These 3 Simple Apps Can Slash Your Bills and Grow Your Wealth in 2021

Credit: Alinabuphoto / Shutterstock

Credit: Alinabuphoto / ShutterstockToggle Dark Mode

According to a recent Fidelity survey, 68 percent of people in the United States suffered some financial degree of setback brought on by the COVID-19 pandemic. It’s not surprising then that financial security is at the forefront of people’s concerns entering into 2021. Thankfully, there is no shortage of apps to help your manage your money. We’ve found three apps – Truebill, Stash, and Dosh – that’ll help you cut your expenses and grow your nest egg in the coming year.

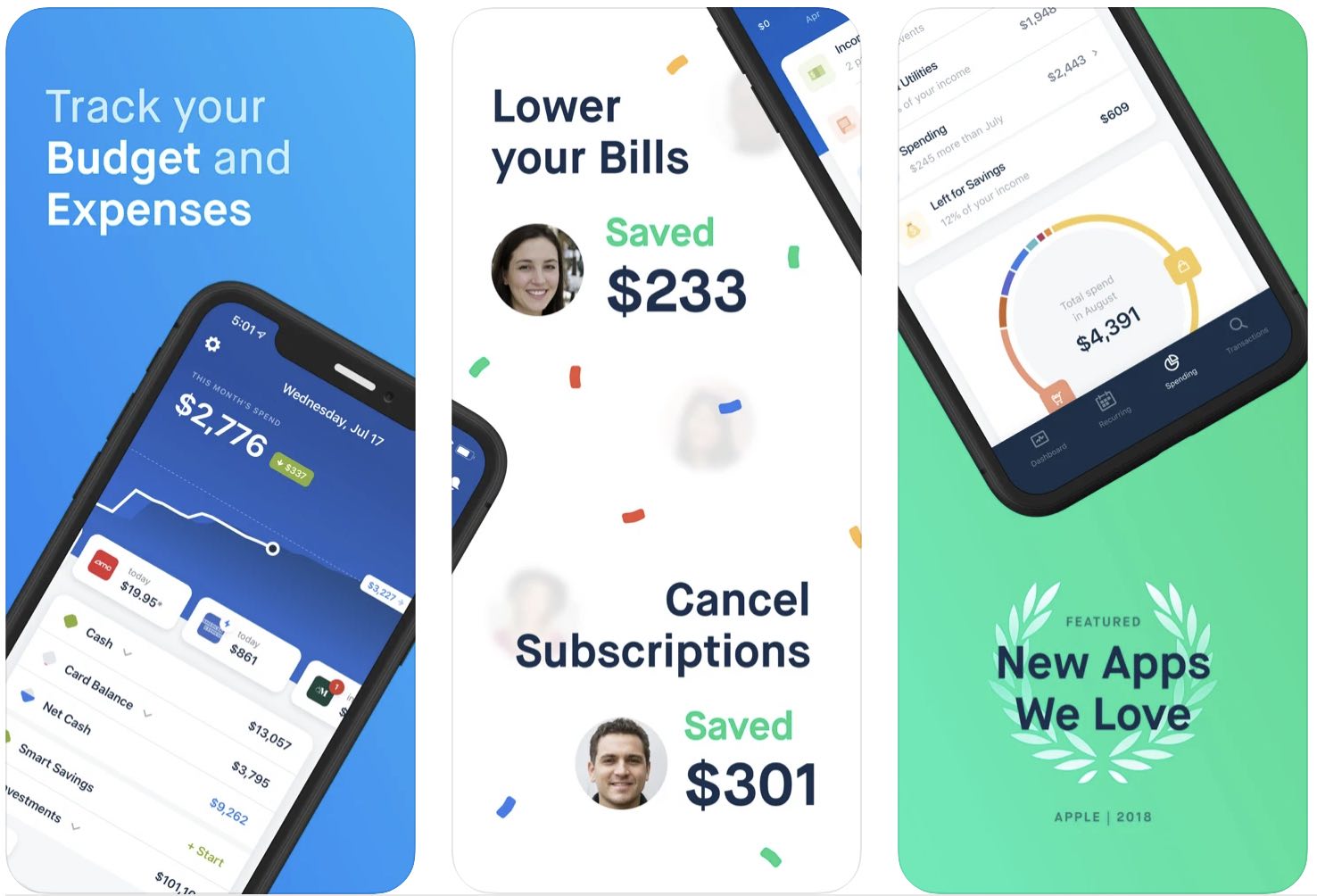

Reduce Your Monthly Bills with Truebill

Truebill is a personal finance service that helps you trim your expenses as you take a deep dive into how you are spending your money. Truebill connects to your bank, credit card, phone, cable, and other monthly billing accounts. It not only details what you are spending each month on each of these bills, but the service also helps you reduce what you are paying.

Truebill will lower your monthly bills by changing your plan, removing features, or signing up for promotions. You can choose to have Truebill do it automatically on your part for convenience, or you can make those changes manually. For every dollar you save with Truebill, you will pay Truebill just 40 cents.

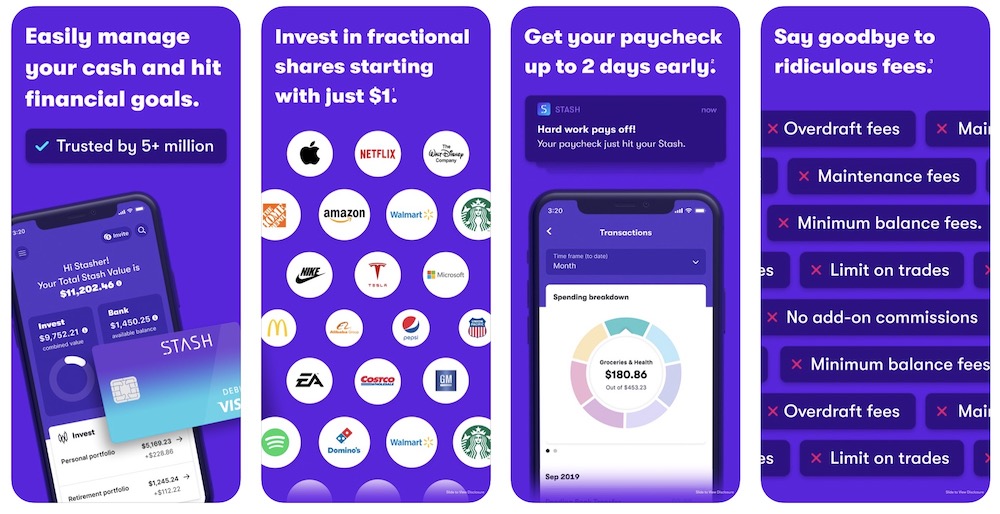

Stash Makes Investing Easy for Everyone

Stash makes it easy to invest in the stock market by removing financial barriers that discourage people from investing. Most brokerages require investors to carry a minimum balance and set up automatic deposits that often are too expensive for most people. Stash does away with these requirements, allowing people to invest with no minimum balance and minimal fees. But that’s not all.

Stash tries to make investing affordable and easy for people. It uses a fractional investment strategy that lets people purchase a percentage of a share instead of a full share. You can invest $5 to buy a portion of an Apple share and make money as the share price increases.

Stash also makes it easy to invest by walking you through the process and offering advice on investing. It’s this educational content and handholding that sets Stash apart from other fractional investment firms.

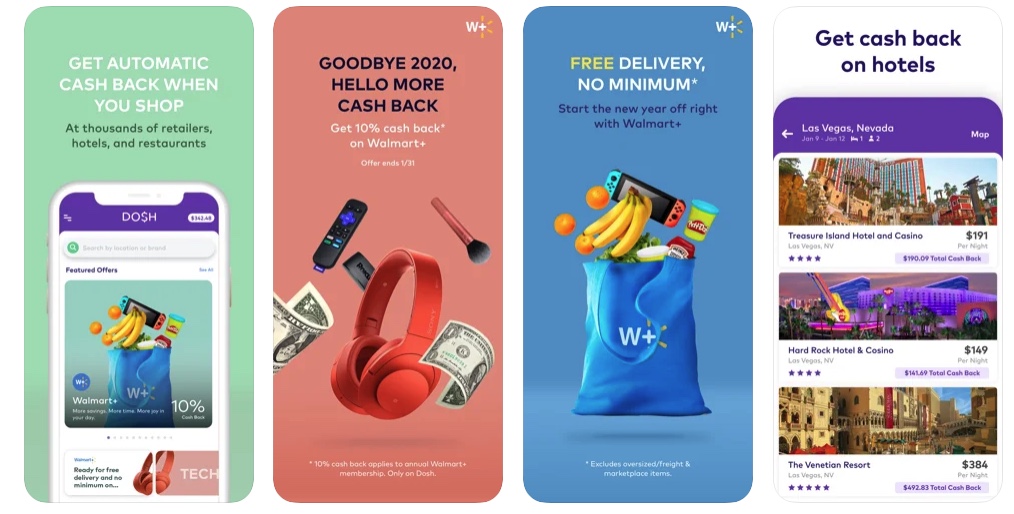

Double Your Cashback with Dosh

Do you shop with your credit and like to earn cashback rewards? Then Dosh may be an ideal way for you to make even more money without changing a thing. The Dosh app lets you double down on cashback rewards.

Once you download Dosh, you can link a credit or debit card and then shop at a participating store. Unlike some promotions that support obscure stores, Dosh has partnered with several high-profile retailers like Walmart, Sams Club, Target, Walgreens, H&M, and more.

Whenever you make a purchase, you’ll earn your standard cashback on your credit card plus a bonus percentage through Dosh. The Dosh cashback return averages around 3%, but some stores offer up to 10% cashback. You can then transfer this free money from your Dosh account to a linked bank account or your PayPal account.

We may earn a commission from affiliate links. Continue Below.