you invest for your retirement with a traditional, Roth, or IRA account. Like active trading, you don't need to pay fees, and you can earn up to 5.00% APY on the cash you have sitting in your account.

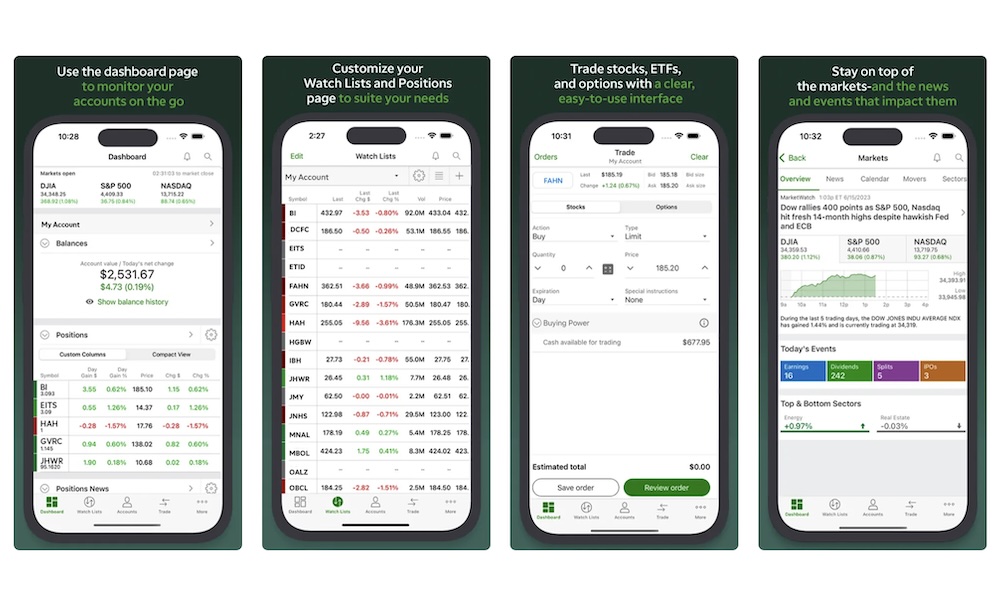

TD Ameritrade Mobile

Ameritrade is one of those investing platforms that have been around for quite some time now, and there's a reason for that.

While the app might not feel as sleek as other options on the list, you have everything you need at your disposal.

You can manage your current portfolio and start buying or selling more stock with just a couple of clicks. Moreover, you can create your own watch lists, so you know when it's time to start buying some stocks.

Granted, the mobile app might not offer as many features as other options on the list, but you can rest assured that your money is safe with a secure investing platform.

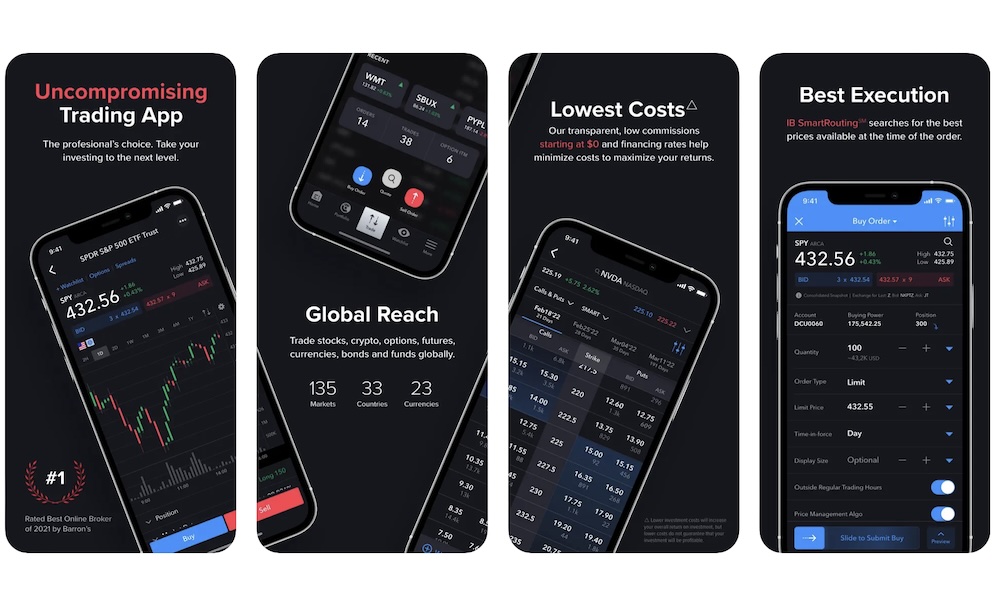

IBKR Mobile - Invest Worldwide

Another long-established platform is Interactive Brokers. Some consider it to be one of the best and most complete platforms out there.

For the most part, they're right. You can easily access your portfolio as well as buy and sell stocks, ETFs, and even crypto on the go.

The biggest issue with Interactive Brokers is its user interface. Compared to other options on the list, this app might feel a bit outdated. But just because it looks "boring" doesn't mean it's not useful.

It comes with all the basic information and data to help you decide whether to buy or sell specific stocks, and you can even catch some news and upcoming events to keep you up to date with what the company you invested in is doing.