5 Best iPhone Apps to Help You Save Money

Putting money away in savings is a no-brainer. Whether you're saving up for a particular purchase or a future trip, trying to build up an emergency fund, or simply putting some money away for retirement, savings is an incredibly important aspect of your financial health. Of course, it can also be hard to do — particularly if you're spend-happy or you've never done it before. Luckily, as always, there's an app for that. Press the right arrow to learn about 5 apps that'll set you on the road to saving. Future-you will thank you.

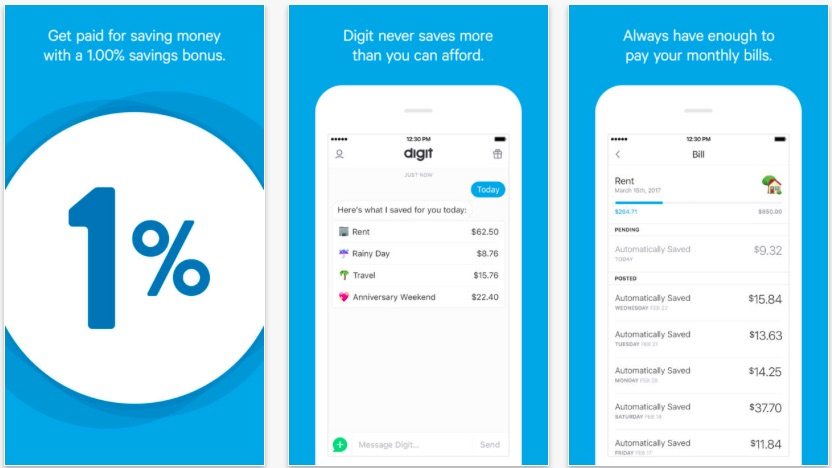

5 Digit

Sometimes, remembering to put money away for savings is the hardest part. Digit makes it easy by saving money automatically. It uses artificial intelligence to base the amount it saves, depending on your current balance and spending habits.

If you have some cash to spare, it’ll pull out a few bucks a day. If you don’t have much money in your account, it’ll only take out a few cents. You can manually save or withdraw money from the app, too. Best of all, it’s completely free to download and use — and the company will even reward you for every three months of successful saving with a 1 percent bonus.

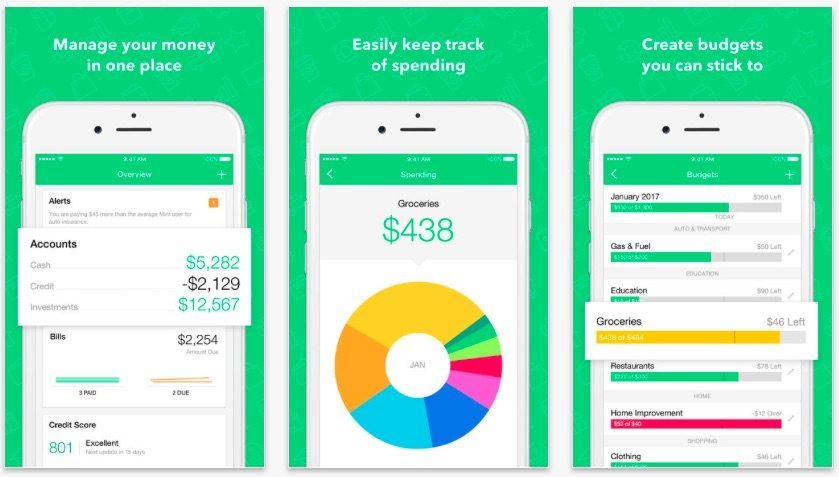

4 Mint

Saving money gets a lot easier when you have a basic handle on your budget and finances. That’s where Mint comes in — it’s a popular, free and powerful all-in-one budgeting platform. While not technically a saving app, Mint can help you become more financially savvy. It gives you a big-picture view of your financial situation, with transaction and balance information across all of your accounts and even a free credit score report.

When it comes to savings, Mint can really come in handy by focusing in on areas where you’re spending too much. It categorizes purchases and transactions, so you can know where you’re overspending and where to cut back. The app also has a handful of tutorials with tips on how to save money, so it's an easy way to get the ball rolling on that front.

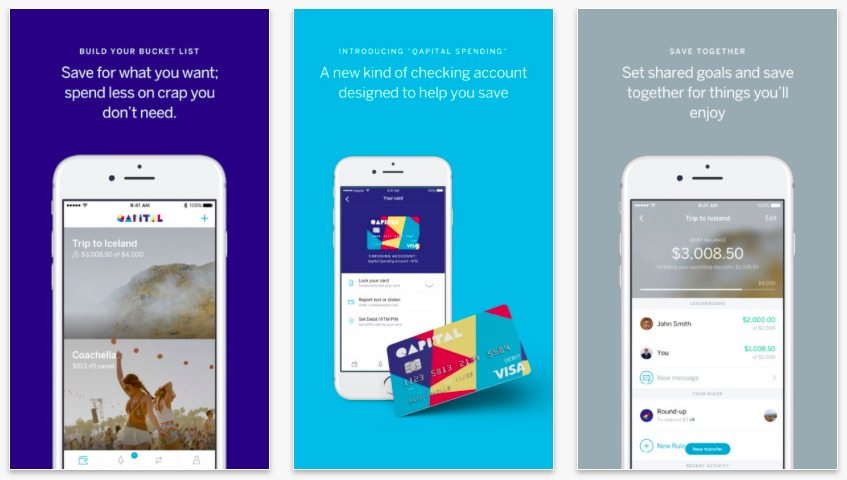

3 Qapital

Qapital is an automatic saving app similar to Digit, but a bit more complicated. Through the app, you can set up various “rules” to automate savings deposits. Tor example, one “rule” could be to round up to the nearest dollar when you make a purchase and move that extra money into savings. The rules are wide-ranging and flexible, so you can find what works for you.

If you have IFTTT, you can even set it up to put some money away when you hit a fitness goal or get your paycheck. If you need some social pressure and accountability, you can let your friends and family track your progress through the app — and even create joint savings goals that several parties can contribute to. The app is free to download and use, but your balance won’t accrue interest like a traditional savings account.

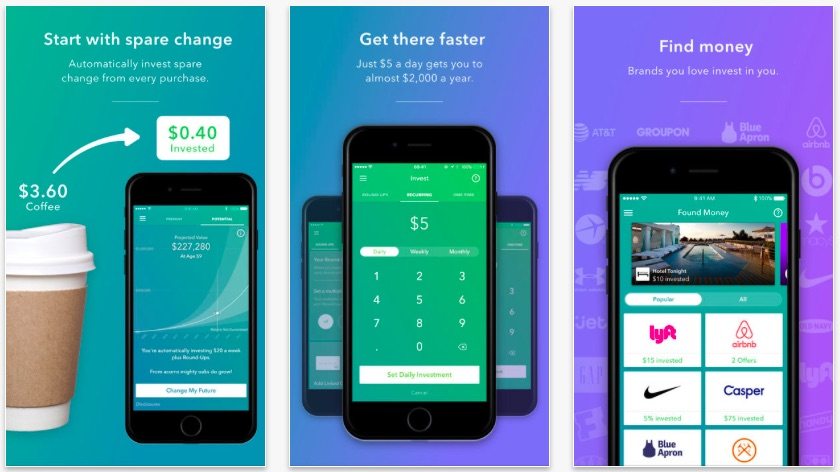

2 Acorns

Sure, saving is not the same as investment — but they’re related. And though not technically a savings app, Acorns can help you put money away. Best of all, it’s not just “saving” that money, it’s actually automatically investing it into various stocks and bonds. So, in the end, you can end up making money using the app.

Acorns also has a feature that lets you round your purchases to the nearest dollar and puts those extra pennies into various financial products. Of course, investing is always a risk — and you could lose money — but the app can ultimately result in balance gains. Which is basically free money for you. It’s also free to download, and costs just under $1 a month to use if your account is under a $5,000 balance.

1 Stash

Stash might be a better option for you if you're a more experienced investor. Stash is an app that easily lets you invest small amounts of money into various stocks and ETFs.

Stash makes recommendations through its proprietary diversification analysis tool suggesting which stocks or bonds you should consider investing your money into. Stash even lets you pick certain ETFs like “Clean & Green” or “Retail Therapy” and more.1 For investment-newbies, the app also has tutorials that can teach you the basics. While it may be more effort than Acorns, Stash gives you more control over where your money is being invested. Similar to Acorns, Stash also has a round-up feature. You can start investing with as little as $1 and plans cost beginning at $1 per month2. Sign up today and Stash will give you a $5 bonus* to invest after you sign up and deposit at least $5 into your invest account.

Disclosure:

*iDrop News is a paid affiliate/partner of Stash. Promotion is subject to Terms and Conditions.

For Securities priced over $1,000, purchase of fractional shares starts at $0.05.

1This material is not intended as investment advice and is not meant to suggest that any securities are suitable investments for any particular investor. Investment advice is only provided to Stash customers. All investments are subject to risk and may lose value. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

2Stash Monthly Wrap Fee starts at $1/ month. You’ll also bear the standard fees and expenses reflected in the pricing of the ETFs in your account, plus fees for various ancillary services charged by Stash and the Custodian. Please see the Advisory Agreement for details. Other fees apply to the bank account. Please see the Deposit Account Agreement.

Stash through the “Diversification Analysis” feature does not rebalance portfolios or otherwise manage the Personal Portfolio Account for Clients on a discretionary basis. Each Client is solely responsible for implementing any such advice. This investment recommendation relies entirely on the responses you’ve provided regarding your risk tolerance. Stash does not verify the completeness or accuracy of such information. Investing involves risk, including possible loss of principal. No asset allocation is a guarantee against loss of principal.

Investment advisory services offered by Stash Investments LLC, an SEC-registered investment adviser. Investing involves risk and investments may lose value.