Stop the Spend: 10 Best iPhone Apps to Save You Money in 2026

If you’ve ever looked at your bank account and wondered where all your money went, you're definitely not alone. Nowadays, making ends meet is harder than ever, and it's that time of year when many of us are especially feeling the crunch. It's even worse if you don't have a budget or aren't mindful of where your money is going.

The good news is that your iPhone can help ease some of the burden. With the right apps, you can track subscriptions, plan budgets, get cash back on groceries and gas, and even invest your spare change.

The App Store is packed with money-saving tools, but finding the ones that actually work can be tricky. That’s why we’ve rounded up the best and most useful iPhone apps designed to help you maximize your savings. Whether you're trying to save for a vacation, cut unnecessary expenses, or just survive the month, read on for 10 apps that will help you keep more of your hard-earned money in your pockets.

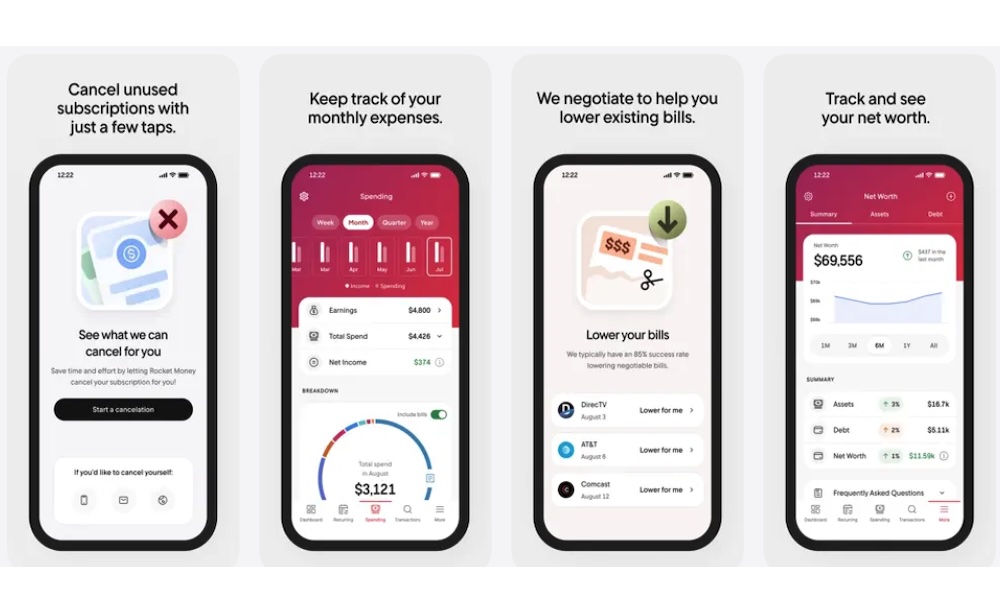

Rocket Money - Bills & Budget

If your subscriptions are silently draining your budget, Rocket Money (formerly Truebill) is the app you need. It connects to your bank accounts and scans for recurring charges like streaming services or forgotten subscriptions. Once identified, Rocket Money can cancel many of these services for you.

Beyond subscription management, Rocket Money can also secure the lowest possible rates by acting as a negotiator on your behalf with cable and phone companies to get you better prices. The app claims it has an 85% success rate for this, which is a huge plus.

On top of that, it includes budgeting features and spending insights. You’ll get alerts if a subscription increases in price or if you're about to go over your budget. It's especially helpful for people juggling multiple streaming platforms or who haven’t checked their recurring charges in months.

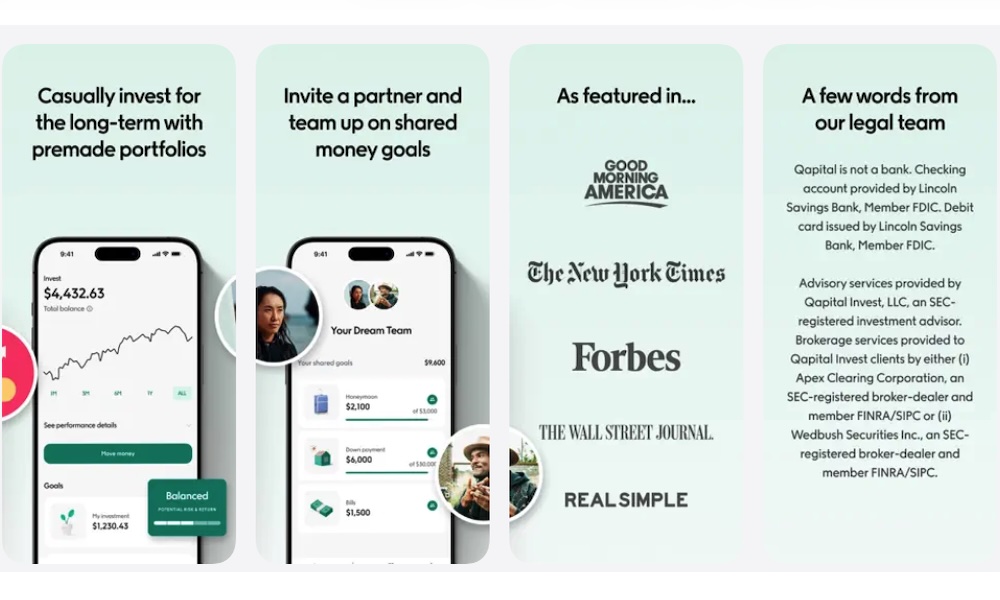

Qapital: The Money Saving App

Qapital turns saving money into a habit you won’t even notice. It works by letting you create custom savings goals and pairing them with "rules" that trigger automatic transfers. For example, you can round up every purchase to the nearest dollar and stash the difference in a savings goal. Or, every time you skip buying coffee, it can put $5 into a savings category like a “vacation fund.”

It’s also a great tool for couples or roommates who want to save together. You can create shared goals and watch your joint progress grow.

Plus, it makes investing your money easy. The app features premade portfolios you can simply copy and let the stock market increase your wealth over time.

Goodbudget Budget Planner

If you prefer the envelope system of budgeting, which is a method for allocating specific amounts of cash to different spending categories, then Goodbudget is a great option for you.

The app lets you create virtual envelopes for categories like groceries, rent, and entertainment. Each time you spend, you can manually or automatically log the amount from the correct category.

Manual tracking may sound like a chore, but it actually increases awareness of where your money is going. It’s great for couples and families, too, since the data syncs across devices. Everyone will know how much money they have available at all times.

And if you're more of a visual person, the app also comes with charts to track income versus spending and debt progress at a moment's notice. You can check your income vs. your spending, and how much debt you still have left.

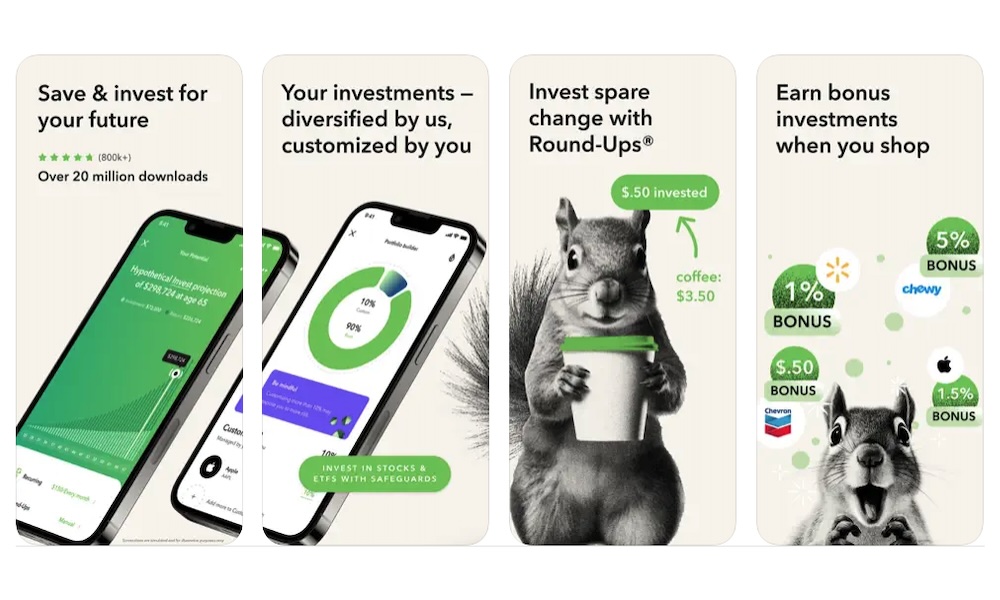

Acorns: Invest for Your Future

If you find it hard to set aside money for investing, Acorns makes it incredibly easy. It links to your debit and credit cards and rounds up every purchase to the nearest dollar, investing the change into a diversified portfolio.

That means if you buy a coffee for $3.40, Acorns takes $0.60 and invests it. You can also set up periodic contributions or boost your savings manually. It includes retirement planning tools, and certain tiers offer a debit card and additional account types.

Another great thing about the app is that it comes with a bunch of resources to teach you about money. You can learn more about saving, investing, and how to view money by reading a few articles whenever you have some spare time.

You won’t get rich overnight, but Acorns is a painless way to build long-term savings from everyday spending.

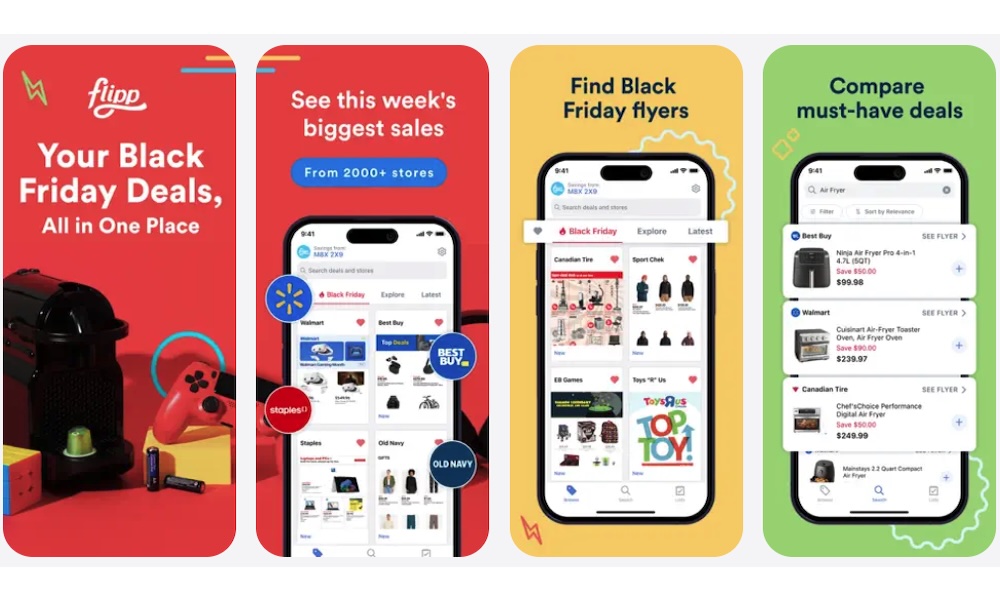

Flipp: Flyers & Shopping Deals

Flipp is a must-have if you’re trying to save on groceries and household items. It aggregates digital weekly ads from your local stores and highlights deals on everything from cereal to laundry detergent. You can compare prices, build a shopping list, and even clip digital coupons directly in the app.

There are over 2,000 stores available in the app, so you'll surely find anything you need or want. Not only that, but you can also keep a watchlist or check the daily offers so you can save money on items you need to buy.

What sets Flipp apart is its ability to match the lowest price available. Just show a better deal from another store, and many retailers will honor it. With grocery prices always fluctuating, Flipp helps you keep your budget in check.

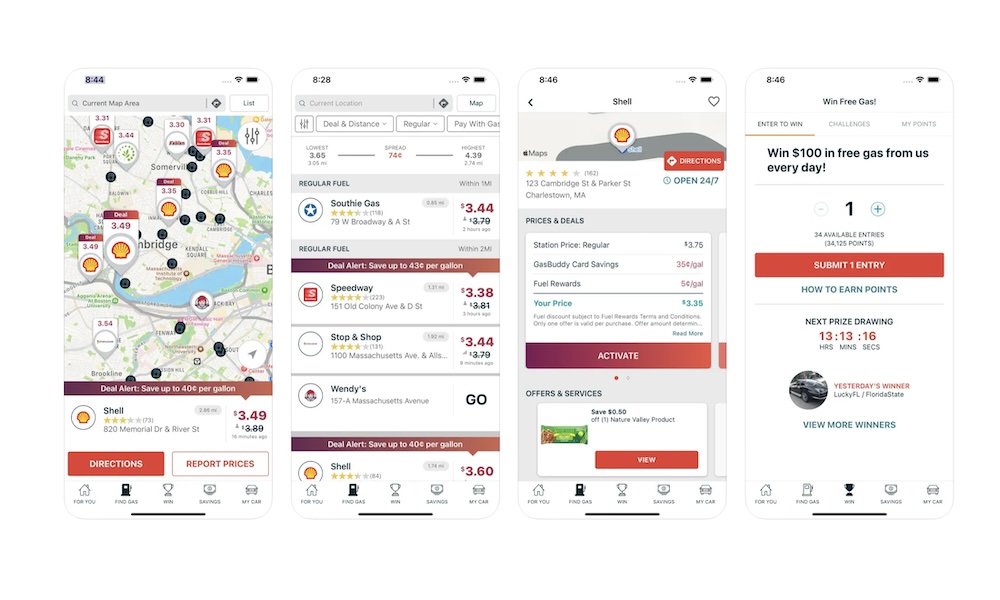

GasBuddy: Find & Pay for Gas

The name of this app says it all, and if you're always driving, you're going to need it. Fuel costs can vary dramatically between stations, even if they're only a few blocks apart. GasBuddy helps you find the cheapest gas nearby in real time. It also includes a trip cost calculator so you can budget road trips more accurately.

What's great about the app is that it has everything you need to make gas last as long as possible. If you let it, the app can also analyze your driving habits to give you a "fuel efficiency score." With it, the app also lets you know how you can improve so you can save more money in the future.

The app also features challenges that you can participate in by doing simple tasks, like reporting the price of different gas stations. If you complete the challenge, you'll be able to win free gas, which is a great way to save money for doing regular tasks.

Additionally, GasBuddy’s rewards program offers discounts at the pump if you use their card. It even tracks fuel trends in your area so you can see when prices are expected to rise or fall.

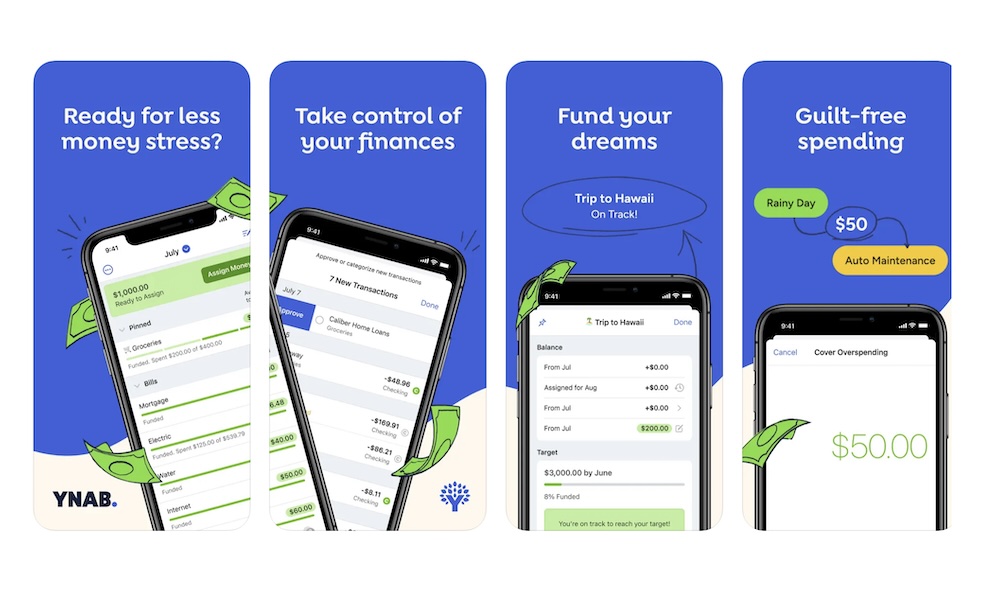

YNAB (You Need A Budget)

You need a budget. That's both a rule and the name of this app. However, YNAB isn’t just a budgeting app; it's also a platform designed to fundamentally change your relationship with money.

The app’s philosophy is that every dollar should have a job, meaning you actively assign income to different spending and saving categories. That way, you know exactly how much money you can spend in a month, and know how much money you need to complete your dream goals.

Another interesting thing about the app is that it lets you create targets for expenses that happen every once in a while. For instance, if you have to pay for a yearly Disney+ subscription, the app will spread the price across the whole year, so you can save smaller amounts of money instead of having to pay it all in one go.

The app also has different videos and articles to help you understand its other rules when it comes to budgeting and money. You'll learn something new while still saving money.

Overall, YNAB encourages forward-looking financial planning rather than just tracking past transactions. You can track your debt and view how “aged” your money is (how long you’ve held onto it before spending). While YNAB requires a paid subscription and a bit more upfront effort, most users find that the amount of money they save far outweighs the monthly cost and learning curve.

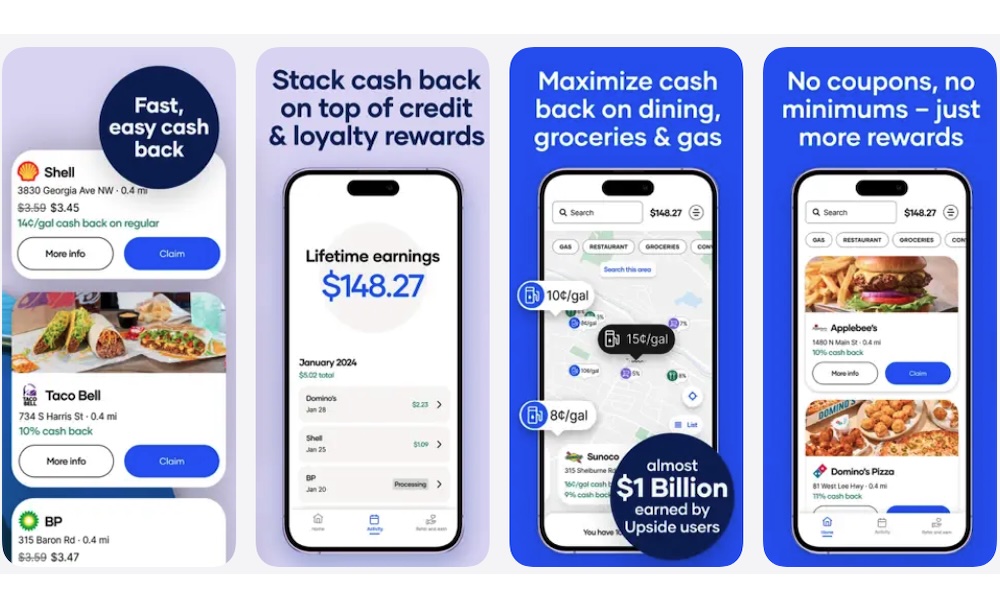

Upside: Get Cash Back on Fuel

Upside is a cash back app that mainly works with thousands of gas stations, though it's also expanded to include benefits for specific stores and restaurants.

Unlike traditional rewards programs, you don’t need to clip coupons or wait for points. Instead, just check the map for offers, make your purchase, and scan the receipt. The app claims that all of its users have earned over $1 billion collectively, and you can get a piece of the pie, too.

Once your account has enough cash available, you can transfer your money to PayPal, your bank account, or redeem gift cards. It's especially useful for people who drive or dine out frequently.

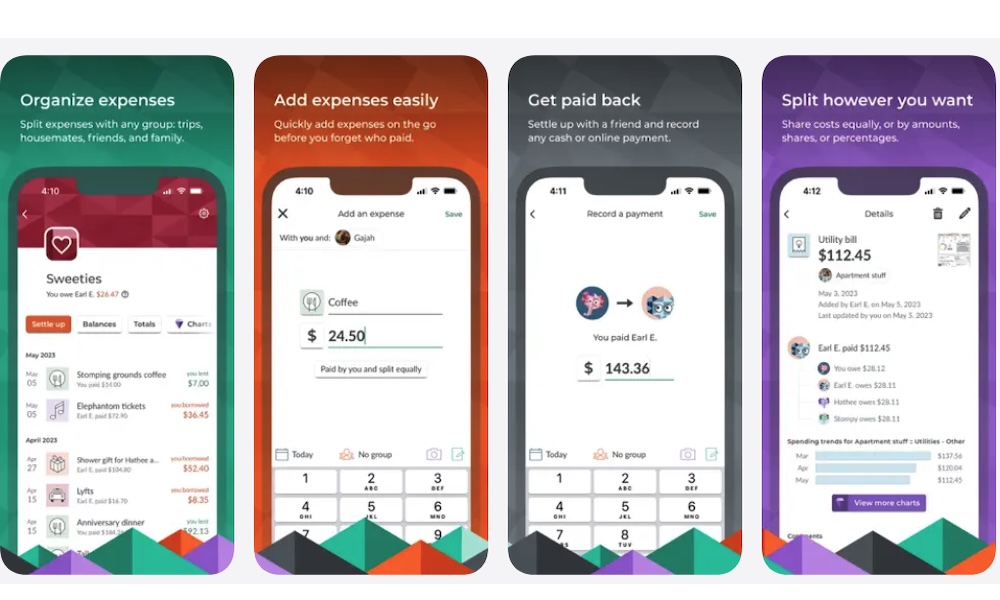

Splitwise

If you live with roommates or regularly split bills with friends, Splitwise is essential. It helps you keep track of who owes what, sends friendly reminders, and logs all shared expenses.

Because everything syncs to the cloud, everyone in your group can access it from nearly any platform to see exactly who owes what and settle up with a tap.

Whether it’s rent, utilities, or a weekend trip, the app calculates the fairest split and tracks payments over time. It gets rid of awkward conversations and makes sure no one forgets to pay their share.

Rakuten: Cash Back & Deals

Rakuten remains one of the gold standards for cash-back shopping. Partnering with over 3,500 stores — from Best Buy to Sephora — it gives you a percentage of your purchase bac in the form of a "Big Fat Check" or PayPal transfer.

You can use the Safari extension to get savings when you're shopping online, or browse offers in the app. Whichever option you choose, the money you earn will add up quickly, especially if you buy stuff during the app's special events.

Additionally, you can refer friends or family to the app and earn rewards and bonuses.

Take Control of Your Finances

Whether you’re trying to cut back on monthly bills, invest passively, or just make smarter everyday purchases, there’s an app that can help.

And thanks to all of the options on this list, saving money doesn't have to be a monumental struggle. Most of the apps on this list are free to download, and many work best when combined. Try a few, set your goals, and watch your savings grow without changing much else about your lifestyle.